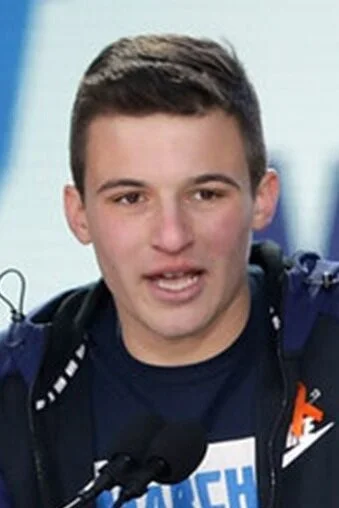

Global Head of ESG Research, MSCI

As Global Head of Research for MSCI’s ESG Research group, Linda-Eling Lee oversees all ESG-related content and methodology. MSCI ESG Research is the largest provider of ESG Rating and analytics to global institutional investors. Linda leads one of the largest teams of research analysts in the world who are dedicated to identifying risks and opportunities arising from material ESG issues. She and her team have been widely recognised as the best SRI/ESG researchers by market surveys and awards.

Linda joined MSCI in 2010 following the acquisition of RiskMetrics, where she led ESG ratings research and was head of consumer sector analysis. Linda joined RiskMetrics Group in 2009 through the acquisition of Innovest. Prior to joining Innovest, Linda was the Research Director at the Center for Research on Corporate Performance, developing academic research at Harvard Business School into management tools to drive long-term corporate performance. Previously, she was a strategy consultant with Monitor Group in Europe and in Asia, where she worked with Fortune 500 clients in industries ranging from beverages to telecommunications.

Linda received her AB from Harvard, MSt from Oxford, and PhD in Organizational Behavior from Harvard University.

Linda has published research both in management journals such as the Harvard Business Review and MIT’s Sloan Management Review, as well as in top academic peer-reviewed journals such as Management Science and Journal of Organizational Behavior. She is frequent media commentator on ESG topics and sustainable investing in outlets including the Financial Times, Wall Street Journal, Forbes and the New York Times.