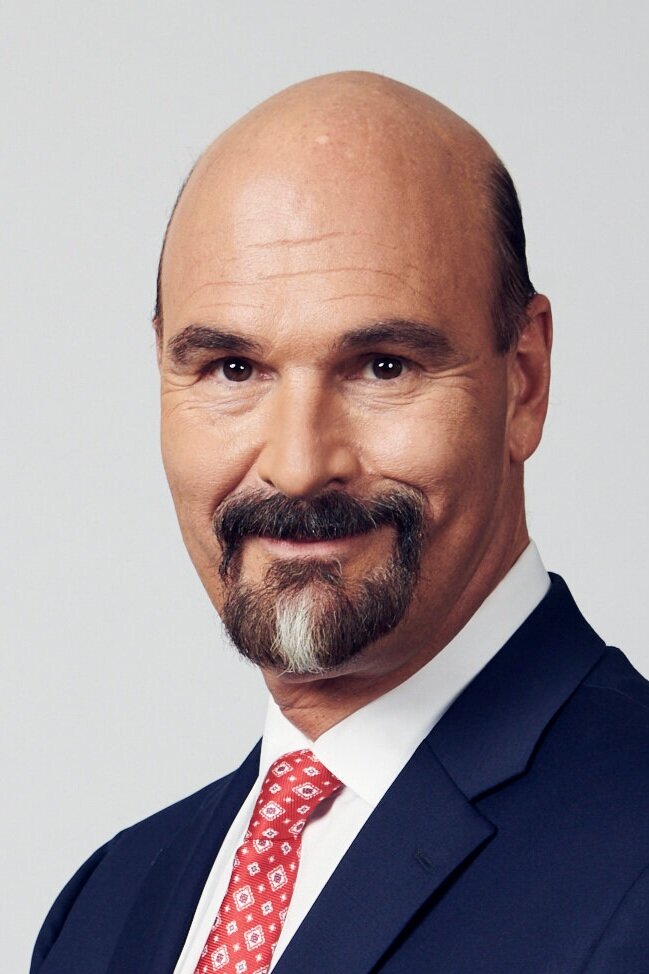

43rd Governor of the State of Florida

Jeb Bush is the 43rd governor of the State of Florida, serving from 1999 through 2007. He was the third Republican elected to the state’s highest office and the first Republican in the state’s history to be reelected. He was most recently a candidate for the Republican presidential nomination in 2016.

Governor Bush remained true to his conservative principles throughout his two terms in office – cutting nearly $20 billion in taxes, vetoing more than $2.3 billion in earmarks and reducing the state government workforce by more than 13,000. His limited government approach helped unleash one of the most robust and dynamic economies in the nation, creating 1.3 million net new jobs and improving the state’s credit ratings, including achieving the first ever triple-A bond rating for Florida.

During his two terms, Governor Bush championed major reform of government, in areas ranging from health care and environmental protection to civil service and tax reform. His top priority was the overhaul of the state’s failing education system. Under Governor Bush’s leadership, Florida established a bold accountability system in public schools and created the most ambitious school choice programs in the nation. Today, Florida remains a national leader in education and is one of the only states in the nation to significantly narrow the achievement gap.

Governor Bush is also known for his leadership during two unprecedented back-to-back hurricane seasons, which brought eight hurricanes and four tropical storms to the state of Florida in less than two years. To protect the state from loss of life and damage caused by catastrophic events, such as hurricanes, Bush worked tirelessly to improve the state’s ability to respond quickly and compassionately during emergencies, while also instilling a ‘culture of preparedness’ in the state’s citizenry.

Governor previously served as a Presidential Professor of Practice at University of Pennsylvania. He also served as a visiting professor and fellow at Harvard University, an executive professor at Texas A&M University, and has been awarded several honorary doctorates from collegiate institutions across the country. Governor Bush has been recognized for his contributions to public policy by national organizations including the Manhattan Institute, The Lynde and Harry Bradley Foundation and the Jack Kemp Foundation. Governor Bush earned his bachelor’s degree in Latin American Studies from the University of Texas at Austin.

Governor Bush currently serves as Chairman of Finback Investments Partners LLC and Dock Square Capital LLC, both merchant banks headquartered in Coral Gables.

Governor Bush maintains his passion for improving the quality of education for students across the country by serving as the Chairman of the Foundation for Excellence in Education, a national nonprofit education reform organization he founded to transform education in America.

He has written three books, Profiles in Character; Immigration Wars: Forging an American Solution; and Reply All: A Governor’s Story 1999-2007.

Governor Bush lives in Miami with his wife Columba. They have three children and four grandchildren.