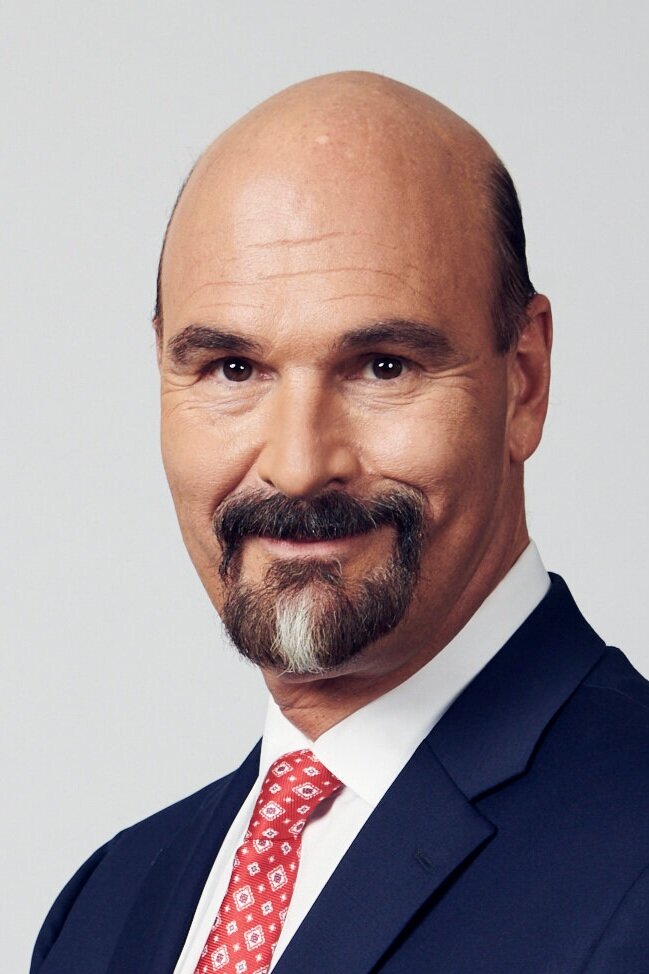

Founder, Global Ventures

Noor is the Founder and Managing Partner of Global Ventures, a UAE-based, Series-A focused, emerging-market venture capital firm with presence in Egypt, Saudi Arabia and Nigeria. With $200 million AUM, and financial returns rating it as a top decile fund, Global Ventures has become a leading investor across the Middle East and Africa.

Since its inception in 2018, Global Ventures has completed 50 investments across ten markets, deliberately focused on sectors positively affecting millions of lives across the world, such as FinTech, Digital Health, EdTech and AgriTech. In addition to generating top decile returns, the portfolio has had a demonstrable impact on millions of lives through its company founders creating 7,200 jobs, enabling female leadership, powering financial inclusion for over 27 million people and expanding healthcare access to over 4 million patients.

Prior to Global Ventures, Noor was the first woman to operate, scale and IPO a company in the MENA region, listing Depa on NASDAQ Dubai and the London Stock Exchange for US$1.1 billion in April 2008. One of the world’s largest interior contractors, Noor scaled Depa tenfold, expanding operations from six countries to 22, including four cross-border acquisitions.

Identified by Forbes as one of the “World’s Top 50 Women in Tech” and by Arabian Business as one of the “Most Influential Arabs”, Noor's previous roles include Chief Investment Officer at The Dubai Future Foundation and a Founding Partner at Leap Ventures. Noor also founded the largest chain of yoga and pilates studios in the Middle East, ZenYoga, which was acquired by Cedarbridge in 2014.

Noor is an active, independent board director of Clue, the largest femtech company in Europe, and VAM Acquisitions Corp., a US based special purpose acquisition vehicle focused on the space ecosystem. She is the Founding Chairwoman of the Middle East Venture Capital Association, a Director of the Global Private Capital Association, TechWadi, and the Karman Fellowship.

She is a member of the Aspen Global Leadership Network and a member of the World Economic Forum’s Young Global Leaders. She previously held Board Director roles at MIT Sloan and was a founding board member of Endeavor UAE.

Noor holds Bachelors’ degrees in Finance and Economics from Boston College, an MBA from MIT Sloan.Noor is the Founder and Managing Partner of Global Ventures, a UAE-based, Series-A focused, emerging-market venture capital firm with presence in Egypt, Saudi Arabia and Nigeria. With $200 million AUM, and financial returns rating it as a top decile fund, Global Ventures has become a leading investor across the Middle East and Africa.

Since its inception in 2018, Global Ventures has completed 50 investments across ten markets, deliberately focused on sectors positively affecting millions of lives across the world, such as FinTech, Digital Health, EdTech and AgriTech. In addition to generating top decile returns, the portfolio has had a demonstrable impact on millions of lives through its company founders creating 7,200 jobs, enabling female leadership, powering financial inclusion for over 27 million people and expanding healthcare access to over 4 million patients.

Prior to Global Ventures, Noor was the first woman to operate, scale and IPO a company in the MENA region, listing Depa on NASDAQ Dubai and the London Stock Exchange for US$1.1 billion in April 2008. One of the world’s largest interior contractors, Noor scaled Depa tenfold, expanding operations from six countries to 22, including four cross-border acquisitions.

Identified by Forbes as one of the “World’s Top 50 Women in Tech” and by Arabian Business as one of the “Most Influential Arabs”, Noor's previous roles include Chief Investment Officer at The Dubai Future Foundation and a Founding Partner at Leap Ventures. Noor also founded the largest chain of yoga and pilates studios in the Middle East, ZenYoga, which was acquired by Cedarbridge in 2014.

Noor is an active, independent board director of Clue, the largest femtech company in Europe, and VAM Acquisitions Corp., a US based special purpose acquisition vehicle focused on the space ecosystem. She is the Founding Chairwoman of the Middle East Venture Capital Association, a Director of the Global Private Capital Association, TechWadi, and the Karman Fellowship.

She is a member of the Aspen Global Leadership Network and a member of the World Economic Forum’s Young Global Leaders. She previously held Board Director roles at MIT Sloan and was a founding board member of Endeavor UAE.

Noor holds Bachelors’ degrees in Finance and Economics from Boston College, an MBA from MIT Sloan.