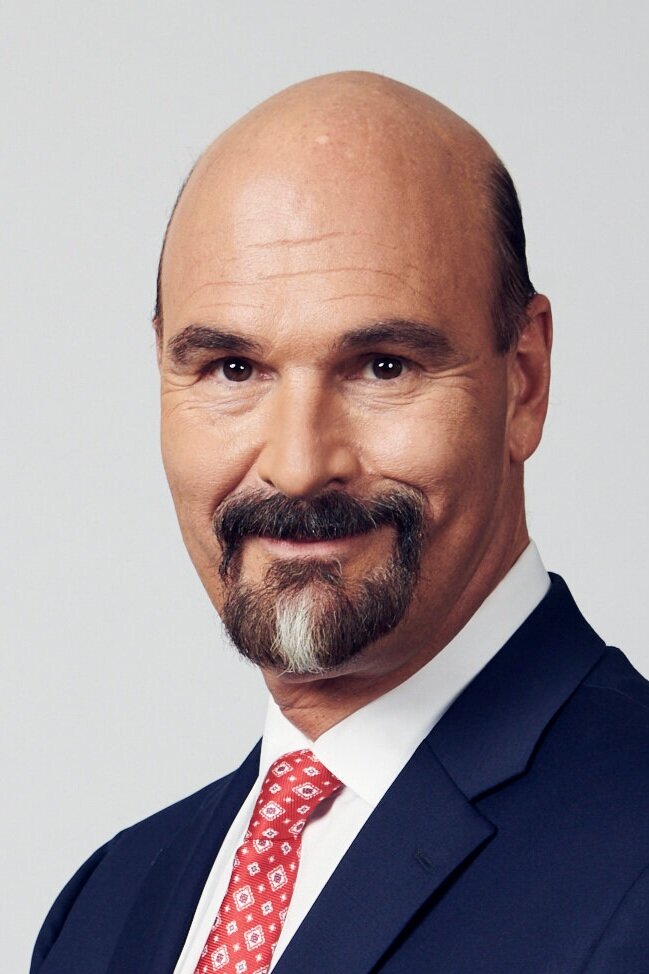

Distinguished Visiting Fellow, The Heritage Foundation

Stephen Moore is a distinguished visiting fellow in economics at the Heritage Foundation, the largest private research institute in Washington, D.C.

He served as a senior economic advisor to the Donald Trump for President campaign where he helped write the Trump tax plan and worked on energy and budget issues for candidate Trump.

Moore is also a senior economic analyst with CNN, where he provides daily commentary on the economy, fiscal policy and politics. From 2014- 2017 he served as a Fox news contributor.

From 2005 to 2014 Moore served as the senior economics writer for the Wall Street Journal editorial page and as a member of the Journal’s editorial board. He is still a regular contributor to the Journal’s editorial page.

He is a frequent lecturer to business, investment and university audiences around the world on the U.S. economic and political outlook in Washington, D.C.

From 1999-2004 Moore served as founder and President of the Club for Growth, a 25,000-member organization dedicated to helping elect free market, tax cutting candidates to Congress. In his tenure as president, the Club for Growth became one of the most influential and respected political organizations in the nation. In 2003-04 the Club for Growth raised nearly $22 million for Republican congressional and Senate candidates, making the Club the biggest single money raiser for Republican candidates outside the party itself.

In 2007 he received the Ronald Reagan “Great Communicator” award from the Republican party for his advancement of economic understanding.

Mr. Moore has served as a Senior Economist at the Joint Economic Committee under former Chairman Dick Armey of Texas. There, he advised Mr. Armey on budget, tax, and competitiveness issues. He was also an architect of the famous Armey flat tax proposal.

From 1983 through 1987, Mr. Moore served as the Grover M. Hermann Fellow in Budgetary Affairs at the Heritage Foundation. Mr Moore has worked for two presidential commissions. In 1988, he was a Special Consultant to the National Economic Commission. In 1987, he was Research director of President Reagan's commission on Privatization.

Mr. Moore is the author of 6 books. His latest book is “Trumponomics: Inside the America First Plan to Revive Our Economy.” His previous books include: “Fueling Freedom: Exposing the Mad War on Energy” by Regnery. He is also author of “Who’s the Fairest of Them All? The Truth About Taxes, Income and Wealth in America” published in 2012 by Encounter. His previous books include most recently Return to Prosperity: How America Can Regain its Economic Superpower Status.“ That book was a finalist for the F.A. Hayek book award for advancing economic understanding. His books also include: “Its Getting Better All the Time: The 100 Greatest Trends of the Last Century,” and “Government: America’s Number One Growth Industry.”

Mr. Moore is a graduate of the University of Illinois and holds an MA in Economics from George Mason University. In 2010 he was awarded the University of Illinois alumni of the year.