How Crypto Changes Everything: The Future of Finance & Culture with Sam Bankman-Fried, Chief Executive Officer, FTX. Kevin O’Leary, Founder, WonderFi. Anatoly Yakovenko, Founder & Chief Executive Officer, Solana. Jeremy Allaire, Co-Founder, Chairman & Chief Executive Officer, Circle.

Moderated by Kristin Smith, Executive Director, Blockchain Association.

SPEAKERS

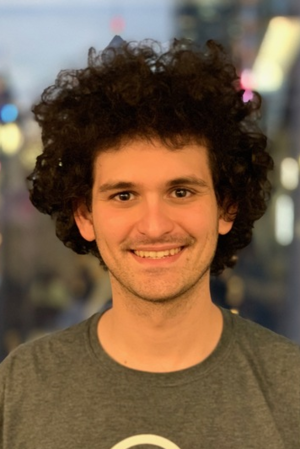

Sam Bankman-Fried

Chief Executive Officer

FTX

Kevin O'Leary

Chairman

O’Leary Ventures

Anatoly Yakovenko

Founder & Chief Executive Officer

Solana

Jeremy Allaire

Co-Founder, Chairman & CEO

Circle

MODERATOR

Kristin Smith

Executive Director

Blockchain Association

TIMESTAMPS

EPISODE TRANSCRIPT

Kristin Smith: (00:07)

All right. Well, good morning everyone. We have a fantastic panel here this morning. I feel like any one of these speakers could be a keynote at an event like this, so really honored to have them all on stage together. So we have a very bold topic, How Crypto Changes Everything: The Future of Finance & Culture. I think for those of us who work in the crypto industry, we really do see on the horizon that crypto networks and the tokens involved with them are incredibly powerful and are going to change the way we do so many things. Not just finance. So very excited about the discussion today. Real quickly, I'd like to introduce everybody then we'll dive right in. I'm Kristin Smith, I'm the executive director of the Blockchain Association, which is a trade association based in Washington, D.C.

Kristin Smith: (00:59)

We work on crypto policy is on behalf of the crypto industry. To my left here, we have Sam Bankman-Fried. For those in the crypto space, this man needs no introduction. He is one of the youngest brightest minds in this space. I also super love his personal style and his hair FTX that is a crypto derivatives exchange. And then FTX US, which is the U.S. component to that. And he's also co-founded Alameda Research. To his left we have Anatoly Yakovenko, who is the founder and CEO of Solana Labs, which is the creator of the Solana blockchain, which for those of you who follow crypto prices, last week everything was down double digits, but so Solana tokens were up. It's been an amazing ride for Solana. They're definitely having a moment right now, very exciting.

Kristin Smith: (01:54)

To his left we have Jeremy Allaire who I've had the pleasure of knowing for several years now. Jeremy is the CEO and founder of Circle which is founded way back in 2013. So they've been around for a long time. Circle helped create USDC, which is a dollar backed stable coin, which is very important for many of the DeFi applications, which we'll get into later today. But also one of the founding members of the Blockchain Association. So wouldn't be here without Jeremy. And last but not least, we have Kevin O'Leary who is many of you probably already know is the co-host of Shark Tank. But also has become a recent convert into the cryptocurrency space and has is a primary investor in a platform called WonderFi, which aim to bring DeFi to the masses.

Kristin Smith: (02:43)

So really a fantastic panel. One quick thought before we get started is several years ago, Mark Andreson wrote a very famous piece I believe it was in the Wall Street Journal that said, "Software is eating the world." Crypto is software and as a good friend of mine Amanda Casa pointed out to me last week. That means crypto is eating the world. And I think what our conversation today will hopefully help you hone in and grasp this point. So with that, why don't we start with you Sam, I want to talk about culture a little bit before we get into the finance piece. FTX has engaged with some major celebrities before we get into how crypto's impacting culture. Can we talk a little bit about how culture is impacting crypto and what you see that role is in bringing crypto to the masses?

Sam Bankman-Fried: (03:36)

Totally. Thanks for me, first of all. When we think about where crypto is today, and I think even more so where FTX is, were one of the newest crypto platforms, certainly the newest of the large ones. We are really proud of what we built and I think there's a lot of exciting things going on in crypto and despite all the adoption that we've seen for the ecosystem over the last few years, it still is touching a pretty small fraction of the world. When you put it into context, a pretty small fraction of transactions are happening through crypto, a pretty small fraction of people transact with crypto in any ways. And so I think a lot of what we've been thinking is like, what are ways that we can take what we see as an exciting growing set of products in industry, and introduce them to tens of millions of people in a way which doesn't dilute the brand, but instead strengthens and underscores it.

Sam Bankman-Fried: (04:37)

We've been working with Tom Brady, you've been working with Stuff Curry with Major League Baseball with TSM and others. And I think that a lot of what we're looking at there is how do we get tens of millions of people engaged with the cryptocurrency ecosystem? And we could buy tens of millions of Facebook Ads. And I don't know, maybe we should, at some point, we'll hire a team to look into whether that is worth doing, but that's not a thing which is going to really make the same sort of impact on people. Anyone can potentially do that.

Sam Bankman-Fried: (05:14)

And instead what we've really been looking for, like who are partners that we're really excited about and are really excited about us? Who can help represent us and who we can really work with in a way to build something stronger and more powerful than what we had. And I think I'll let him talk about more, but we've been working, with Kevin as well on this, which we're really excited about. And on other [Madison 00:05:45] work have been working with Jeremy and Anatoly on the product side a lot, which has been super exciting too.

Kristin Smith: (05:52)

Awesome. Anatoly maybe we could go to you for a second. I always thought of Solana originally, which by the way, I had heard about for the first time from your son, Jeremy, who told me to buy it like 18 months ago. And I really regret not doing that.

Anatoly Yakovenko: (06:08)

Think you heard about from me.

Kristin Smith: (06:09)

But in Anatoly, when I first thought abouts Solana, I thought of it for decentralized finance or I applications, but it turns out it's also been a great place for NFTs. And actually just like over the weekend, there was an NFT that was sold on Solana that was valued at over a million dollars for the first time. So, super exciting. Can you talk a little bit about what the role of blockchains is on culture and how artists are getting involved and some of the cool things that you're working on there?

Anatoly Yakovenko: (06:40)

For sure. I think the beauty of this technology is that it really gives the tools for artists to scale their work globally, without depending on traditional finance infrastructure, where if you're an artist that wanted to sell paintings, hundred million dollars worth of volume of paintings, you would need galleries lawyers, legal support in every jurisdiction in the world. And that's just a huge ask. For an up and coming artist. You really need to build up to that level, but with blockchain, those rules are enforced with software and they're unbreakable. So somebody that catches the right idea at the right time can spend maybe a day, maybe it took him like years to build this, but if they release it on chain, they're guaranteed that the financial support that they need is already there, and it's free. And the code and the infrastructure that is based on blockchain is designed to really give us much value to the artist as possible and extract the least amount of value from the process. That's really the goal of this technology is how do you eliminate the sand and the gears?

Kristin Smith: (07:56)

So Jeremy NFTs are for much more than just artwork. Can you talk about some of the other types of assets that can be incorporated into NFTs and then also what Circle is doing to help empower some of these businesses?

Jeremy Allaire: (08:10)

Sure. Yeah. I mean, I think the way that we look at it, I mean, the general concept is crypto's really good at proving a record, it's great at establishing providence of ownership and allowing that ownership to be highly liquid and exchangeable and tradeable. And I think a lot of people years ago, if you remember the interest in the space was like, how do you tokenize real estate? Or how do you tokenize stock in a company or real world things? And I think what NFTs really represent is that the friction is pretty high when you cross over into those established kind of juries, sort of legal frameworks, but with intellectual property, especially digital intellectual property, the barriers are super low. And so it's naturally, I think the first place where you're seeing this really explode, and that obviously is finding it's way in particular creative expression, creative outlets, but it's now moving into other arenas.

Jeremy Allaire: (09:12)

So owning moments, owning entitlements, owning brands that are attached to entitlements, all these kinds of things that were hard to do are now really easy to do. And so there's just a huge amount of experimentation beyond that. And I don't know if I have it right Sam, but I think you could buy like a pair of FTX socks that includes a lunch with you, or so something like that, but something like that, pretty powerful stuff. But in all seriousness, I think what we're seeing is just lots and lots of people who are trying to take lots of categories of intellectual property and digital intellectual property and represent that using this methodology.

Jeremy Allaire: (09:54)

And so what we're doing I mean, basically, I mean, we provide payment and treasury infrastructure for digital currency applications, for financial applications. And one of the very fastest growing categories is just people building different types of NFT apps, NFT markets, these kinds of things. And we're really just trying to make it really simple and seamless for people to go from the legacy fiat system into actual digital currencies. So you can transact in these markets and transact with these items. So we're a bit of a arm supplier to all the different people who are trying out lots of different stuff in creating NFTs.

Kristin Smith: (10:27)

So Kevin, as a bit of a cultural icon yourself, what brought you to crypto? It seems that this wasn't something you were always bought in on. What changed your mind and what makes you excited about this space?

Kevin O'Leary: (10:40)

I was a very vocal non advocate back in 2017 because I'm forced to live in a world. I service pension funds and institutions with indexing. We are a 100% compliant, 100% of the time. And my first purchase was not in our operating company. I just bought some Ethereum and some Bitcoin in a wallet myself back in 2017. And one day just talked about it on television, on business press. And my compliance officer called me up while I was still in the green room saying, "Are you outta your mind? Are you out of your mind? We cannot have this dialogue because we're going to get a call." And sure enough, we did. And what's changed is the regulatory environment because I don't have the option to be noncompliant. I don't even have that at all, but slowly and surely in other jurisdictions first Switzerland, Germany, France, Australia, England, Canada, which has allowed ETFs now with Ethereum and with Bitcoin.

Kevin O'Leary: (11:53)

So I changed when the regulator changed and I'm very interested in crypto now as an asset class and in my world, let's say you're running a billion dollar mandate, which is a typical mutual fund or ETF or whatever. And generally, if you're compliant with your own compliant department, there's 11 sectors in the S&P for example you're allowed to go up to 20%, in one sector and up to 5% in any one name, that's generally how it works. I argue today that crypto is the 12th sector of the S&P that's what it is. It doesn't mean I have to have everything in Bitcoin and I don't want to have everything in Bitcoin.

Kevin O'Leary: (12:38)

I want to have a portfolio of crypto coin, chain, tokens, whatever is compliant, and what's going to happen here and what we need to do and why I'm so happy. We have these dialogues and these conferences think about the typical institution every night at 4:01, they mark to market every position they have, the internal compliance department sees it, how much leverage is used, what the positions are. Is it within mandate? Not over 5%, whatever it is. Then their external auditors come in on a weekly or quarterly or annual basis and sign those auditing statements. Then they issue that report to the regulator. We don't have that infrastructure in crypto right now. On this stage there's two guys trying to do it, Sam and FTX and Jeremy here with Circle. And I'm definitely involved with both of them because I want to be getting that, but it took me months just to get my first purchase done on Circle with my own compliance department barking at me like a dog saying, "No, no, no, we can't do this."

Kevin O'Leary: (13:44)

And I'm saying, we got to do it. We got to get there. We have to figure it out. And my auditor and the regulated reports we going to put out and it's working same with Sam. I want to build a portfolio in FTX, because it's big enough that I can be compliant. I'm saying to everybody on this, if we solve this, there's trillions of dollars coming into this in the 12 sector of the S&P that's what it's going to be. So that's our job. We got to solve for compliance. It's boring, but it really matters.

Kristin Smith: (14:14)

Well. Yeah. And as somebody who's on the ground in Washington, looking at the regulatory side we have had some great progress, but there are still some things that if we could clear up, I think, would address that misconception that many compliance teams have. So well, why don't we pivot then into financial services a little bit because we do believe that finance is one of the first places that we're seeing crypto networks have an impact. And maybe we'll start actually with you Anatoly, can you talk a little bit about Solana and why it's different from other blockchains and what are the types of decentralized finance services that are being built on top of Solana?

Anatoly Yakovenko: (14:59)

Sure. In a lot of ways, Solana is ideologically very close to every other blockchain, it's a decentralized ledger that records AMP that has happens on it. The differences in terms of the architecture, how it's built is it's designed for speed. It's a technology. And when I think of technology, I think of Moore's law, Intel, the folks that build chips that are faster and faster every two years, if you're building a technology then as those guys make progress, your technology should get cheaper and faster. And this is the core thesis of how we architected the whole thing. Is that every two years when Intel, AMD ships a faster and cheaper chip than the network itself gets twice as performant, has more bandwidth, more capacity, and the cost to users should drop accordingly. And that's really the thesis of it.

Anatoly Yakovenko: (15:55)

Can we build a network that extracts the least amount of value from the applications running on top of it? And the rest is a high performance operating system that in my case, I spend my career at Qualcomm building brew and a bunch of mobile operating system. A lot of the ideas that went into developing those are now being developed on top of Solana. And we see it as a technology that is very well aligned to the tools and development practices that were prevailing at places like Apple, Intel, Google and stuff like that.

Kristin Smith: (16:31)

That's very cool. Sam, you own an exchange, you own a derivatives exchange in crypto exchange. But you've also been involved with Project Serum, a decentralized exchange. Can you talk a little bit about that and how that works and maybe to slowly ease into the regulatory conversation any sort of regulatory concerns you have around that?

Sam Bankman-Fried: (16:54)

Yeah, so really the genesis for that was, we started looking at DeFi a year ago. Well, I guess a year and a half ago now. And what became clear really quickly was that first of all, there were some really cool things going on in DeFi. And I think just to illustrate part of that, if you have a DeFi protocol which basically it's a company or a program, or some protocol, some system, which is built entirely into a blockchain, it's all transparent. It's 100% transparent, it's 100% predictable, what will happen given how people interface with it. And that means that if a third party comes and wants to integrate that protocol they can, and you can get potentially the sort of exponential explosion of creativity and innovation because all of these different parts can be composable into each other.

Sam Bankman-Fried: (17:48)

If you build a borrow lending protocol, then any other protocol on that blockchain can integrate it natively in which just doesn't work in centralized finance in the same way. And so it was really cool. There's a ton of hype around it. And it also absolutely sucked to use, it was unbelievably bad. And I think for those who haven't used DeFi and a lot of those who have it's worth just running side by side a DeFi protocol in a centralized one, just reminding yourself of how painful it sometimes is. And the reason is it was taking five minutes to finalize a transaction because the blockchain was completely overwhelmed. It cost $50 to click a button because you had to outbid everyone else trying to get their transactions in. And what became clear really quickly was that scaling the problem of scaling a blockchain wasn't one of the 17 constraints on a blockchain. It was the single blocker to mass adoption.

Sam Bankman-Fried: (18:54)

You cannot have a billion people using a chain that has 10 transactions per second. It just doesn't work. There's no two ways around it that map doesn't work. And in order to take these programs and scale them to masses or even scale them to a single large enterprise, you needed to get into tens of thousands, hundreds of thousands, millions of transactions per a second just take your favorite big enterprise. Whether it's a protocol, a company, a messaging protocol, whatever, it's going to have a million transactions a second, that's what it means to have a billion users. And you needed a blockchain that could keep up with at that. So we just had phone calls with a lot of blockchains.

Sam Bankman-Fried: (19:33)

And I don't know, our call with Solana was very different than our calls with other blockchains, one of the first things that Yakovenko said was, "Hey, we've been thinking about how many transactions do we need to do things like we want to get wherever we need to get? And like, here's where we are now. And here's a place you can go test it out." And so anyway, what I'm think I'm really excited about is a lot of the applications that bring built on so Solana and it's one of the few places in DeFi right now where you can see it scaling to a billion users and it's not there right now. It probably has another factor of what, 50 to go or something.

Sam Bankman-Fried: (20:16)

But that's a lot better than a factor of 50,000. And like Anatoly said, one of the foundings or principles of Solana is that it gets better over time, that it gets better with Moore's law, that it has an ambition to be able to service billions of users with millions of transactions per second. And we just see that sort of the holy grail of what DeFi could become. And so we've helped people build out Dexus on the Solana blockchain, serum being one of them. I don't know, as I've invested in a number of projects on the Solana blockchain in the serum ecosystem. We've worked a lot with Jeremy, Circle has added Solana support for USDC stablecoin, which now all of a sudden you have a massively scalable, stable object that can act as a pricing reference and pricing currency for transactions happening and for payments happening on Solana.

Sam Bankman-Fried: (21:17)

And again, you go to a payment company and you're like, "Hey, can you try to integrate crypto?" And they're like, "Great, we have 17,000 payments per second in this subclass that we'd like to test out on your network. How does that sound?" And your answer, but be like, "Yeah, we can make that work rather than can you try 17 without the thousand." And that's really where it all came from. Nothing is there yet. No DeFi protocols are at the level where centralized protocols have to be quaking in their boots because they're going to be overtaken tomorrow, but that's not the goal. The goal is moving, making progress and building the fundamentals and the infrastructure is something that could get there, that could get to a point where real large systems decide that it is the correct decision for their business to build on a blockchain. And I think up domestically we're a year or two away from getting real adoption there. If the industry builds its products right, plays its cards right. And I'm really excited about that progress.

Kristin Smith: (22:20)

Yeah, no, I think when I'm in Washington and I'm talking to policy makers, they're like, "This stuff, isn't useful. There's nothing that anyone's actually doing with this, is improving their lives." And I'm constantly having to reframe the conversation to this is still early stages, and there's a lot of great development that's going to lay the groundwork for all of these things to come. But Jeremy why don't you tell us a little bit about USDC and stable coins and what their role is both on the payment side, but maybe also as they work with the decentralized finance world. Because I think as Sam alluded to there is a lot of use of USDC in the world of DeFi.

Jeremy Allaire: (23:04)

Yeah, sure. I mean, I think the problem that we set out to solve was even when starting the company and then eventually when the technology got to a point where you could actually build something like USDC was, how can you build a protocol for dollars on the internet? How can we actually have something akin to being able to have photos like JPEGs on the internet or music files or streaming video, but actually have a protocol where anyone anywhere connected to the internet, can transact with anyone else anywhere. With the backing of something like a dollar and that technology really only became viable with second generation blockchains to do it well. And that's when we introduced, we started working on it four years ago and introduced it a few years ago, but a lot of people asked, "Well, what's the use case for this?"

Jeremy Allaire: (23:53)

And my use case is what's the use case for a dollar? And so I really think that it's actually going to have more use cases than existing dollars because you can do more things with a digital currency dollar than you can with a traditional dollar. And we see this even today, you see micro payments for a piece of digital intellectual property on a network, like an NFT on Solana to people who are using this to settle billion dollar trades and everything in between. And I think there's been boots strapping of this in the capital markets function of crypto. And so it's been really, really important for people who are trading to have stable settlement, irreversible settlement around the world. And I think that's been really key and we're just now as Sam was pointing out and really looking at infrastructure like Solana as well, we're really just now getting to a point where this can now start to be connected to everyday payments.

Jeremy Allaire: (24:49)

And if you have a way to I mean, the USDC on Solana today, as an example, you can settle a transaction in milliseconds, several hundred milliseconds. It has throughput to handle like real consumer scale applications and a tiny fraction of ascent. You that's incredible. And that's not with the centralized network, that's running on a decentralized infrastructure. And so I think we're just now starting to see, and we're seeing this in our own business, mainstream institutions, whether they be financial institutions, FinTechs, consumer companies, commerce companies connecting up to this. And I think that's tremendously exciting. And I think the timeline of one to two years is right in terms of when this will reach many, many hundreds of millions of people and then eventually billions of people. So I think we're making progress.

Jeremy Allaire: (25:33)

And then the payment utility piece is great and I think our vision has always been that payments is just going to be a commodity free service on the internet. There's not really going to be a business model and payments in the future. It just like, there's not a business model for transmitting data or emails or things like that. Those are just commodity free services for everyone. And the real value is going to be once you have hundreds of billions or even trillions of dollars in these stable value, digital currencies that they'll be used in capital allocation, capital markets, they'll be used really, really broadly in a lot of other applications. And so I think part of what we're excited about is all these building blocks in decentralized capital markets infrastructure, which is what like serum represents and so on are starting to come online and will be major, major uses of this in the coming years.

Kristin Smith: (26:25)

Kevin, tell us a little bit about WonderFi and how you see a roadmap for bringing DeFi from this early stage to something where a consumer can actually go and get a loan or do some financial service without going through traditional intermediate?

Kevin O'Leary: (26:44)

Well, what I hope WonderFi becomes and I'm very proud of it. The genesis of it is that it's a use case in our operating company. About 18 months ago, we reduced our exposure to commercial real estate and it generated a lot of cash. And we went to our cash desk and said, what can we do on short duration? And they said, 20 basis points, 21 basis points. Inflation is 2%. So that was the first time I said, wait a minute, this isn't going to work. And we started to look at platforms like FTX and Circle to try and solve for that. That's what got me into stable coins, because we started to explore that. But if you are a consumer and you are 18 years old, and you're making zero in your bank of whatever account, and you want to actually get some yield that keeps pace with inflation, you can't do, it's not easy to set yourself up unless you're really out there in the crypto community.

Kevin O'Leary: (27:46)

WonderFi is going to attempt and I think it's going to do a great job to really simplify this for anybody, an app based product, you download it, you ACH X dollars into your account. It writes the contracts for you. It generates the 1,099 for compliance. It does everything you have to do to stay compliant, even as a regular individual being taxed in whatever jurisdiction you're using it in. And that's the beginning of it. I'm very fortunate I took it public a couple of weeks ago and now it was well received. It's one of the very first public DeFi consumer platforms in the world. It's in Canada, where the regulator is very accommodative. It will soon be in Germany and we will continue to do it around the world. And then have the different use cases for it. I'm very interested in NFTs for example, but not every NFT, I'm investing in NFTs for high end watches.

Kevin O'Leary: (28:47)

There's a community of people out there that have billions of dollars tied up in watches. They're all insane. I'm one of them. And we want to be able to have a way to authenticate our inventory of ones we own with a maker of proving it. I want the WonderFi app to also be able to allow people to easily own those NFTs without knowing anything about how to set up a wallet or anything else. It's attempting to simplify it. Now, I'm very fortunate I have a very large social media following. I'm getting a lot of feedback from our base, Josh Richards who's a phenom on TikTok is an investor, as well as Sam. I think he supports some democratization of this and we're very excited about where this is going, but it's really about simplifying it and making it really easy.

Kevin O'Leary: (29:41)

I mean, we're all in tuned and excited about crypto, but it's not easy to use. And it's nearly impossible to be compliant. You cannot afford not to disclose your capital gains and your income, if any, to the tax man, I don't care if you're 18 or 84, I'm the compliant guy. I live in that world saying, okay, how do we get the forms out? How do we get the 1090s? How do we make sure these people never get in trouble? That's the value of WonderFi.

Kristin Smith: (30:12)

Well, in the last third of the conversation here, I do want to talk about something you brought up earlier Kevin, and that's the regulatory issues, but maybe we'll start with Sam. Sam, where do you live and why?

Sam Bankman-Fried: (30:26)

It's a good question. And I grew up here in the States. I worked here in New York for a number of years for Jane Street had a great time there. I was in the Bay Area till 2018 and then spent a bunch of time in Hong Kong. And the context there are a number of pieces of it. One of which is that crypto is really a global business. And there is a U.S. economy there's an Eastern economy, there's a European economy, there's an African economy. And especially, I think coming from a Western background, it was really important to be able to meet a lot of people in person to form those connections and those relationships to build up a multicultural team that could help understand where different users are coming from.

Sam Bankman-Fried: (31:33)

And I think you see really different demands and use cases from different parts of the world. I think, especially if you have less trust of banks in a country, you're going to start to see a lot of demand for an alternative way to store your assets. And I think that that creates very different dynamics in different places. We've recently been building out our offices in a number of places in Bahamas Gibraltar. And we also have a U.S. operation, which is at this point, biggest offices in Chicago, I've been flying between them because helping to foster the international exchange, helping to foster the U.S. exchange. We've hired a really great leadership team there with Brett and Ryan and others. In Chicago, I've been a little more stuck than I wanted to be recently because of quarantine and COVID as the world, hopefully it will open things up.

Sam Bankman-Fried: (32:39)

I have to be mobile one way or another. We're frankly trying to decide where the right places are to have the bulk of our workforce. And I think that the factors that are going into that basically are a combination of who's taking the lead on crypto regulation? Who's taking the lead on licensing? We have licenses, a number of jurisdictions and we are applying for licenses in a number of other jurisdictions. And I think getting to your question here, that's a really important piece of this is right now, many, many regulators are looking hard at crypto. And I think some of them are taking the lead on building out regulatory frameworks. Some examples that obviously the MAS in Singapore we've been in discussion in Singapore, been working on licensing, we don't have one, but we've started that process.

Sam Bankman-Fried: (33:31)

We've been in the United States, recently acquired a features exchange license through [inaudible 00:33:41], which we're really excited about, really excited about the paradigm the CFTC has, I think built for a while there. And I think it's been sort of living a little bit below radar. But I think that could be a huge piece of the industry going forward because it allows for futures and frankly, a lot of other contracts and you look at what call she has built on top of LX through the CFTC regime with event contracts. We're really excited about that. And there are a number of other regulars who are popping on the map.

Sam Bankman-Fried: (34:14)

And so I think basically the biggest things we're looking at actually are where is their licensing? And I think especially actually, there are a lot of countries that have started the licensing process, but haven't yet built licenses that can accommodate futures or derivatives that haven't built licenses that can accommodate a lot of the types of products that frankly are the bulk of volume in every asset class. And then frankly, honestly, quarantine's, I important to us to be able to get employees into a now future jurisdiction. This is not something we were thinking about three years ago when we were choosing office locations. It's now like our number two criteria. Can we get people basically into the country if we can. It's hard to hire. It's hard to grow.

Sam Bankman-Fried: (34:57)

And I think that that's becoming one of our top criteria for where we're going to be building out offices, where people are going to be moving and frankly that's changing on a monthly basis. It's pretty frustrating not to have sort of long term clarity on that, but those are the factors I think, going forward. And I'm going to be help building out our regulated offices is in probably four or five jurisdictions over the next year.

Kristin Smith: (35:27)

Okay. Jeremy, Circle is one of the most regulated crypto companies, I think in the United States you have just about as many licenses as anyone has. Can you talk a little bit about your regulatory structure that you have to deal with? But then maybe also talk a little bit about, there was some news last week that Coinbase announced that they aren't going to be moving forward with their lend product, which was related to USDC maybe give your thoughts on that. And I know Kevin, you have some thoughts on that as well.

Jeremy Allaire: (35:59)

Yeah, sure. I mean, I think when we got started in 2013, there was zero regulation. But the Treasury Department had basically said, "If you're going to sit at the intersection of the banking system and virtual currency, as they called it, you needed to be a money transmitter." So that was the first thing we did is we went out and got licensed in all the states as a money transmitter, the sort of first crypto company to get all those licenses. And then New York had a special license called the bid license and we got the first bid license. And then we did the same thing in Europe and went after an e-money issuer license. We also operate a broker dealer and then ATS. So those are a few of the things, and then an international entity, a couple international entities that are licensed as well.

Jeremy Allaire: (36:45)

But I think the big thing is regulation around global scale stable, coins is definitely a moving target. The framework for electronic money, and mission and stored value money transmission, I think has been a good one. But clearly as these go from tens of billions to hundreds of billions to potentially trillions of dollars of value, banking regulators and national regulators are looking a lot more seriously at it. And so that's one of the reasons why we're in the process of preparing an application to be a national commercial bank but we're interested in full reserve banking, not fractional reserve banking. And so there's a journey ahead for us on that. But I think the reality is as these get used at scale and if other financial institution want to build on top of this and do that at scale, that structure is definitely going to evolve we think certainly for centrally issued stable coins like USDC.

Jeremy Allaire: (37:50)

I think there are a lot of other major regulatory issues in the space, not just related to payments and banking, obviously exchanges and securities and all that fun stuff. But I think that maybe ties in, we all know that and referencing Kevin's comments as well. There's been a rapidly growing lending and borrowing market in USDC itself and in other crypto assets but USDC has become a really common form of digital currency to borrow and lend, and that's really grown significantly. So we have a product which is a yield service that's available exclusively to businesses, so we're not offering it to retail individuals.

Jeremy Allaire: (38:39)

But our view is that if you're going to offer a product where people are essentially making an investment and getting essentially like a fixed income type product, that that's a security. So we designed and launched our yield as a security and it's exclusively available to accredited businesses and it's offered through a regulatory regime as well, where there's a supervisory framework around it and around the risk management. And I think for these markets to really take, hold and get scale, and if you really want this to be something that is ultimately grow into tens or hundreds of billions of dollars of borrowing and lending, it's going to have to fit in those kinds of models. I think that's somewhat different than of the retail products that are out there.

Kristin Smith: (39:27)

Kevin, did you have any thoughts on the Coinbase news last week?

Kevin O'Leary: (39:31)

About regulators?

Kristin Smith: (39:32)

The regulators.

Kevin O'Leary: (39:34)

Yeah. I would make this comments. Somehow over the last, I don't know, two years the popular press position, the crypto community as an adversary to regulators globally, and that's simply not true. And it's very stupid because probably some large percentage of the constituency in this room is somehow tied to financial institutions one way or another. And we have not even tapped. There's so many institutions that don't even play in this space of although they want to. And the primary reason is their compliance departments and the tone of that relationship between the crypto community and the regulator. And every week, we hear another case of somebody in a position of power let's call it that that's running a large crypto company striking out at the regulator really bad idea.

Kevin O'Leary: (40:38)

There is zero upside in that, because the regulator wants to solve for this because this, and I'll say it again. It's going to be the 12th sector, the S&P there's no question about it. It's not going away. And the demand is huge. The tone should be that of accommodating their concerns. I'll give you an case study this NFT investment I'm making in watches. Is it a security, or is it a piece of art? I can't go forward until it's resolved. I can't just throw it out there and start trading it all over the place, not knowing that outcome. And so I'm willing to reach out as an advocate to that one little sliver of NFTs and say to the regulator, "Give me guidance. Let's work together."

Kevin O'Leary: (41:23)

And if it is security, tell me I'm good. I'm good with it. I will treat it that way. I'm not fighting you on it. Just give me the rules so I can play football. You can't play football without the rules. And that's where we're at here. And the upside to solving this problem is trillions of dollars of assets that will pour into this. You want to see Bitcoin at a $100,000? You got to let the regulator determine what terms they'll allow it to go into an ETF. It's that simple. Look, what happened in Canada. They got a billion dollars demand in a matter of hours in just the first Bitcoin product. And it wasn't even institutional. It was just simply retail saying, "Oh, it must be safe. I can buy it and put it in my count online." And the regulator said, "It's okay." So my thing is, as a community, we have to form a lobby voice and say, "We are here to serve and protect just like you are, give us the rules so we can go back and play football." That's simple.

Kristin Smith: (42:29)

Well, and as that voice we represent 50 companies in watch, Washington, D.C. that are part of our trade association. And we do go and speak with regulators and are actively trying to bring ideas to them. That makes sense. Because what we don't want is to just put regulation on this new system and that doesn't address the actual risks, but we need something that is appropriate and gets the same goals, but doesn't in a way that's that makes. But one of the things that we focus on when we're interacting with regulators is it's very important to distinguish between the people developing the software and yes, crypto does have centralized intermediaries that are interacting with customers or taking custody of funds. But Anatoly can you give us your thoughts as you guys have built out and your company has helped contribute to these projects? Have you had regulatory concerns or do you feel that you're free to do what you want without having to think too much about regulation?

Anatoly Yakovenko: (43:30)

The challenge, I think it really hits teams that are trying to build and innovate in the space, like the example that Kevin brought up this idea that at 401, they check all the positions and check leverage and manage risk. Two guys built this as a smart contract. It runs on Solana. Those checks happen every 400 milliseconds and they balance a bunch of lenders and a bunch of borrowers without ever taking custody of the funds. It's just a bunch of software. So what does this team do in terms of regulation? How do they define the risk for themselves as founders? Where should they base their product out of, which jurisdiction? So if you're a startup and you just raised a really successful one and a half million dollar seed raise, which is massive amounts of runway for two, three people and the compliance in the U.S. is going to cost you 3 million compliance, somewhere else is going to be much, much cheaper, those folks are making those choices every day.

Anatoly Yakovenko: (44:32)

And that's really, I think the risks aren't that these products are not going to get built. They're going to get built because they're awesome. It's that they're going to get built elsewhere. And that's really, me as somebody that's been living in United States since my family were refugees from the Soviet Union in '91, that's really sad for me to see, I just want all this stuff happen to happen here.

Kristin Smith: (44:57)

We only have a couple minutes well left, but I want to do one more quick question before we get some final thoughts from everybody. How do we see in maybe 30 seconds or less the traditional finance world, or I guess tradfy, is that what we're calling it these days? Will they be embracing DeFi or is that going to be attention between those two worlds, but maybe just quick answer Sam.

Sam Bankman-Fried: (45:26)

I mean, I think there's a lot of work that has to be done before that decision can even be made. I think that right now DeFi isn't quite ready. I am optimistic it will be in the next couple years. Once it does, I think you're going to see companies decide that they are best off working with decentralized ledgers. I think we've already started to see those. I mean, you've seen Visa as an example, really embrace blockchain technology in a large number of ways. And they've seem to have made the decision that they want to try to find a way to work with I think emerging technologies and grow stronger from it.

Sam Bankman-Fried: (46:09)

I'm guessing you're going to see a number of companies make those statements. I'm guessing you're going to see a number of companies not make those statements. And I think that's going to be a task way of saying maybe they're not going to be actively fighting against crypto. But they're not a planning to work with DeFi, they're not planning to work with blockchain and they're going to be trying to hold their turf there. I think you're just going to see a split depending frankly, on gut calls from the leadership of lot of different companies with some going in one way, some going in another way it's going to be messy.

Kristin Smith: (46:43)

I see only have about five minutes left, so I'm going to just cut to the last question which I want to ask of everybody. Maybe we'll start with you, Kevin. So what is your prediction for where we will be 10 years from now, in the crypto space since it's going to change everything?

Kevin O'Leary: (47:03)

Let me tell you the one of the I'll make it short and sweet. Let's say a traditional mandate such as I want to go long Europe. I'm going to buy 50 stocks. I have to buy Swiss Franks, Euro based stocks, and British Pounds because I want to trade them on their domestic exchanges. In between me and that transaction is what called the bane of the earth. The FX trader, the currency trader who clips me every time I buy and sell, adds zero value, zero value and sucks friction out of the system and has my entire adult life as I've traded in Europe. I can't wait until we solve this problem and give them a new career shining shoes because they add no value whatsoever. This is where DeFi can take us on just one use case, but it's a multi-billion dollar one, and I want to be alive to have a regulator domestically, allow me a payment system to a Swiss Frank back and forth if I want to trade it 50 times a day with zero FX traders, that's my mission in life to help them find a real job.

Kristin Smith: (48:15)

Jeremy, where will we be 10 years from now?

Jeremy Allaire: (48:18)

Yeah, I mean, I guess I look at this from a couple of lenses, I think from the payments finance commerce lens. I mean, I think we'll be in a world where exchanging value is just this ubiquitous commodity free thing, and people don't even think about that and things like what Kevin described will be obviously the case. I'm really interested in the impact on capital markets and the internet has been amazing at creating these multi-sided platforms that create these incredibly like long tails, so long tail markets in advertising and content and media and retail. And I think that access to capital will be transformed on internet capital markets. And that will be a radically different world than things like Nasdaq or the New York Stock Exchange. But I guess the final comment is just I look at this way beyond finance. I mean, I think these are operating systems that are going to really restructure how the basic units of the economy function or corporations, everything else.

Kristin Smith: (49:25)

Anatoly?

Anatoly Yakovenko: (49:27)

I mean, in 10 years, imagine a world with more than a billion people with self custody, with cryptography that hold their own keys and understand how to use them at the same level of people understand how to browse the internet. That world is going to be as unpredictable as the internet in the '90s trying to predict that sharing pictures that are cats is going to be worth a trillion dollars. It's just something that I feel will revolutionize, like Jeremy said, every industry that we know today. Communities will never need advertisement to self monetize, folks can communicate and make financial decisions without any intermediaries at global scale. So what you see today with 10 million users in crypto, it's really going to be a dramatic change.

Kristin Smith: (50:16)

Sam?

Sam Bankman-Fried: (50:18)

I think the downside is the industry can't find it's footing. But I think in the upside case, which I'm optimistic will be able to reach, I don't know, 25% of activity could be on blockchains. I don't think 100% will be. I don't think a Bagel really will be, because you can't eat a blockchain or a block. But when you tweet, I think that tweet could be natively on a blockchain when you pay for something that payment could go through blockchain rails when you invest that can go through blockchain rails, huge swabs of industry can be rebuilt in open, composable, efficient ways on blockchain technology. And I think could really lead to a [inaudible 00:51:03] explosion of innovation if it's done right. And if it's done in a compliant way, and if industry can work with regulators to make that happen.

Kristin Smith: (51:14)

I'm going to make my own prediction. And that is that we were going to spend more money on digital goods than on physical goods in our home. Because all I know, I don't know about you guys, but I usually just wear yoga clothes and I stare at a computer screen all day long. So I would like that world to be more reflective of my personality, so. Well we are right at time. So why don't we give a round of applause to our fantastic panel.