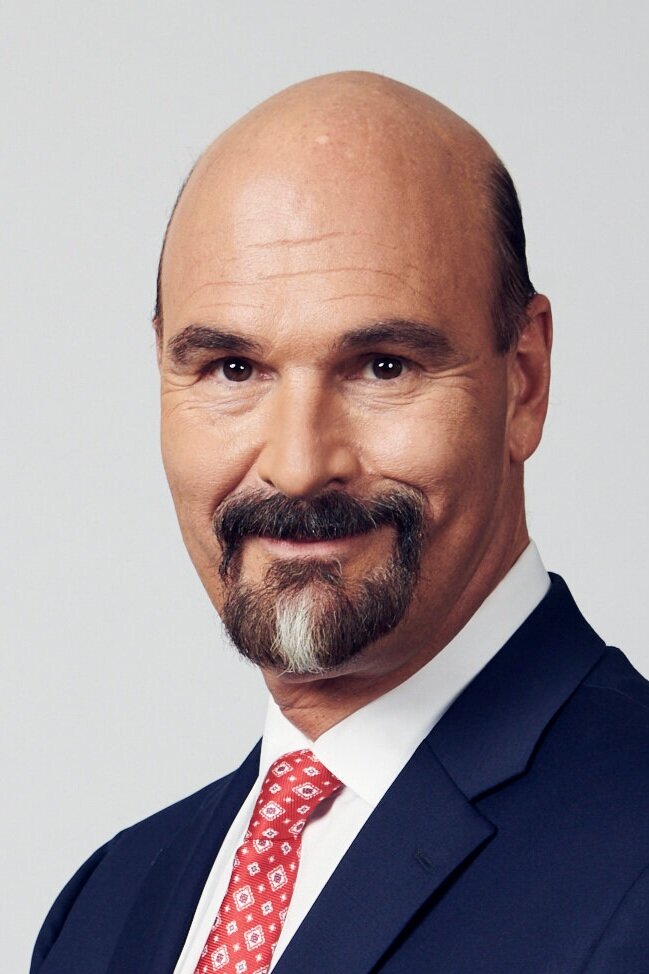

Entrepreneur-in-Residence, ConsenSys

Darius Przydzial, CFA, CQF, is an Entrepreneur in Residence at ConsenSys, who co-founded Fund Foundry and is managing the buildout of software services designed exclusively for the digital asset management industry. Mr. Przydzial is a blockchain specialist with 4 years of activities spanning research, mining, trading, coding, and smart contract security auditing. He has deep expertise in decentralized exchanges, stablecoins, token economics, and consensus mechanisms. He also actively advises projects across ConsenSys’ venture production studio, including Token Foundry, Ventures, research, and business development.

Prior to ConsenSys, Mr. Przydzial spent 12 years in the hedge fund industry, including Fortress Investment Group $7B Global Macro fund, Woodbine Capital Advisors $3.5B Global Macro fund, SAC Capital $16B fund, and J.P. Morgan. His experience focused primarily on risk management and algorithmic strategies research.

Before J.P. Morgan, Mr. Przydzial was an Advanced System Engineer at Lockheed Martin Corp. for 6 years, where he worked on top-secret development programs related to the B2 Stealth Bomber and Naval Radar Weapons Systems.

Mr. Przydzial holds a Master of Science and a Bachelor of Science in Electrical Engineering from Stevens Institute of Technology. Mr. Przydzial holds a Master of Science in Networking from University of Pennsylvania. He holds the Chartered Financial Analyst and the Certificate in Quantitative Finance designations.