“Bitcoin is a governor or regulator on governmental spending. If spending goes too crazy, more money flows into Bitcoin because people are worried that the government is making their money worth less.”

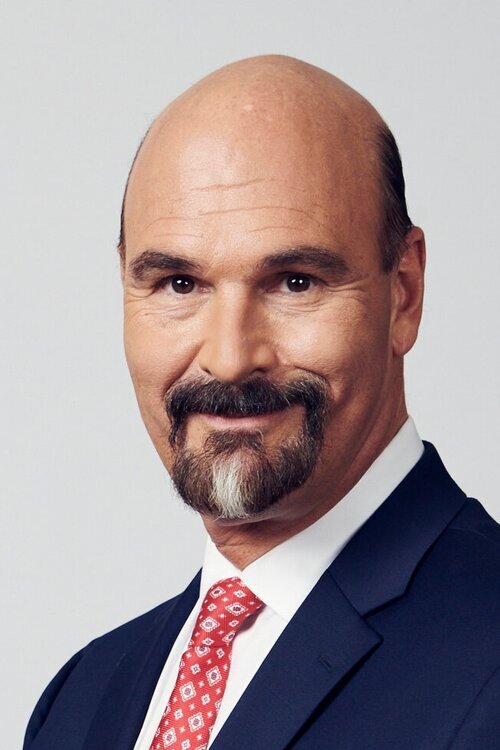

Jon Najarian is the Co-Founder of Market Rebellion. Market Rebellion offers in-depth trader education, coaching and mentoring – from beginner to advanced – to help you build the knowledge base and practical skills required for market success.

Jon tells crypto newcomers to focus first on simply buying the dips in price of Bitcoin. Najarian preaches the importance of having an emotional detachment to trading and sticking to sound fundamentals that mitigate risk. He sees Bitcoin’s value derived from its scarcity in a world of expanded money supply via government spending- Bitcoin acts a regulator against excessive spending and potential inflation. Najarian thinks Ethereum will continue growing into one of the most valuable crypto assets because of its use around smart contracts.

LISTEN AND SUBSCRIBE

SPEAKER

Jon Najarian

Co-Founder

Najarian Advisors

MODERATOR

Anthony Scaramucci

Founder & Managing Partner

SkyBridge

TIMESTAMPS

0:00 - Intro

8:26 - Approach to investing and responding to adversity

13:47 - Value of Bitcoin

16:38 - Equity markets

21:22 - Evaluating Ethereum and other crypto altcoins

24:57 - Analyzing Elon Musk’s role in recent Bitcoin dips

33:00 - Emerging crypto trends

37:15 - Growing participation in markets and trading among newcomers

42:25 - Effects of crypto governmental regulations

EPISODE TRANSCRIPT

John Darcie: (00:07)

Hello everyone. And welcome back to salt talks. My name is John Darcie. I'm the managing director of salt, which is a global thought leadership forum and networking platform at the intersection of finance technology and public policy. Salt talks are a digital interview series with leading investors, creators, and thinkers. And our goal on these salt talks is the same as our goal at our salt conferences, which our guest today has been to many salt conferences over the years. And we're excited to resume those conferences with his presence, God willing in September of 2021 here in New York city. But our goal is to provide a window into the mind of subject matter experts, as well as provide a platform for what we think are big ideas that are shaping the future. And we're very excited to talk about some of those big ideas with one of our great friends, Dr.

John Darcie: (00:52)

John Najarian, uh, John or Dr. Jay has he's affectionately known by many of his friends that was a linebacker for the Chicago bears before he turned to another kind of contact sport, maybe even higher contact, which was trading on the Chicago board of options exchange. I became a member of the CBO, E N Y S CME and CBOT and work as a floor trader for some 25 years. Uh, today John is a professional investor, money manager and media analyst. He has earned reputation in the industry as an options, trading expert and pioneer. Uh, he developed a patented trading application or many patented trading applications and algorithms, uh, used to identify unusual activity in stocks, options, and futures markets. Uh, John can be seen weekly on CNBC, which if you watch CNBC, I'm sure you've seen John's face plenty of times where he's a cast member of the halftime report and fast money programs.

John Darcie: (01:45)

Uh, John and his brother, Pete, invest in and work with startups via rebellion partners of venture consulting firm. They launched in 2015 and in 2016, John and Pete co-founded market rebellion, which is a company focused on educating the individual investor. Uh, joining today's show as moderator is Anthony Scaramucci, who is the founder and managing partner of SkyBridge capital, which is a global alternative investment firm. Anthony, uh, many years ago was a CNBC contributor and recently rejoined the network as a contributor. So we're excited to see him back on the network there, hopefully alongside John here in the near future. Uh, but with that, I'll turn it over to Anthony for the

Anthony Scaramucci: (02:21)

John I'm the Michael Corleone of CNBC, right? They thought they were getting rid of me, but I pulled myself back in see that. So

Jon Najarian: (02:30)

They're smart to do that, Anthony, because you're one of the brightest and most active voices in finance. And I'm not just saying that, uh, uh, anybody who's attended salt knows that Anthony is a great moderator as well as a keynote speaker. And I'm thrilled to be here with you, Anthony. I can't wait

Anthony Scaramucci: (02:49)

Me. There'll be no questions for Mr. Jinja Darcie. There'll be no questions for Misena Jerry. And just, we're just going to let him continue. I know he has an ear in and my mom is talking to him. So thank you. Thank you for channeling all that into John. I want to go off the grid here a little bit if it's okay, because we had you on our Bitcoin review a few weeks ago, obviously spectacular. Uh, and we're thrilled to have you on salt, but John, there's a way of life that you and Peter, uh, you have a joy to Debree. You have a joy of life that, uh, I've experienced, uh, for a decade and a half. Uh, other people around you have a debt I've experienced that. There's an aura about you, of positivity. And, uh, I wanna, I want to go there. Where does this all come from? How do you generate it every day? Um, how do you deal with your worries and troubles? All human beings have those as well. Uh, give us a little bit of a sense for your personal philosophy, your personal background, your folks, you know, your mom and dad, et cetera. Then we'll, we'll get into investing in a second, but we have a lot of young people that listen to these things and I want them to get the ethos of John at Jerry.

Jon Najarian: (04:06)

Sure. Well, Anthony, thank you. I think any of us who have survived for years, uh, on the street as you and I have, um, although it seems to have taken more of a toll on me, Anthony. Um, I think you, you

Anthony Scaramucci: (04:20)

Don't have my dermatologist and the Gerian, but then again, I don't have your physique. Okay.

Jon Najarian: (04:25)

Uh, come on. Um, physique, that is part of it. Um, not how you look, but how you feel and you, and I know you gotta take care of yourself, um, wall street, uh, you know, when you're at Goldman Sachs or, uh, you know, Pete and I traded for the partners at Goldman for years when you're under pressure from things like that or any of the myriad of, uh, uh, great hedge fund managers, uh, it's not luck. Those guys are grinders. The men and women like Kathy woods, uh, obviously fantastic. Five-year run she's up 40% a year, uh, on average. And people want to say, she's a flash in the pan, Anthony, but we both know it's grinding and it also can grind you down because just like a football coach, Pete would say that, uh, you know, years ago, bud grant from the Vikings used to show up, uh, not too long ahead of training camp.

Jon Najarian: (05:27)

He didn't want a long training camp because he said, if you're not, if you don't show up ready to play, I don't want you. So he didn't figure that he had to get people into shape during training camp. But these days, Anthony it's flipped 180 degrees. Um, not that they don't arrive in shape, they do, but it's a 365 day grind to be a pro athlete to be a professional trader. Um, very similar in that regard. And you can spend all day watching film just like you and I could spend all day on spreadsheets, whether it's fundamental analysis, technical analysis, whatever else. And then you're going to have a horrible life. You might have some fantastic returns here and there, but your life overall is not going to be great. You've probably not going to be appreciated by your significant other or your children. Um, and so I think you and I have more or less made a decision that, okay, I'll grind hard and then I'm going to go home and I'm going to make sure I take care of my body.

Jon Najarian: (06:32)

I'm going to make sure I'm there for my kids. And by doing those things, uh, even for the young traders out there, yeah, you do need to grind, but you don't have to make this. The only reason that you're alive, uh, the other reasons are very important too. And so, yeah, I get up at five 30. I go out and I workout Anthony because I know it takes the stress off me. Um, I know I'm a better dad, a better husband by doing that and I feel better. So I I'm addicted to those endorphins. Uh, and I think all of us love the idea that we're just going to keep grinding, uh, as long as we can.

Anthony Scaramucci: (07:14)

So, and I totally agree with you. I try to hit the gym regularly. Um, although I'm a talions, so I ended up eating too much pasta. I'm going to punch Darcie in the mouth, you know, let me tell you something bad doors. He's right outside the door now, you know, when we were in full COVID. Okay. It wasn't this close. Okay. I just said, I like eating pasta and the expression on his face was you fat bastard. That's basically, this is a projection, John [inaudible] these young guys. Okay. We may do a zoom wrestle me and Darcie. Okay. And I got a lot of middle-age

Jon Najarian: (07:51)

Rage per view,

Anthony Scaramucci: (07:54)

So just be careful there. So, so, so John you've been wracked, I've been walloped a few times. I got wild at the white house. I took it down 24.7 months in March of 2020. I got kicked in the teeth in 2008. I thought we were going to lose our business. Um, tell us about one of those experiences for John and Jerry. And, and how did you pull yourself together and how did you rebuild from a down period? Um, give us your thoughts there.

Jon Najarian: (08:27)

Sure. Well, um, I try not to let it swing too wildly, Anthony, and I think, uh, you know, not to put myself on a pedestal with Leon Cooperman or Carl Icahn or some of the iconic figures in our industry, but I do like to celebrate, and I'll say, bang, you know, when I have a good trade or whatever it is, um, because that's kind of my signature thing now, but I get so crazy about it. Um, that, uh, it's swings all the way over the pendulum goes so far over that. As soon as you have anything that of that, you're going to be negative. You're going to feel all that negative energy. So when I've had big losses and I've had, um, you know, just like you have, uh, I've looked, uh, I mean, by the way, this past week, um, I have two wallets, if you will, Anthony, for my Bitcoin or my crypto trading, one is a stone that I've held since 2016 and 2017 without touching it.

Jon Najarian: (09:35)

Um, because I just want to put that away. Hopefully just give those coins to my daughters or charity or whatever. Um, but I just want to hold those. I'm a hold alert for that. But then I have a bunch of other coins that I'm trading now this past week. Um, well we saw the crypto universe trade from a 2 trillion market cap down to 1.2 trillion in a matter of days, a 38% drop. And that includes Bitcoin. So if you take Bitcoin out of there, it was more like 60%. I mean, the drop in market cap was so dramatic that, you know, I don't want to focus on that because that'll make me crazy. But I also, um, whenever and you and I, when we've discussed Bitcoin, I always tell news newbies to Bitcoin. You don't have to buy a bunch, just buy it on dips. Um, this was a very significant dip.

Jon Najarian: (10:33)

You got two shots in the last week to buy it right around between 32,000 and 30,000. If you took them, congratulations, that means you're paying attention. And very quickly you had a $10,000 per Bitcoin profit in those kinds of purchases. On the other hand, if you like yourself, get too focused on, oh my God, I'm just losing so much money. Number one, you're probably way too big in the position we Pete and I always called that Anthony, you know, getting the right blinders on like this. I can't see anything else. All I can see is this huge loss. So I'm missing all the stuff out here on the periphery. Um, you know, that means you're too big. Um, you need to cut back your size. Um, you know, uh, I apologize folks, but another sporting analogy, we shorten up our swing. Uh, if I'm not hitting the ball, right.

Jon Najarian: (11:27)

I don't like put my hand down at the number of the bat. I move it up because I just want to make contact. And that's what I did. So I'm not saying, oh, I doubled down down there at 30,000 or 32,000. I didn't, but I did add to positions down there and I traded out as it traded up to 38 and 39, um, more or less, I think that's the way you're supposed to do it. But again, if you get too focused on the loss, just as if you get too focused on, wow, I made all this money, I'm going to buy a Ferrari, I'm going to buy a jet or whatever it might be. I'm going to buy a new watch. Um, most of us in this business that are successful, you don't see Anthony, an awful lot of that kind of behavior. They just want to grind the out there, make the money and just say nine times out of 10, um, I'm gonna be in the right church.

Jon Najarian: (12:23)

I might be in the wrong pew, but I'm going to be in the right church, whether that's tech and growth or whether that's value. Um, and I might occasionally be in the wrong stocks in that right church. So that's the wrong pew. I need to switch quick quickly and get into the right pew. And that's what I try to do is just, don't let the losers, you know, mess with my head or I don't let the losers dominate the performance I've got in my account when I get to a certain level. Um, just like Michael B. Jordan. Um, I cut it without remorse. I like that new movie that he's starring in. And that's one of the things that I live by Anthony is I cut it without remorse just because it's not my kids. It's not my, my life. I just need to move on to the next trade if it's not working.

Anthony Scaramucci: (13:11)

Yeah. So you're basically what you're talking about is you're, you're trading with some level of emotional detachment, right? No remorse, no, uh, love for the coin or hate for the coin. Just, this is what I'm doing. It's right here inside of my field of vision. Um, what do you say to those, but you're also a fundamental issue or a fundamental investor. You, you look at things from font fundamental perspective. What do you say to those that say Bitcoin has absolutely no value? What would be your response to that?

Jon Najarian: (13:47)

Um, I think it's got tremendous value and the value is derived by its scarcity. Um, and again, this is something folks that Anthony knows far better than me, but when you're looking at assets, if I knew there were 50 Honus Wagner baseball cards instead of eight or seven, um, I'd put a whole different value on those cards, um, because they do gather their value by their scarcity Bitcoin. Right now there's 18.6 million of them out there, uh, in the wild, a bunch of them have been lost, um, because you know, some of them were used for nefarious purposes and people lost their wallets and other cases. Um, so not all 18.6 million Bitcoins are even in anything close to circulation, a bunch of Marine cold storage too. So again, uh, when people are looking around and looking for an asset that will appreciate, they tend to look for things, uh, that there aren't that many of now you've got something perhaps like, you know, some of the stocks in the market that have billions and billions of shares of stock, does that mean they can't go up in value?

Jon Najarian: (15:06)

Of course not, but that's a different animal we're talking about. Um, you know, like a trophy property, there's only a couple of them. Okay. So guess what they're worth right now? I mean, go down to Palm beach and tell me what those mansions on the ocean go for. Now, you'd be shocked folks. They're tearing down $30 million mansions and they're building $70 million mansions down there. Why? Because there's a limited amount of land and it's gathering its value by its scarcity. So, uh, when I hear people say Bitcoin's worthless, um, I'm not saying it's currency, I'm saying it's an asset. Um, and it's certainly, uh, in that defier decentralized finance space. I think it's very important because it's almost a governor or a regulator on governmental spending because if they go too crazy, more money flows into Bitcoin because people are worried that the government is making their money worth less. Again, as Warren buffet said, not worthless, but worth less because they're printing so much of it, even if they don't actually add it to paper. Let,

Anthony Scaramucci: (16:22)

Let let's switch topics for a second and talk about the equity markets, um, your technical and fundamental analysis of the equity markets. What sectors do you like John, uh, is the market overheated, do you think there's still value represented in the market today? Uh, what's your opinion there?

Jon Najarian: (16:39)

I do think there's there's value and I think Anthony an awful lot of the forward, um, you know, wall street tends to be a discounting mechanism. We're looking out so many months into the future, predicting what a company might earn, um, whether it's CarMax or whether it's apple. And, you know, since used cars are really a focus right now, CarMax probably a pretty good pick in that space. People just love apple products, they're ubiquitous, uh, and they make money on a reoccurring basis. It's not just, uh, you know, the Tim cook testifying about the app store and them getting a 30% take on something that they didn't make. Um, but, uh, apple will continue to thrive. And after this ruling comes out, even if they ended up paying a fine, I don't think the judge is going to take and throw out Apple's ability to regulate their app store and these in-app purchases and things like that, that Fortnite and all these folks would like to, um, say that apple doesn't deserve an extra little spiff for everything happens in my game or whatever an apple says fine.

Jon Najarian: (17:52)

Don't put it on my platform. Um, you know, there's no gun to your head. You don't have to be here, just go over to Google play. But then of course, uh, all the, all these, uh, I-phones beg to differ with exactly that. I mean, whenever they compare apple to Samsung Anthony, I just shake my head because I think, well, Samsung is great. The phones are great. Android operating system is great, but, uh, there are so many different levers that Tim cook can pull, uh, from the health to the app store, to the cloud. Um, all these different things that apple can do, uh, to make money from a product that they sell once. And they keep getting reoccurring revenue from Samsung, unfortunately for them and no other real manufacturer that you, or I know gets that. And so, uh, when I look at something like that, I say, uh, since you asked, okay, John, which sectors do you like?

Jon Najarian: (18:51)

I still like tech. I still like growth. Um, I think that a lot of the, uh, um, uh, things that are happening right now in the economy, I'm not blaming president by or Congress, but I'm saying if you're, you're assuming that people can't do math, if they sit around and say, why should I go back to McDonald's, uh, and work at a McDonald's and make 1150, or even $15 an hour, if I'm making 17 not working. Now, we both know that runs out in September and 21 states, maybe more have already ended their supplemental payments. Um, and the people that need it really did need it. I think a lot of people that didn't need it, Anthony also got it, but that's the nature of the beast. You know, when Anthony wants to give away his money through a charitable trust or anything else, it has a more direct impact than when the government, as you know, much better than me tries to give money away. So right now, Anthony, we've got people that are sitting at home because they can do math, uh, because they're not stupid and they'll probably stay there for the most part until close to September. When these extra payments run out, it'll be really hard to drag them back in and they'll probably start trickling back in, in August. But certainly not now, not in may. Why would you,

Anthony Scaramucci: (20:18)

Well, I mean, I've had a debate with a lot of people about this. I definitely think there's a segment of the population doing that. You know, I grew up in a blue collar neighborhood, so, and my cousins are doing anything from clamming auto parts, auto glass, pizzerias, and delis. And they're having a hard time finding help. But what they are telling me is people are taking black market jobs. They're, they're working, they're just not working in the economy. They're yeah, they're taking cash. And so we will say they're sitting at home, there's probably a small group of those people, but by and large people are out there hustling and they're like, well, I'm not going to take that full-time job until the big runs out on the government. So I do, I do see any issue, but trust me, those people are working. John they're hustling. A lot of them are hustling. So let's go back to, uh, excuse me, let's go back to Bitcoin for a sec. Um, will it, will it be the apex predator in the space three, five and 10 years from now? Or will something come into the digital asset curve that will overwhelm Bitcoin?

Jon Najarian: (21:22)

Um, I think a theory comes well on its way to overwhelming Bitcoins and Anthony. So

Anthony Scaramucci: (21:27)

You think, you think a theory and we'll flip Bitcoin?

Jon Najarian: (21:30)

Yep. Not in price. Um, but it's already, um, where Bitcoin was last November, as far as market cap, it got up to, I think, as high as 480 or 500.

Anthony Scaramucci: (21:44)

Yep. Almost a half a trillion dollars a market gap. Yep. Yep.

Jon Najarian: (21:47)

And, uh, so some people in the space called this a flippant thing, when it would flip in market cap value higher than Bitcoin, it's just got a lot more uses. Bitcoin is something that, like I say, I think you want to own it, hold it, put it away. Um, whether it's max Kizer or pump Liano or, you know, any of these folks tone, Veys Charlie Shrem, the Winklevoss twins, they'd all tell you just hold onto the Bitcoin. Um, and many of them, because not all of them are maximalists, meaning of course, that they just focus on Bitcoin. Um, some of them are willing to trade those alt coins. And Ethereum seems to me to be one of the best out there because so many of these smart contracts are part of that ERC 20, you know, the, the Ethereum makes all those smart contracts possible.

Jon Najarian: (22:42)

And you know, to me, Anthony smart contracts, uh, are just the future. I mean, literally imagine, uh, that there's a smart contract created by, oh, I don't know your favorite firm or one of your favorite firms, Morgan Stanley and Morgan Stanley coin. Let people say the smart contract could be written such that the, the owner of the coin gets to dictate at what point they want money pulled out of their account and put over into fixed income. Once I get up to X amount, do this automatically, all those kinds of things. Yeah. You could do it in other types of programming, but certainly with a smart contract, especially sports betting, online gaming and things like that. Every time I have over a thousand dollars, move it out off of my draft Kings account over here into this, would that contract, that smart contract be something people would like, heck yeah, because it would discipline them a little. You'd probably even get gambler's anonymous, uh, saying that would be a good thing, but there are just so many different areas that a theory touches indirectly because it is, you know, it is the works behind those smart contracts,

Anthony Scaramucci: (24:01)

So, okay. It's, it's, you know, it's great. I mean, we, we, uh, we'll be launching in a theory and funds soon. I, I love your opinion on it. We don't know the answer a hundred percent, but I do believe that a theory is going to be a prominent couldn't flip Bitcoin, you know, anything's possible, but I do think it's going to be a prominent, uh, application and store value and potential currency certainly is on these NFTs. Um, do you think Elan mosque pop the Bitcoin bull market? Do you think he was a part of it? Do you think there was other things going on maybe too much leverage in the system? Well, you know, if you were analyzing the collapse, the move from 64,000 to 30,000, I guess as we're speaking now, it's about 38,000. Uh, what do you think the factors were?

Jon Najarian: (24:57)

Yep. You're exactly right. I mean, Chinese government oversight, we had so much, you know, all the time. It seems that when you and I have shared time together on CNBC, Anthony, we talk about perfect storms, um, and a perfect storm. You know, just like the book implied was, you know, you get a low pressure system and then you get this, um, certain amount of, uh, uh, moisture coming up from the golfer coming up from the Caribbean that hits this cold weather, weather pattern, and just causes this perfect storm where, you know, it's just Katy bar, the door, uh, that happened in Bitcoin Musk was definitely part of it. China was part of it, um, that over leverage you talk about last week, Anthony, we were checking out some of these stats, 800,000 people were liquidated out of their Bitcoin holdings last week. Um, that's a big number.

Jon Najarian: (25:59)

Um, even if most of those accounts were 2000 to $20,000. Um, and most of that, well, all of that liquidation, unless the, except for the self liquidation, except, you know, if somebody had the discipline to say, boom, I'm cutting, I'm running, I'm getting out liquidations that we're talking about. Folks are ones that are done by derivatives done by Binance done by Coinbase done by anybody, um, who has their money at risk because they let the customer, um, get some leverage. And in the case of Darebin or Binance, or, um, some of these big FTX obey these off shore, Anthony, that you can really only access through a VPN, a virtual private network. You can get a hundred to one leverage. So instead of owning one Bitcoin at say 45,000, um, somebody that has 45,000 in their account might own 10 Bitcoins, 20 Bitcoins, 50 Bitcoins, uh, on the future side. And if that starts going against them, those liquidations happen at light speed. So what happened is we've been broke from 45 to 40. Everybody was stacked up with short puts at that 40 and 39,000 strike. And then as those tumbled, the waterfall of liquidations just drove it to 30 like that. It's why it went so fast. So

Anthony Scaramucci: (27:32)

It all makes sense. And I've seen this happen over the 33 years, I've been doing this. Where are we now? Is that leverage out of the system? Or you still think we're over levered in the, in the crypto space? I

Jon Najarian: (27:44)

Think we took most of that over leverage out of the system. Now, on the other hand, most of those people that, uh, were liquidated, it wasn't all of their money, probably. Um, the many of those exchanges, you know, just like I say, somebody put wires in 20,000 bucks or moves 20,000 in Bitcoin onto an offshore exchange. You're fair game. You're ready to trade. If once you lose that, you probably just reload and go back in with another 20,000 because you made so much money the last few times when you were able to catch the wave to the upside. Um, so do I think they took most of that bad leverage out of the system? I do. Um, I think comments like Elan's about green mining, um, a mutual friend of ours, Anthony, uh, Kevin O'Leary wants to start a green mining council. Um, and obviously that would feed right into what Elon Musk is focused on right now as well.

Jon Najarian: (28:47)

Do I think that there's a value to that? Yes. Um, I think that, you know, green miners, whether it's hydro solar wind, um, those would be the cleanest ways to mine, of course. And anybody that has access to those in, in large enough amounts could be a significant player. And a lot of people probably like Anthony's customers at SkyBridge. A lot of them will probably want if they're, uh, endowments and things like that. They'll probably want green coins, um, in their holdings. Um, so I think that's probably a good thing that Elon has focused in on, but I think he's also kind of playing around on the periphery of it, Anthony, with, um, he's trying to get doge started up, uh, doge of course was really just a couple IBM engineers that said, yeah, we create a coin and they did. Um, a lot of people can create coins.

Jon Najarian: (29:45)

Some six or 7,000 of them are out there in the wild. Um, and don't just the popular ones, uh, because of the Alon primarily. Um, but I love trading dojo. I've still got a bunch of donuts here. Um, I sold most of it before he went on Saturday night, live Anthony. And then, because I said, that's a classic by rumor sell news, you know, as they say, there's nothing new under the sun. So by rumor sell news still works. Um, no triple bottoms still works, um, breakouts to the upside or downside support and resistance charts. And what was support becomes resistance when you try to get back up through it and so forth, all that still works. So right now I'm focused on, um, if Elon can sort of stay a little quieter about crypto, um, if China's not constantly in Janet, Yellen's not pounding the table about whether or not they should do away with crypto or not let minors and hash power. If it moves from China, that's a good thing, by the way. I think Anthony, the more miners that move out of China, the better, um, and I'm sure they're looking for, you know, low cost of, uh, execution, meaning electricity to cool, those plants, those rigs, and so forth. I think a lot of that's good that's happening right now.

Anthony Scaramucci: (31:13)

So we, we, we agree, um, which, uh, sometimes the sparring isn't as much fun. That's why I have to turn my attention to John Darcie once in a while that Jerry, and because you and I agree on a lot of things, but I'm going to turn it over to John. Uh, he's always got, uh, clever questions from the audience and his own questions and, uh, very, very grateful to have you on. Cool. And Darcie, if you're nicer to me, I'll buy you one of them. Najarian Barets okay. You gotta be nicer to me on

Jon Najarian: (31:44)

The salts. All right. I got to send you some of these Anthony, the

Anthony Scaramucci: (31:47)

Rebellion hats. Yeah, there you go. You say we can get swag from the Najarian.

John Darcie: (31:51)

I don't think you are. I can pull off, uh, the bra as well as, as, than

Anthony Scaramucci: (31:55)

A Jerry. And that's true. I accept that.

John Darcie: (31:58)

But, um, I might try to get one of those hoodies from you, but, uh, yeah, John, it's a pleasure to have you on, and it followed you for many years in markets, and it's great that, you know, you were an early adopter in the crypto space and have helped us along our journey, frankly, in terms of adopting it. Uh, last year we made our first big investment into the space. You talked about a theorem and Bitcoin. I think it's a fascinating topic of conversation. You know, Bitcoin is obviously, as Anthony has said on CNBC before the apex predator and the space in terms of market cap in terms of the breadth of the network, but Ethereum is quickly catching up in terms of defy. You talked about doge coin there's there's defied tokens like Eunice swap or sushi swap there's other blockchains that aiming to compete with Ethereum, like Cardona or Solano. Uh, what aspects of the crypto market are you most excited about and using your skills in terms of analyzing order flow and technicals and as well as fundamental adoption, what aspects of that market are you most excited about right now?

Jon Najarian: (32:57)

Well, and thank you, John. Great question. Um, just like with auctions, John, I'm really focused on volume and volatility, those two primarily, but given, uh, the impact that influencers have, uh, it's doubtful that Elon Musk or anybody else could have as much impact on stocks as they have on crypto. Um, now granted, if Elan is on a show smoking a joint, um, that could hurt that stock his stock Tesla, and it did, uh, create a great buying opportunity down to 180 5. And that was before the five for one split. Um, but, um, I think for the most part, uh, we monitor a lot of Reddit and social media. So I would say in this order volume volatility and then social, and I'm counting both Reddit and Twitter, primarily as social. And that's what we're looking at. We've got algorithms that are sitting there, pulling from those, um, and basically putting them on a, uh, on a dial, something as easy as it's not red green.

Jon Najarian: (34:11)

It's not like that kind of stuff, folks, but it's literally like, okay, you know, we're right in the middle right now. Now we're really pushing into bullish territory. There's a lot of bullish commentary and it's matching up with volume and volatility. We're going to be long, whatever that is. Um, and the great thing about cryptos as well is they do trade 24 hours a day. So you can see that surgeon volume and almost all the time, except around those liquidations, John, that surgeon volume, um, is telling you that whales are somebody big, you know, in Bitcoin speak anybody that has a thousand Bitcoin or more, they call it a whale wallet. Um, and those people are probably active at that level when you're seeing volume pick up dramatically. In other words, if it goes from say $150 million worth of trading in a 24 hour period, which isn't a lot in crypto land to all the sudden 500 million or nearly a billion in a 24 hour period, that ramp usually is a great tell as far as where that coin is going.

Jon Najarian: (35:23)

So we're using that. And then we're monitoring those, uh, Reddit and, uh, tweets to see, and obviously what we use as far as it's not terribly complicated, John, but what we're doing is we're waiting the value of the people that are tweeting and out are posting on Reddit so that we don't give every post on Reddit or every, you know, bot on Twitter, the same credence, the same, uh, sway over our upside or downside bias. So when we're seeing a whole bunch of negative stuff or anything out of Ilan, yeah, he's going to swing that needle, but if it's not Ilan and it's just a bot with six followers on Twitter, or just one post, that's only posted eight times in the last a month on Reddit. Yeah. We're probably not as interested. Um, and the algorithm more or less throws those away and is looking for the ones that are really quote unquote influencing price,

John Darcie: (36:27)

Right. We saw a huge explosion retail trading during COVID. There are some theories that, you know, maybe people that were into sports betting when sports shut down, they moved into to online gaming. People at Barstool were, uh, potentially instrumental in that Dave Portnoy. Uh, but you saw this massive explosion, retail trading, somebody like Robin hood, uh, was a big part of that as well, in terms of the game of vacation they provided, uh, for young people to get, get into trading and investing. Do you think that was a positive thing, or are you concerned about some of the risk-taking that occurs now in markets? I know you guys at market rebellion and some of your previous endeavors have been very focused on risk management and education before you get people at diving head first, especially using leverage with things like options in markets, but what is your analysis of where we are right now in terms of market participation?

Jon Najarian: (37:16)

Well, um, and I know you're not dismissing those younger traders either John. So this is once upon a time

John Darcie: (37:24)

I was one of those bright-eyed younger traders until I got plenty of expensive educations and mark.

Jon Najarian: (37:30)

Well, I think it's great that we have so many of these, you know, uh, I forget how many, I think it was 12 million accounts were opened at Robin hood in the first quarter of 2020. I mean, just a crazy number of those are new accounts, funded accounts, crazy number. Nobody had ever seen that before. Not Schwab, not, uh, city, not, uh, uh, E-Trade you could put them all together. They never opened that many accounts in a quarter. Um, but, uh, that does come with some risk, but these folks, like you say, maybe they were hungry for a way to make some money. Um, maybe they were taking extraordinary risks that they really didn't understand. I mean, I'm looking at an article right now on CNBC talking about exactly what I just discussed with Anthony about Bitcoin traders using 101 leverage driving wild swings in cryptocurrencies.

Jon Najarian: (38:28)

Yeah. And they did the same thing in stocks last year, and they did the same thing this year in the likes of AMC or AMC ex or game stop, you know, the poster child for exactly what of an army of, uh, young traders could do. But there's an awful lot of really, uh, smart, thoughtful, um, even if they are trache taking on incredible risks, you know, they're basically saying go bigger, go home. Um, and if you and I didn't have what we already have, John, um, right now I am a singles and doubles hitter. That's what I go for because I don't need to swing for the fence. Um, I've, I've, you know, knock on wood had a degree of success in my career. So singles and doubles, I just would like to just keep building the stack if you will, um, rather than risking the whole stack.

Jon Najarian: (39:24)

But if you're somebody who's 22 years old to 30 years old and you've got, you know, just a little bit saved and all of a sudden the government starts giving you 600 extra bucks a week to stay home on top of the unemployment that you're getting to stay home. All of a sudden you're saying, well, you know, what, if I start using this and what if I pull another 500 out of my savings every month and throw that in here, I could actually swing and see how good I am at following the markets and things like that, that gamification that you mentioned is something that I think made, gave these traders, um, uh, a little of a leg up, instead of it being such a difficult thing to understand all of a sudden they said, well, all I really got to do is say, I think the stocks going up, I'm going to buy a cause.

Jon Najarian: (40:14)

Or I think the stock's going up, I'm going to sell these puts. And it works until they're over levered. And the market makes that move against them and they get liquidated. Hopefully they pull a lot of that money off the table. We know that the guy roaring kitty, um, or deep effing value, um, over in a game stop, we know that he, um, pulled an awful lot of that money off the table eventually. Um, you know, 50, $60 million when you dangle that kind of potential out there in front of a bunch of young traders. Um, they're going to get excited about it and it's been good for trading. It's been good for the New York stock exchange NASDAQ and, you know, obviously Coinbase and all the crypto exchanges and Voyager, a firm that we're involved with has just grown by leaps and bounds because of this interest in, you know, enhancing some of the returns you can get from investors. Right?

John Darcie: (41:13)

The last question I have for you, John is around regulation. So we were talking before we went live about sort of the, uh, the rollercoaster that's taken place in crypto markets over the last two weeks. Part of that was Elon Musk coming out and expressing concerns about the environmental impact of Bitcoin mining. Another piece of it was India potentially taking the next step towards banning and cryptocurrencies, and then China issuing its third crackdown on crypto and taking it even a step further than its prior ban in 2017, basically outlined outlawing Bitcoin mining, as well as basically trying to rid their entire financial system of any crypto asset transactions in the U S you've seen some news in the last few weeks about the Biden administration, maybe taking a more standoffish, uh, tone as it relates to crypto activity. Are you concerned at all about, uh, you know, any regulatory issues, whether it be with Bitcoin or you move down the spectrum to more of these altcoins or where you've seen a lot of, you know, really rampant speculation, uh, based, purely on, you know, social signals and things like that. Where do you see regulation shaking out as it relates to crypto and, and what impact you think it would have on Bitcoin, Ethereum and the rest of the market?

Jon Najarian: (42:24)

Um, uh, another great question. Uh, the real part of that question that I'd like to unpack first, John, is that right now the U S still remains a leader, um, in virtually every financial market. Now, what we wouldn't want to see is Bitcoin, um, get pushed to all off shore exchanges. Uh, so I would hate to see a regulation come down so hard on Bitcoin that people just migrated to these VPNs, again, virtual private networks and trade off shore. They will though, um, as long as the Internet's there, Bitcoin will exist. And most of these cryptocurrencies will trade. You know, you could put in some really draconian measures like death sentences and things like that. Um, not in the United States, of course, but, you know, in jurisdictions where that kind of Totara totalitarian regime could basically dictate if you do this, you could die those kinds of regulations.

Jon Najarian: (43:28)

Yeah. That's got teeth and people would really have to decide if they want to make that risk. But if you just moved Bitcoin and Ethereum and, uh, stellar and EOS and light coin off shore in the United States, like you have with XRP ripple, ripple, doesn't trade here in the United States. Um, it doesn't because they're negotiating some sort of settlement perhaps with the U S government, uh, or one of the regulators in the U S government, if you kick Crip, but a theory rather ripple still trades. And I guarantee you a lot of Americans own it and trade it, even though it doesn't trade here. So it's just one example of people will migrate, um, to where they can trade these assets. And when you look at something like a ripple that was 24 cents back in February and shot to nearly $2, um, and it's, that was one of the top coins in the world at one point, and came all the way back to there.

Jon Najarian: (44:30)

And now breaks back down below a buck again, um, you can't really stop it unless you stop access to the internet, you can't stop it. Could they put other draconian measures like, um, they've already said, you know, if you trade over $10,000 in Bitcoin, the IRS is looking for you. I think most of us realized that the IRS is always looking at what we do when I moved money from a bank account here in the U S to either offshore or onshore exchanges, they're going to follow it. Um, so I'm not trying to play games with the IRS because I get audited pretty regularly. Anyway, John, I don't need more attention. Um, by trying to skirt some sort of rule about holding those cryptocurrencies and so forth on the other hand, um, like I said, I would hate to see us lose our leadership role in the financial markets, by doing something draconian to the trading of Bitcoin, which I think instead should be like the next great asset class.

Jon Najarian: (45:35)

And then a lot of people could certainly use it to hedge, um, currency exposure. They, they could use it to hedge, uh, you know, some of the, uh, uh, risk assets that they'd like to hold on to, but they might like to hold onto them. I mean, as you know, you can already trade apple in cryptocurrency. You can trade a lot of big stocks. Tesla included in cryptocurrency, they're denominated in those currencies and traded it's the same apple that you trade on shore, but the more that you push this stuff off shore, instead of bringing it here, um, the more that we, uh, take down the U S is leadership. And so that's something that I worry about and hopefully that we don't

John Darcie: (46:24)

Well, we think with, uh, with Gary Gensler at the helmet, the STC being enlightened about the digital asset space, having taught a blockchain course at MIT, we think that whatever the outcome is, it's going to be sensible. So we're looking forward to having more regulatory clarity. I think that's the final hurdle for even greater institutional adoption than we've already seen. But, uh, Dr. J uh, Mr. John, and has been great to have you on Anthony have a final word for John before we let him go.

Anthony Scaramucci: (46:49)

Not really, actually I may have, it was very comprehensive, John, I'm a, I'm super grateful for having you on, and, you know, we've got to get you back to salt September 13th, to the 15th at the Javits center,

Jon Najarian: (47:01)

Javelin Senator 13th to 15th folks in person, instead of Vegas in New York, we had to bring

Anthony Scaramucci: (47:09)

Them this year for all those obvious reasons, John, but we'll, we'll be back in Vegas. We just needed to, uh, send a message to our great city.

Jon Najarian: (47:18)

I like that. And, uh, you're a great American for doing it, Anthony,

Anthony Scaramucci: (47:24)

And I'll, I'll see you I'll see you soon. Uh, and, uh, go ahead, Darcie, close it

John Darcie: (47:30)

Out. All right. Uh, thank you everybody also for tuning into today's salt. Talk to learn more about a subject that obviously we have tremendous interest in, which is the digital asset space, as well as learning from John about the way he analyzes markets. I think he's such a student of markets and so great about educating people around risk, um, that as we talked about this preponderance of, of trading and participation in financial markets is a great thing. As long as people get the proper education. So make sure to check out a market rebellion, uh, where John, his brother, Pete provide tremendous education around, uh, understanding markets from all times all types of different vantage points. But, uh, you can access this episode as well as all of our previous salt talks episodes on our website@salt.org backslash talks and on our YouTube channel, which is called salt tube.

John Darcie: (48:14)

We're also active on social media. Twitter is where we're most active at salt conferences are handled. We're also on LinkedIn, Instagram, and Facebook as well. And please spread the word about these salt talks. If you have still a skeptical uncle or, or grandmother or brother or sister, who's looking to learn more about crypto markets, uh, please pass along this conversation that we had with John Glenn, half of it on behalf of Anthony and the entire salt team. This is John Darcie signing off from today's salt talk. We hope to see you back here again soon. Thank you.