“I always live in the future, so I'm always aiming for something. You don't know which path you could take, but it increases your probability of getting there.”

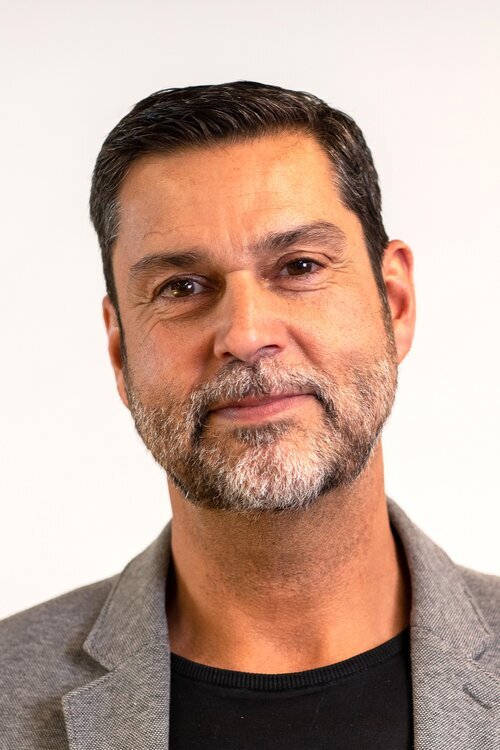

A former hedge fund manager who retired at 36, Raoul Pal is a co-founder of Real Vision, a financial media company offering in-depth video interviews and research publications from the world’s best investors.

Bitcoin appeals to three different types of people: Libertarians like its decentralized and anonymous nature; technologists see its potential as an engineering solution to the financial system; early adopter investors identify its value as an uninflatable store of value. Bitcoin serves as hedge against inflation caused by fiat currency. “What's clever is this money can't be devalued. You can't create more of it. There's only 21 million Bitcoins.”

Bitcoin basically amounts to a mathematical formula that guarantees there will never be more than 21 million Bitcoins. The decentralized structure, run on about 10,000 different nodes and recorded on the blockchain, ensures it can never be changed. Bitcoin is the only asset with a completely knowable supply.

LISTEN AND SUBSCRIBE

SPEAKER

Raoul Pal

Co-Founder

Real Vision

MODERATOR

Anthony Scaramucci

Founder & Managing Partner

SkyBridge

EPISODE TRANSCRIPT

John Darsie: (00:07)

Hello, everyone, and welcome back to SALT Talks. My name is John Darsie. I'm the Managing Director of SALT, which is a global thought leadership forum at the intersection of finance, technology, and public policy. SALT Talks ... Excuse you, Anthony. SALT Talks are a digital interview series that we launched during this work from home period with leading investors, creators, and thinkers. What we're trying to do on these SALT Talks is replicate the experience that we provide at our global conferences, the SALT Conference, which we host annually in the United States and then an annual event internationally as well, most recently in Abu Dhabi in December of 2019. What we do at those conferences and what we do on these talks is try to provide a window into the mind of subject matter experts, as well as provide a platform for what we think are big ideas that are shaping the future.

John Darsie: (00:55)

Today's talk is going to focus on one of those big ideas largely and also, in the context of discussing that big idea, bitcoin and cryptocurrency, talk about some more of the interesting economic and worldviews of our guest today, who is Raoul Pal. He's a former hedge fund manager who retired at the age of 36, and Raoul's the co-founder of Real Vision, which is a financial media company offering in-depth video interviews and research publications from the world's best investors. He ran a successful global macro hedge fund, co-managed Goldman Sachs' Hedge Funds Sales Business and Equities and Equity Derivatives in Europe, and helped design the BBC TV program Million Dollar Traders, which trained participants in investment and risk management strategies.

John Darsie: (01:40)

Raoul retired from managing client money and now lives in the Cayman Islands. He's currently in Little Cayman, which I think he's figured things out. The rest of us need to follow suit with him. I don't know what we're thinking sitting here in New York as it gets cold. But from the Cayman Islands, he manages Real Vision and he writes his newsletter, the Global Macro Investor, which is a very highly regarded original research service for hedge funds, family offices, sovereign wealth funds, and other elite investors. Just a reminder for anyone on today's talk, if you have any questions for Raoul during today's talk, enter then in the Q&A box at the bottom of your video screen on Zoom. Hosting today's talk is Anthony Scaramucci, the founder and managing partner of SkyBridge Capital, a global alternative investment firm. Anthony's also the chairman of SALT. With that, I'll turn it over to Anthony for the interview.

Anthony Scaramucci: (02:29)

Well, it's great to have you on, Raoul. I got to tell you, our careers did overlap for a little while, so I know [Noam 00:02:36], I know Jonathan Green, I know Pierre, all those guys.

Raoul Pal: (02:40)

All the old gang.

Anthony Scaramucci: (02:41)

I know the whole gang. In fact, I'll make you laugh before I get started. Noam taught me how to flip underwritings. I don't know if you remember that whole thing that was going on in the 1990s, but that was a big career move for me. It was quite profitable. We don't have to get into that right now. But I want to go to you for a second and your personal journey, which is extremely impressive. You're growing up where? What did your parents do? How did you end up getting into the business that you ended up in? How did you realize that this was going to be the career journey that you were taking?

Raoul Pal: (03:16)

I grew up in England, but my father was a first generation Indian immigrant. My mother was Dutch. They met on a blind date in Birmingham. So I grew up in England, just outside of London. I grew up in the '80s, and the '80s was all about Porsches, stripey shirts, red braces, champagne.

Anthony Scaramucci: (03:39)

Camden Palace. You said North London, Camden ... I was hanging out at Camden Palace. You and I probably overlapped.

Raoul Pal: (03:45)

And so-

Anthony Scaramucci: (03:46)

I was probably trying to cut your rug in stepping in front of those girls.

Raoul Pal: (03:50)

Exactly.

Anthony Scaramucci: (03:51)

You look like you're a little bit taller than me, so I could've kneed you properly. Okay, so you grew up in the '80s. Go ahead. We're talking Boy George, Camden Palace.

Raoul Pal: (03:59)

Yeah, Boy George and Wham!. I was a big Wham! boy at that point.

Anthony Scaramucci: (04:05)

Of course.

Raoul Pal: (04:10)

But what was at that time, I was at university and I went to a pretty crappy university, the only one that would accept me because I'd discovered girls and cars and pubs. So I got into university, and I was graduating and speaking to a friend of my father. My father was in marketing. He then ran a management consulting firm. But he was international marketing director of Xerox based out of Europe. He wanted me to go into marketing. I saw this flashy world of finance. I had written my dissertation about junk bonds, basically copying the Drexel Burnham Lambert booklet about it.

Raoul Pal: (04:41)

Somebody said to me, a friend of my father's said, "So what do you want to do," and I said, "Well, it's kind of marketing or finance." He said, "Let me give you a bit of advice. You can go and work for Mars in marketing, and they're amazing, and they'll give you free Mars Bars, or you can go work for a bank and get free money." I was like, "Okay, that's what I need to do." It took me a while to get there because I graduated in the recession of 1990. I went to a terrible university, got a decent degree in economics and law but from a bad university. So I hustled my way through and eventually got into a UK prestigious brokering firm called James Capel, part of HSBC.

Anthony Scaramucci: (05:19)

Sure, I remember.

Raoul Pal: (05:19)

I landed on the stock index derivatives desk, knew nothing about futures and options. My baptism by fire was my boss left off six months and I was head of the desk, and that was my career started.

Anthony Scaramucci: (05:30)

I got to ask you this question because I always have to ask myself this question, and so since you're cheaper than my therapist, maybe you can provide some insight here. You're not an establishment guy, I don't think, when I look at your life, your career, the Gas Monkey t-shirt. Yet you're going to Goldman Sachs and places like NatWest, and so what attracted you to them? By the way, I don't see myself as an establishment guy either, so this is why I'm asking. Then how do you go from there to where you are now?

Raoul Pal: (06:01)

Because [crosstalk 00:06:02]-

Anthony Scaramucci: (06:01)

Was that a transitory step and you always had in your mind you were going to do what you're doing? Tell us.

Raoul Pal: (06:07)

Yeah, I always live in the future, so I'm always aiming for something. I have a very clear plan because that's how you get there. You don't know which path you could take, but it increases your probability of getting there. What I identified quickly is that if you go to someone like Goldman Sachs, it's full of the same people wearing the same clothes, who went to the same universities with the same friends, who all worked in investment banks every summer, and that's all they know. So if you come in with character and somebody who's traveled the world or you have a passion for something different, then you stand out. Even my name, right?

Raoul Pal: (06:43)

So I would call up people like Paul Tudor Jones and just call him up, and you'd get to his assistant and you say, "Is Paul there?" They say, "Who's speaking?" You say, "Raoul," because you can't say Raoul Pal because it's a bloody mouthful, so you just say Raoul. She's going to say, "Hey, Paul, it's Raoul on the phone." He thinks he's your best friend already. So all of these little things means that to be an anti-establishment figure within the establishment increases your chance of success.

Anthony Scaramucci: (07:04)

So you make this big, bold move. You discover something called bitcoin. When do you discover bitcoin, and when do you realize that bitcoin is something that you need to make a big part of your life?

Raoul Pal: (07:20)

Yeah, fascinating. I was in Europe in 2012 and 2009. I was living in Spain. In 2012, we almost lost our banking system. We had riots in the streets.

Anthony Scaramucci: (07:30)

Yes, I remember.

Raoul Pal: (07:30)

The whole thing was a mess. I was writing about it for Global Macro Investor. I kind of knew it was going on. We had a round table in Spain with a bunch of Global Macro Investor clients, and one of my clients came along and presented his trade idea, which was bitcoin. It was that moment I was going around with some people that you will know trying to set up the world's safest bank, realizing we had a problem in the financial system and it hadn't been solved. The moment I saw bitcoin by another ex-Goldman guy who ran a hedge fund, I realized that this might be the answer to a lot of the fragilities in the banking system and the store of value and that kind of thing. I was very early into it. I think by 2012, I'd written the first Macro article about how to value bitcoin and basically just brought a load of people with me on that journey of discover because like everybody who comes into the space, you think it understand it, then you realize you know nothing, and then eventually on the other side, you have an understanding of how big this really is.

Anthony Scaramucci: (08:33)

So let's talk about how big it really is. Let's say that I'm a bitcoin skeptic. I'm not, by the way. I see its destiny. Peter Thiel said something to me that I'll share with you. I'd love to get your reaction to it. He said, "While bitcoin is libertarian, bitcoin is freedom and decentralization, AI could be used to track to social norms and to start grading people's lifestyles, and that's more authoritarianism and more centralization of government. But bitcoin is the full expression of political and financial freedom." So, one, I would like to get your reaction to that statement, and then, number two, I'd like you to address bitcoin skeptics, if you don't mind. What don't they see about bitcoin that you do?

Raoul Pal: (09:26)

So there are three kinds of ... Going back to Peter Thiel, there's three kinds of people that make up the bitcoin crowd. Libertarians, because of its decentralized nature and its pseudo-anonymity. It's not totally anonymous, so it's not this drug currency, but what it gives you is some freedom to move around the world because it's owned by nobody, there's no CEO to throw into prison. There's nothing you can do about it. It just exists. The other side were the technologists. They looked at this and, using engineering minds, saw what had happened in 2008 and said, "Maybe we can engineer something to create a better financial system," and they loved the maths behind it. Then there's a bunch of people like me and the early adopters like Dan Morehead, John Burbank, all of these guys from the hedge fund world, who realized that it was the answer to a lot of the problems we had. I think Peter Thiel's right, but that's only part of the story.

Raoul Pal: (10:28)

Why it's so big is because we live in a digital world. Whether we like it or not, everything we do now is pretty much digital. You and I are now talking digitally. This was something that didn't exist five years ago, but we're doing it now. The Internet has never had an ability to have a money layer embedded into it that works in the same function. We have to go via our bank and use a credit card and all of this stuff. Bitcoin gets rid of all of that, as does the whole cryptocurrency revolution. It allows the instant transfer of money. But what's also clever about it is this money can't be devalued. You can't create more of it. There's only 21 million bitcoins.

Anthony Scaramucci: (11:08)

Okay, let me stop you right there, Raoul. Why? Because a lot of people are fearful of that, they don't understand it.

Raoul Pal: (11:14)

Sure.

Anthony Scaramucci: (11:14)

I know the explanation, but you want you to explain in your language why can't Mr. Satoshi or Mrs. Satoshi just say, "I got you all hooked into this thing, here's another 21 million coins?"

Raoul Pal: (11:26)

Yes. So the premise of bitcoin is basically a mathematical formula, a cryptographic formula that is sold by computers. It takes a lot of computing power, and so cleverly, that formula gets more difficult over time. Every time you solve it, you get rewarded, so it's like behavioral economics. You get rewarded a mining token, a bitcoin. The number of those bitcoins are restricted by the formula, which can never be changed. Why can it never be changed? Because it's not centralized, so it can't be Anthony saying, "Well, we're going to change the number today." It's actually run on about 10,000 different nodes and all of these miners, and it's all recorded on this thing called a blockchain. So nobody can change anything. It's set in stone. It's impossible to change the number of coins or the algorithm, and that's what makes it interesting.

Raoul Pal: (12:20)

Unlike gold, for example, where you can get what we've just seen in Russia, this huge find, so suddenly there's a new supply of gold. That's what blew up Spain when they discovered the Americas. They brought all the gold back, they thought they were rich, but they devalued everything because there was an excess supply of gold. You can't do it with bitcoin. It's the only asset where it's completely knowable. We live in a world, you and I, of supply and demand. That's what we understand. Well, there is no change in supply. You've got a fixed supply commodity. It never changes, which is the same with art, and a lot of people watching this will understand, there is only one Monet Lilies or whatever it is, and so that's why they trade at huge premiums. So bitcoin is this. It's like having a Monet that's fractional, so it goes down to eight decimal places, and instantly transferrable and storable. That starts to sound like very interesting money.

Anthony Scaramucci: (13:20)

Okay, so you're a big bull. I listen to your podcast, and so you see this going to a million dollars a coin. Is that fair of me to say that? I don't want to-

Raoul Pal: (13:32)

Yes. No, I mean-

Anthony Scaramucci: (13:34)

... [crosstalk 00:13:34] exaggerate, so-

Raoul Pal: (13:35)

Yes, so, again, let's look at it in the terms of institutional investors. It's currently a 200 billion dollar market cap. It's basically a mid-sized S&P company at this stage. So it's meaningless, really. But if you look at the distribution of price returns and how skewed it's been to the upside, the ability for this to go up 50X is normal. Every time we have the big bull cycles, which are driven by a reduction in supply that's mathematically derived in advance, what we find is bitcoin goes up a lot because the demand remains steady or it goes up and supply falls. So to get to a million dollars, that's pretty straightforward, and you're at about a trillion dollar market cap then or, sorry, 10 trillion dollar market cap. 10 trillion dollar market cap in terms of an asset, that's a reasonable size. It's not huge. Gold alone is an 11 trillion dollar market cap.

Raoul Pal: (14:35)

So if it's a real asset, it's still in price discovery mode. We haven't actually got to what's its real market cap. That's what gives it this ridiculous skewed upside. In addition to it, it also operates on a Metcalfe's Law. Because it's a distributed platform, essentially, the more participants that become in it, the more its worth. It looks like technology and money combined. These kind of things, we've never seen before. We've never dealt with an asset like this, which is why it's been the best performing asset of all time, the best performing asset in 10 years and five years.

Anthony Scaramucci: (15:12)

Well, you had a spill. I think you traded at 20,000 and 3000 in a five-year period of time, and now it's back to 15, I guess, or-

Raoul Pal: (15:22)

Yeah.

Anthony Scaramucci: (15:23)

... [crosstalk 00:15:23]. So what do you think caused that spell?

Raoul Pal: (15:27)

Well, the spill, again, its actually very cyclical. Like all commodities, we understand that commodities tend to be cyclical. So what happens is it's driven by the mathematical formula called the halving, where they halve the mining supply to make it more difficult. As you start getting closer to the 21 million coins, they make it more and more difficult over time for these computers to talk.

Anthony Scaramucci: (15:49)

Where are we right now in terms of mining, the number of coins that have been mined?

Raoul Pal: (15:52)

I'm not sure exactly where we are, but I think we've mined about 19 million. There's very little left, so it becomes incredibly hard to mine the rest. So you need more technology to do it. As we do that, you get this period where you get speculative boom because demand starts bringing more people in. Then, after a while, the demand ... The people turn to sellers, and it's just a cyclical phenomena, and it usually crashes significantly, 90%. You have to have-

Anthony Scaramucci: (16:27)

You think you're going to see another crash, 15 to 3000?

Raoul Pal: (16:30)

No, I don't. I think how the price will evolve this time, we're in the next wave up. The halving happened in May. The chances are we probably hit something like 100 to 200,000 on this wave, which will be probably by the end of 2021, 2022. Then we'll correct somewhat, but there's a difference coming now. Don't forget, this was driven by retail. This is the only asset that's been driven by retail from the ground up, by its very distributed nature. But the next time around, the institutions are going to be in, the investment banks, the asset managers, the RIAs, the hedge funds, and that's going to give much more price stability, so the volatility of bitcoin itself is going to collapse. So we won't get a 90% drawdown. Maybe we'll get a 50%. Well, that's normal in terms of most asset prices when they have a cyclical bear market.

Anthony Scaramucci: (17:20)

So let's talk about something that's conjoined in my mind to bitcoin and perhaps it is in your mind, is massive deficit spending by governments, and concomitant to that massive deficit spending is monetary easing and the expansion of monetary supply and all of that other stuff. So let's overlay that going on at the same time that you have this bitcoin development, and tell me your thoughts on those two subjects.

Raoul Pal: (17:51)

Well, to put it in the simplest form, the central banks are undertaking quantitative easing at an extreme level, as we all know. I'm not telling anybody anything new. Bitcoin is programmed to quantitatively tighten. So you've got two divergent paths. If you want to look at ... We're all used to using gold as an offset to central bank printing and maybe equities as well. So how are they done against the central bank balance sheet? I've looked at this. I took the four largest central bank balance sheets, the ECB, the Fed, the PBOC, and the BOJ. You put those four together and create an index and then divide assets by them. Gold did a pretty good job, but it's basically underperformed by 50%, so the amount of money in supply has outperformed what gold should've done. The equity market has done a bit better but not perfectly. But bitcoin, well, it's massively outperforming central bank balance sheets as well.

Raoul Pal: (18:59)

The reason behind that, it's a store of value but it's also a call option on a future financial system. That's the important function that bitcoin has. It has two roles. If it was just a store of value, it'd look more like gold. But it doesn't because every week they can build on top of it and it's creating a whole ecosystem around it, including the central banks with their central bank digital currencies. So, yes, the point being is the only answer for this massive debt bubble that we've got is more printing, and the only outcome is bitcoin goes higher. It will significantly outperform gold because of the fact that, a., it hasn't achieved its full market cap by it's still in price discovery mode and it's also a very disruptive technology. Gold can't create a payment platform or a store of value or a trusted source of storing things on the blockchain. It can't do any of these, but bitcoin can.

Anthony Scaramucci: (19:50)

Okay, it's fascinating. So we are now in a situation where you had bitcoin, you have this phenomena taking place. Literally, we keep dipping into quantitative easing. I have my own thoughts about it. I mean, I think Haynes is right in so many ways, but when you do all this deficit spending, you weaken the middle class and you weaken the lower class. That's the reason why you're having this systemic rise in populism, because my dad was a crane operator, Raoul. He had an hourly wage, and if you have inflation, guess what happens to that hourly wage? Your real purchasing power goes down.

Anthony Scaramucci: (20:25)

If you have this type of inflation, it's asset inflation. So if I'm a wealthy person, I have a big building, and the dollar amount of the building goes up, I still have that asset. But if you're working a wage, the money in your bank account is going like this, and that is pain in our system. It's causing your old country to Brexit. It's causing this upheaval in my country. So my question to you, which I don't necessarily have the answer to, what happens to equity markets in an environment like this?

Raoul Pal: (21:01)

Well, actually, just before we get into that, really interesting because I'm actually writing a whole article about this with Global Macro Investor breaking the entire medium income down, comparing it to asset pricing, and looking at what happened. Basically, between Bretton Woods, the Baby Boomers entering the labor force all at the same time, so competing for jobs, plus the WTO, plus China entering WTO, and then quantitative easing have basically destroyed wages. They've all deflated except anybody who earned over $200,000 a year. Everybody else has seen wage deflation. So it's a killer, and so you're dead right.

Raoul Pal: (21:40)

Equities in this, the problem is, a., these people don't have much money, so if we're trying to look at the little guy, they don't have savings to invest in equities, and with equities at all-time high valuations, what is the upside? Well, maybe it offsets quantitative easing, but maybe it doesn't. Maybe the economic cycle catches up with equities. So the future expected returns that most people look at for equities, whether it's Grantham, Mayo, or any of these guys, are kind of negative for the next 10 years. That's why crypto has become so powerful amongst retail investors because they see for once they were ahead of the institutions and they have a real chance of actually offsetting some of the losses elsewhere. It has a passionate amount of supporters because of this. They realize it's a chance for them, and that's great.

Anthony Scaramucci: (22:34)

I like it. I think it's very interesting. So it's also tied into my next question, then. John Darsie, who's a ... I don't know if he's a Millennial, a Quintennial, I don't know what the hell he's doing, but he thinks he's a lot better than us because he's in a different generation, Raoul, so we'll get to him in a moment. But he's got a ton of questions because all these guys know more about bitcoin than me, so they like giving it to me, as you ... But before I get to him, the 60/40 portfolio, is that dead?

Raoul Pal: (23:09)

Look, bonds just act like cash. I'm still bullish bonds, and I think they actually had a negative interest rate. I think the US will follow the rest of the world because of the structural issues going on, whether it's demographics, deflation, debt, a number of things. But regardless of that, the real juice in that trade is gone. So, therefore, what offsets volatility? Now, it works like cash, so it does help somewhat, but it doesn't add to the balance sheet when things go wrong. So it is somewhat dead, and people are looking for answers. Gold is one of them, and I think a lot of people are starting to think, "Okay, should I increase my allocation to gold to give me some of that cushion within my portfolio," and others have looked at bitcoin.

Raoul Pal: (23:51)

Adding a 1% allocation to bitcoin makes a dramatically different reward profile for almost any portfolio because it's so uncorrelated. And uncorrelated returns, as you know, not easy in this world. That's why equity longshore hedge funds have had such a tough time. Even macro guys have had such a tough time. Everything's correlated. But this whole world, not only of bitcoin but tokens and other cryptocurrencies, genuinely less correlated, and that means it's higher alpha. That's really interesting. That's why it's attracting so many of the really smart guys from our industry who move across to the crypto industry, because alpha exists.

Anthony Scaramucci: (24:30)

All right, Mr. Darsie, I know you're dying to ask questions, and-

John Darsie: (24:35)

You actually did a decent job today, Anthony.

Anthony Scaramucci: (24:37)

Raoul, I got to just tell you something. Raoul. Raoul, I got to just tell you something. I am so happy that you have a full head of hair because usually we get these bald old guys on this show, and Darsie really tries to go all Rico Suave on them, you know what I'm saying? So just to let you know that. Okay, but go ahead, Darsie, go ahead.

John Darsie: (24:51)

Well, I appreciate it, Anthony. Further to Anthony's question about the 60/40 portfolio, which I think we can all agree is outdated at the very least, I know you're not here to give constructing portfolios. How should they think about building a modern portfolio? Let's say the average investor with about a million dollar in savings, do you think they should be overweight bitcoin in a significant way, or do you think it fits in as just a small part of an asset [crosstalk 00:25:17]-

Raoul Pal: (25:17)

Well, it depends on the age group. If it's you, John, then-

John Darsie: (25:20)

Yeah. How about me?

Raoul Pal: (25:21)

Well, listen, and I've talked a lot about this, and this is really serious, your opportunity to put your money in your 401(k) and buy equities at all-time record valuations is not a good bet. For you to buy property for price gains is not a good bet. Versus your income and versus what's happening to prices, it's very expensive. Now, if you want to buy a house, which I recommend to live in, because lifestyle is the ultimate token that we work for, but outside of that, if we're just talking about investment, your house is not an investment. Property's too expensive. Credit yield, all-time low, yields, all-time low. Okay, what the hell do you do to generate wealth? Sure, you earn income, but how can you compound your income?

Raoul Pal: (26:08)

I can only find crypto. I think VC investing as well, but most young people can't do it. So building a business is one of the most important things I think people should do if they can do it because you can take risk when you're young and hence why you can take bitcoin as a risk when you're young. If you think of the opportunities that the Baby Boomers got given in 1980, 1982 when the bulk of them joined the labor force and started peak earnings, they started hitting their 30s, they got equities at a P of 6, bond deals at 18%, and property had been destroyed after the inflation of the '70s, and there was no debt. They had four aces given to them.

Raoul Pal: (26:53)

You've got all four aces, but they're in the crypto space. That's where you've got 50X [inaudible 00:26:59], bigger than the Baby Boomers ever had because you're getting the nexus of not only an underpriced asset class, but you're also getting the future of technology combined with it. Those things never happen. It's like investing in VC at the same time as buying Russian equities in 1990 when everybody hated them. The magnitude of this is enormous. So that's why I think you should be aggressive as you could be, because maybe I'm wrong, maybe Raoul's a total idiot, and you lose 50% of your savings. It doesn't matter because you've got an income and you've got a future ahead of you. But if you're 70 years old, well, I wouldn't do it.

John Darsie: (27:40)

Like Anthony.

Anthony Scaramucci: (27:43)

Hey, let me tell you something, Raoul. I'm actually 105 years old, and I think I look fantastic, okay, so-

Raoul Pal: (27:49)

I think you don't look a day over 100.

Anthony Scaramucci: (27:51)

I'm taking that as a compliment, okay? Keep going, Darsie.

John Darsie: (27:56)

Yeah, well-

Anthony Scaramucci: (27:56)

Keep going.

John Darsie: (27:56)

Absolutely. And I want to talk to about-

Anthony Scaramucci: (27:58)

And, Raoul, just so you know, we pay his bonus in dollars, okay, and they're cheapening every second of this podcast, so keep going, Darsie, go ahead.

John Darsie: (28:06)

I might start demanding my bonus in bitcoin at this rate.

Raoul Pal: (28:09)

You should, though.

John Darsie: (28:11)

But I want to talk about-

Anthony Scaramucci: (28:11)

Me, too. Me, too.

John Darsie: (28:11)

... bitcoin as a currency. So you talk a lot about fiat currencies and the inherent risks of fiat currencies and how they really historically have a short shelf life. Could you talk a little bit about historically how long fiat currencies generally last and what the future of the US dollar is in your mind?

Raoul Pal: (28:28)

I can't remember the exact numbers, but, essentially, most fiat currency regimes don't last 100 years, many 50, many less. If you look at Brazil, in my lifetime, about three or four of them. What happens is banks and governments are incentivized to destroy their own currency to pay their own debts. Right? That's what quantitative easing is. So they're always incentivized to do it. This perverse incentive means that they always go away. Everybody ends up with too much debt, tries to print their way out of it, and then the currency, eventually people lose faith in it. That's why gold has been around so long, because you can't do that with it. Bitcoin, as I've talked about to Anthony before, you can't do that. So it stops anybody screwing around with it.

Anthony Scaramucci: (29:16)

I got to interrupt for one second. Is there another currency that could hop over bitcoin? Is the bitcoin the Yahoo and there's another currency that could be the Google?

Raoul Pal: (29:23)

Yeah, so looking at the network adoption effects, it's highly unlikely. It is a theorem. Could it become bigger in market cap as people build out a whole financial system, define stuff? Potentially. But as pristine collateral, which bitcoin is, as the reserve asset, I don't think it's going to be displaced. But there are other massive opportunities in this space regardless.

John Darsie: (29:47)

So I want to talk about that a little bit. We had a very interesting guy, Marty Chavez, who you may know, who spent-

Raoul Pal: (29:53)

I know Marty from Goldman.

John Darsie: (29:54)

... many years at Goldman. He was the chief information officer when he left. He's on the board of a few crypto organizations. He offered such a balanced view of the space that I thought it was very fascinating. He talked about the idea of central bank digital currencies and digital currencies that are backed by governments. I thought it was interesting, the way he framed it, talking about, let's say, a stimulus package that the US government wants to pass out to its citizens. Today, they're having to wire money into bank accounts via the IRS, they're mailing checks, there's a lot of waste inherent in that. One, do you think we'll see central bank digital currencies? What do you think the potential is for that? How will they work, and what impact, also, do you think that would have on bitcoin if you had government-backed digital currencies?

Raoul Pal: (30:41)

I've been following this for a long time. The Bank of England, the BIS, the IMF, the ECB, the Fed, the PBOC, the BOJ, Australia, Singapore have all written white papers on it. It's happening, and it's coming, and I think China's just launching as we speak. I think Sweden's got a pilot scheme going. I think Singapore's about to launch. Bermuda's just launched. Look, this is happening, fact. The question is, is how it happens. What does it mean? Well, it's really interesting. Firstly, the IMF two weeks ago had this big debate, Jay Powell was there, everybody's there. They're talking about the new Bretton Woods. So what are you saying?

Raoul Pal: (31:29)

What they're actually saying is that they understand we're in unprecedented times and everybody needs to fiscally stimulate and nobody's got the money to do it. Their proposal, hidden beneath their wording, is, "Okay, let's move to central bank digital currencies, make an agreement amongst all nations, and allow us, let's say, all to print another 50% because then there's no one currency versus another." The idea is you're devaluing everything at the same time, but it doesn't show. Okay, so that's what they're thinking of.

Raoul Pal: (32:02)

But then the bigger revolution, and many of these guys ... Benoir Coeure from the ECB who's now the BIS spends a lot talking about this. Some central banks will just have a digital currency that'll be a means a payment. So I can just flip you a dollar, straightforward, nothing else attached. But the incentive schemes for the government, much like printing money, the actual incentive scheme is to create programmable money. So programmable money gets around the problem of monetary policy, which has now stopped. We've got monetary printing or interest rates negative. That's all we've got left, and neither of them are really working. So monetary and fiscal policy, if you listen to Jay Powell and the ECB, they're screaming every day, "We need fiscal, we need fiscal."

Raoul Pal: (32:52)

Well, this way, it puts fiscal in the hands of the central bank or the central bank in the hands of the government because they can give you a different stimulus to me. They can say, "Raoul, you're an older saver. We're going to penalize you with negative interest rates. But we want to help John out, and we're going to give him a cash payment so he can pay his student loan," both at the same time. So we can use behavioral economics to run economies, which is game-changing. Now, if you understand how behavioral economics has changed the Internet, we all use Google or Facebook or whatever or even Twitter, it's all behavioral economics. So it's all about incentive systems. You can define incentive systems to different people. We're going to see a completely wholesale change in how we run monetary policy, fiscal policy, and the relationship between central banks and governments.

Raoul Pal: (33:45)

All of that fits in with bitcoin because bitcoin is ... As Anthony said at the beginning, it's this libertarian thing. It's the life raft. If you don't agree with your government, you've got somewhere to go, much like people use gold for now. If you're in Brazil and they're printing too much money or they're going to lose control because of the budget deficit, oh, well, I'll buy some gold. But bitcoin links in so perfectly with digital currencies because it's all instantaneous. So in the digital world, they're called on-ramps and off-ramps. This is incredibly constructive. All of the white papers acknowledge bitcoin, how this whole fintech revolution, cryptocurrency revolution, DeFi revolution is all part of where they have to go. So there's no chance of them banning it. They actually want to integrate with it.

John Darsie: (34:35)

Well, that's a good segue to my next question about the risks associated with bitcoin. You talked about, and we talked about before the call went live, about how asymmetric this opportunity set is for people buying bitcoin today. Could it maybe go to zero in certain scenarios? Yes, but it doesn't seem likely. What are the risks or the elements of security that people were concerned about after the Mt. Gox hack and things of that nature? Are those still risks of buying bitcoin, and what do you see as the biggest risk to cryptocurrencies?

Raoul Pal: (35:07)

So if you understand that bitcoin is the network effect in money form, it's extraordinary. But that's what it is. It's Metcalfe's Law in money. So what is that built on? It's built on one thing only, which bitcoin excels at better than any other instrument ever invented. That's trust. Because of its distributed nature, I don't need to take your word from it and we don't need a notary because we've got 10,000 nodes all confirming it. What we know is that anything that's on the blockchain is now 100% trusted.

Raoul Pal: (35:43)

So the trust element takes away the risk of something that is a network effect because, usually, it's because either it doesn't give you a benefit, i.e., the price doesn't go up, or if it's Facebook, you don't find your friends on it, whatever it may be doesn't work. But once you get to a certain point where people trust it, it's very difficult to get rid of it. That's why even after it had these big cycles, because it was still a relatively thin market, it goes down 90%, the trust never went. People still knew it's this pristine asset, this incredible asset that can't be screwed around with. So it just drives trust again, and the more people adopt it, more trust. I don't think there's any risk of zero.

Raoul Pal: (36:25)

The arguments go quantum computing. If they figure out quantum computing, they could break the cryptographic keys. Well, there's too much money in this space, and people are already aware of this, so there's all anti-quantum layers being built, there's a bunch of other stuff. So that's not going to be an issue. The other really weak argument is, well, if they shut down the electricity, there's no bitcoin. Well, we've got other problem if the entire world's Internet or electricity goes down, so I'm not worried about that one. By the way, you can still store it on a piece of paper, your crypto-key. You actually don't need a computer. So that's okay, too.

Raoul Pal: (37:04)

The last one is governments will ban it. Well, first up, explain that the IMF, the BIS, the ECB, the Bank of England, the Fed have all regulated it and said in their white papers, "This is part of the future, this is where it's going." So there is no noise of that coming, but maybe one day, it's a 10 trillion dollar asset class. They're not going to ban a 200 million dollar asset class, not even a trillion dollar asset class. It's still smaller than Google at that point, and Google is much more nefarious than bitcoin is. They own all the world's data. So let's say it gets to 10 trillion dollars, my million dollar price target. How are they going to ban it?

Raoul Pal: (37:44)

Let's go through that, and this is really crucial. So the IMF say, "We don't want to have this currency, it's destabilizing to central bank currencies," and everyone goes, "Okay, fine." They say, "Anybody owning it will be banned. You can't have a wallet." Problem is, is we live in a globalized world and this is on the Internet. There's no borders. There's no gold in a vault. This is borderless, semi-anonymous, and instantaneous. So all it takes is for Brazil ... And we've seen this in healthcare when it came to genetic testing. Brazil and Israel said, "We'll allow it." Guess what? A bunch of scientists go over there, they do it from there. Game theory always suggests that somebody will go against that ban because they can make all the money because we're actually dealing with money here. So it's incredibly lucrative to capture that market share.

Raoul Pal: (38:41)

The other part of this is as the central bank digital currencies come, there are going to be ... And my guess is that in the next two years, we'll see one of the small Latin American nations, maybe one of the Caribbean nations, put bitcoin into their reserves because they're so fed up with having [crosstalk 00:38:58] currency-

John Darsie: (38:57)

Yeah, like MicroStrategy.

Raoul Pal: (38:57)

Like what?

John Darsie: (38:59)

Yeah, like MicroStrategy did, Michael Saylor did with their reserves.

Raoul Pal: (39:03)

That's right. And then one of them will say, "You know what? We're just going to use bitcoin as our currency," as opposed to having a currency board with the dollar like we have in Cayman. They're totally fungible here here, so it's not a peg, so it can't break. But if it was the vagary of the dollar being expensive or weak that they have to deal with, what if you just say, "Okay, bitcoin is the currency we want to peg ourselves against?" You're away from that whole currency system and [crosstalk 00:39:31].

John Darsie: (39:31)

Yeah, I think China's journey as it relates to bitcoin and cryptocurrencies is an interesting and informative one, is that early on in the rise of bitcoin, the way I understand it is that Chinese that were evading capital controls and pulling money out of the country accounted for a significant portion of the trading volume of bitcoin. The Chinese made some noise about wanting to regulate it, but then they realized the power of that type of technology if it's leveraged by the state. So they obviously haven't banned it and are working on their own digital currency.

Raoul Pal: (40:03)

Russia did the same, and we've seen similar things elsewhere, and they looked at banning it and then realized it didn't make sense, and they've all walked away from it. I think the probability of it being banned on a global basis is low. Will Turkey try and ban it? Of course they will because their currency keeps collapsing every day, like they banned gold. But does it work? It's never worked. Capital controls have never, ever worked. India tried to ban it as well. Guess what? It's coming back. India's integrating it with their banking system now. So it's not going away. It's only going to get bigger.

John Darsie: (40:48)

In your view, and you might talk about how you own it and how you store it, what's the best way for a retail investor or an institution to buy, own, and store securely cryptocurrencies and bitcoin today?

Raoul Pal: (41:00)

Yeah, so here's one of the truisms in life. Anything that's slightly hard to do usually has better rewards. Emerging market investing, the more frontier you get, the higher the rewards are. So crypto right now, to do it perfectly, you need to open a brokerage account with an exchange, do your KYC. Well, we're all kind of used to that. Then you go on and buy it. There are some brokers who will do it. So if you're an institution, you're a hedge fund, you can get somebody to do it for you, so that's pretty straightforward. The problem is the custody because it's a bearer asset and we gave up bearer. We used to have bearer bonds and bearer equities. There's a few left. I think Nestle have still got some bearer equities and bearer bonds left, and a few companies do, but there aren't many.

Raoul Pal: (41:44)

So now you're like, "Okay, do I leave it on the exchange?" Well, we've all heard [inaudible 00:41:50]. People can hack exchanges like they can hack banks. So you're like, "Okay, so I need to store it somewhere safe." You can buy a cold wallet or a hard wallet, and that basically is a little unit that has your keys on it. It doesn't actually store your currency. It's not like a USB. But it's basically your codes to unlock it. So to do that, that's a safe way, and then you can put it in a safe. I store mine in a gold vault, in a proper secure gold vault. Then it's safe, I don't have to worry about it, nobody can come to my house and try and get it. I don't have it. But it's as simple as that. You can still check your balances online. It's not like you can't see it. You own it. It's all in your name.

Raoul Pal: (42:38)

Now, let's say you're an institution and you don't want to go to a family office. Well, Fidelity have just set up a whole custody business, so if you don't trust Fidelity, well, you might as well give up. The US have just approved it as a custody asset for a whole group of banks. What does custody asset mean? So any hedge funds listening to this, what that means is prime broking. Prime broking's coming, and it'll be here, my guess, early next year. So prime broking bitcoin, that's coming, too. The whole custody issue goes away. It's actually harder for individuals because you have trust one of the wallet providers, et cetera. But that whole space is getting better and better. You can also buy insurance against it. So all of these things that were hard in the beginning are now actually relatively straightforward.

John Darsie: (43:27)

All right. It's something at SkyBridge and with SALT, we have a growing interest in the space given some of the adoption we're seeing, so we look forward to being in touch with you and other leaders in the space as we figure out exactly how we're going to get involved. But, Raoul, we're going to leave it there. We could probably have a 10-part series and not cover all the interesting topics that we could talk about. We really encourage you to sign up for Real Vision. It's the media entity that Raoul launched that has tons of fascinating things on macroeconomics, financial markets, and bitcoin. So we would definitely encourage all of our community to sign up for Real Vision, and, Raoul, we really appreciate your time.

Raoul Pal: (44:00)

Good talk. Really enjoyed it.

Anthony Scaramucci: (44:02)

Raoul, I just want you to know, I have a mechanism in my computer that's slowing down his Internet service so that he sounds like Godzilla at the end of this thing, okay? It's just something I do to him once in a while, just to be cheeky.

Raoul Pal: (44:14)

Just to bring him down a peg, right?

Anthony Scaramucci: (44:16)

Yeah, I got to bring him down a peg, and-

Raoul Pal: (44:18)

I get it.

Anthony Scaramucci: (44:18)

... just to use a British word I love from Thomas the Tank Engine, just to be a little cheeky, you know what I'm saying? But thank you so much. We really, really enjoyed it. I'd love to get together with you at that bar behind you. I hear you mix one hell of a gin and tonic, so I want to sit at the bar with you someday when the world is safe.

Raoul Pal: (44:38)

I look forward to it, my friend. Take care.

Anthony Scaramucci: (44:40)

Great to see you. Thank you for joining SALT Talks.

Raoul Pal: (44:42)

Really appreciate it.