“Conservatively, I think Bitcoin will have $10-$50 trillion market cap in ten years.”

Willy Woo is a leading on-chain analyst, a new field that extracts market intelligence signals from Bitcoin’s blockchain. He writes the Bitcoin Forecast which is the most popular paid newsletter in the crypto industry.

Bitcoin exists on the public blockchain, so every transaction is visible and from that ledger an on-chain analyst can make informed predictions related to the cryptocurrency. Bitcoin’s volatility continues to decrease as more of the population is exposed to the asset and scale grows. There has been a movement towards long-term Bitcoin investing which has helped drive the asset’s bull market. “We’ve seen a net flow of coins away from participants who are traditionally just speculating or buying for the short-term and then selling. These new investors are coming in and locking up coins [long-term].”

There is a lot of leverage in the current Bitcoin cycle. If the price starts to teeter, then there could be a sell-off that leads to a bear market. Though, if institutional capital moves into Bitcoin at the end of the year, then the price will run up even higher.

LISTEN AND SUBSCRIBE

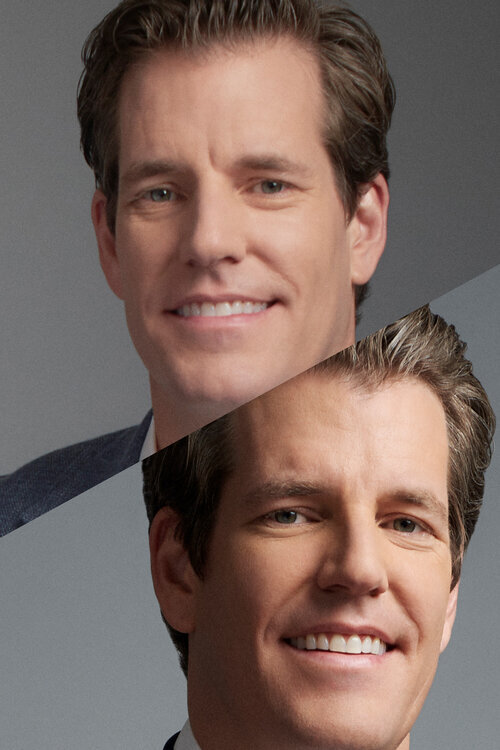

SPEAKER

Willy Woo

Author

The Bitcoin Forecast

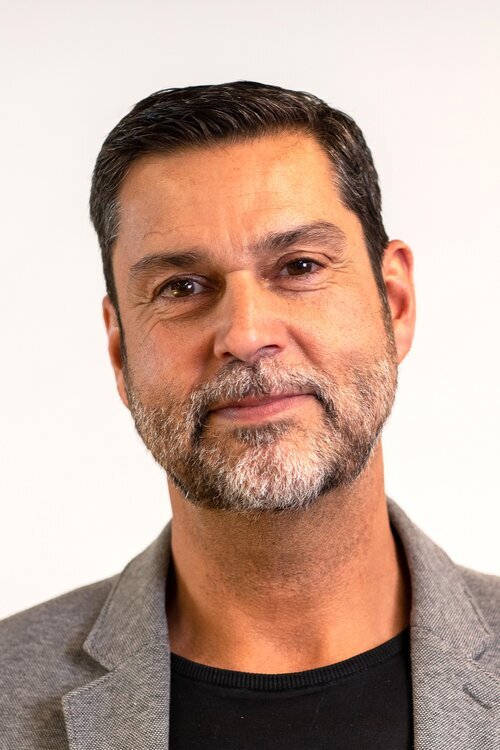

MODERATOR

Anthony Scaramucci

Founder & Managing Partner

SkyBridge

EPISODE TRANSCRIPT

John Darcie: (00:07)

Hello, everyone. And welcome come back to salt talks. My name is John Darcie. I'm the managing director of salt, which is a global thought leadership forum and networking platform at the intersection of finance technology and public policy. Soul talks are a digital interview series that we started in 2020 with leading investors, creators and thinkers. And our goal on the salt talks is same as our goal at our salt conference series a which we're resuming by the way in September of 2021 in New York, Willie, I don't know if you'll be able to make it, uh, flying in from Hong Kong, but we'd love to have you there. And that's to provide a window into the mind of subject matter experts, as well as provide a platform for what we think are big ideas that are shaping the future. And we're excited to bring you the latest in our series of salt talks on crypto digital assets and Bitcoin with the great Willie.

John Darcie: (00:54)

Woo. Uh, if you're in the crypto space at all, and you don't follow Willy, I don't know where that, what rock you're living under basically. And if you don't follow crypto and you're looking to learn more about it, there's no one better to follow both his writings and his Twitter feed and everything he puts out. Uh, then Willy will, uh, Willy as an on chain analyst, a new field that extracts market intelligence signals from Bitcoin's blockchain. He writes the Bitcoin forecast, which is the most popular paid newsletter in the crypto industry. Again, I couldn't recommend that newsletter highly enough. And I think Brett, our host today will echo that sentiment hosting today's talk is Brett messing. Who's the president and chief operating officer at SkyBridge capital, which is a global alternative investment firm. I would say, Brett is sort of our crypto enthusiast in chief.

John Darcie: (01:40)

And I would actually revise that to say our Bitcoin maximalist and chief he's very much a Bitcoin guy, although a fan of everything that's going on in the ecosystem. Uh, and with that, I'll turn it over to Brent for the interview. Thanks John. Willie, thanks for joining us. I think we're going to have some fun today. It'll be educational. I'm going to teach part of our discussion with your answer from Ryan will explain this or explain this later to our, uh, to our, our, our, uh, our fans here. Um, before we hop into the fun stuff, can you explain, and I am a subscriber and do echo John's, uh, suggestion that people should do. Likewise, can you explain what I'm chain analytics are? Because I think, again, for those of us that are traditional investors, these are just not tools that we had or are just, we're not sort of generally familiar with. So if you can just provide a quick one-on-one and then we'll jump into the fun stuff.

Willy Woo: (02:36)

Yeah, sure. Um, Bitcoin is quite unique, um, as in that it's got a public blockchain. So every transaction that we see is totally visible, um, on that ledger. So there's this whole process where we can pull that data and analyze it and essentially get, um, like demand and supply, um, from different investors coming in and out of Bitcoin. Um, you know, it turns out there's a lot of signal in there. You can make, um, forecasts and predictions. You can diagnose what's happening with the network at any time. Um, like recently we just had a massive drop in the hash rate when there was a big power outage in China affecting minors. So you could see, um, all sorts of, um, you know, things that happen, um, on the ledger. And, um, within the matrix of the network, you, you

John Darcie: (03:26)

Mentioned the, the, uh, what happened in China with the mining going offline. I think the thing that paid people paid more attention to was we had a bit of a, you know, a flash crash, if you will, this weekend, right where we had about a 15% decline in half an hour. And as we taped today on April 22nd, we're trading, you know, at 54,000 or so down from, you know, a high of 63,000. Um, can you talk about sort of that decline, what you think triggered it? Um, uh, yeah, I I'd be curious what your insights are. Sure.

Willy Woo: (04:04)

I'm like, yeah. Where we're trading in, um, sort of the high range of 60, 60 to 62,000, um, uh, like a few weeks ago. And, um, you know, it's, it was, it was trading in a near all time high and whenever we're at an all time high trades, like to go long because, you know, there's no resistance overhead and the whole market was very highly leveraged. Um, there was more, um, open interest contracts in the derivative markets than we've seen any time in this year. And so when, um, you're in a situation where, um, the market's highly levered, it's very emotional. And so what happened in China was, um, there was, um, a power sort of outage to China. Um, like China is, um, the Chinese power companies were, uh, undergoing our safety inspection. And so they look like, um, the, the miners in China, which some estimates of between 25 and 40% of the, um, mining power on the Bitcoin network is located in this particular area.

Willy Woo: (05:10)

Um, these, these miners went offline and that went on offline at a very critical point, um, because, uh, essentially the, the Bitcoin network and balances, you know, the, the amount of hash power, these miners throw at the network with the difficulty adjustment. Um, so this sort of keeps everything can check. So our block times keep being processed every 10 minutes. And so the difficulty just went up and within, um, like something like 12 hours of that difficulty adjustment, um, the miners, uh, went offline and let part of China. So we had a reduction of, um, compute power thrown on it, the network, um, just at a time when we needed it for this higher amount of compute that, um, is normally, um, thrown at it. So immediately the, um, the network started to slow down, um, the amount of the amount of mining, the compute, um, was not sufficient to balance off the difficulty.

Willy Woo: (06:15)

And so block time started to slope down and can imagine if, um, hash power starts to drop out of the network. Um, and there's a, there's always been this correlation between hash power and price. Um, you know, we're in this highly leveraged zone and, um, speak later sold off. And, um, and so, yeah, it was, it was a sell off that was quite, um, unprecedented for this year. And there, uh, nearly 5 billion, um, contracts got liquidated, um, a hundred lowers. Our million accounts were liquidated across, across the whole ecosystem. Um, if you were to include, um, the entire crypto asset space, it was nearly $10 billion of liquidation. So we had a big flash crash. So, I mean,

John Darcie: (07:07)

I can put that into layman's terms is what we really have is where we have people who were levered right. 20 to a hundred, a one, right. And that as the price starts falling, right, you have people that get sold out and that puts pressure on the market, which then sells out more people. Right. And then you get this sort of cascading effect. Is that, is that really the that's, that's the dynamic you're describing, right, exactly.

Willy Woo: (07:33)

It's a, we call it a long sweet squeeze, um, either, um, you know, if you're, if you're, um, if you were trading on leverage you're esentially, um, buying assets with money, you don't have. And so liquidation is essentially the bank foreclosing on you. Um, so, you know, when that happens, your entire positions get sold and that's dumped onto the market. And obviously that pushes the price down and then it sort of cascades to the people below you with, you know, with their risk limits, see a little bit below, and that just creates this chain reaction in the whole thing starts collapsing. And, um, until, until everyone's liquidated, um, and then the price bounces back up. So, I mean, so

John Darcie: (08:15)

We do a weekly Bitcoin show because there's just so much news in Bitcoin. One of the things we someone asked yesterday was, you know, how is the market different today than it was in 18? And the answer I gave, which would be curious to your reaction and tie it back to this is in 18, it seemed like everyone was speculating people, right? We're buying Bitcoin to sell it at another price to make money, to go buy stuff with, right. There's this sort of idea of hobbling or being like an investor, I think really hadn't taken hold. And I, and I'm not going to tell you as an institutional investor, we own, you know, $600 million or so of Bitcoin we're investors. Right. We, we haven't sold any Bitcoin. Right. You know, we deal with the ups and downs. Um, but it does seem that there's still, uh, and I don't know what percentage of the market right. Is composed of speculators. Right. And price action tends to be driven by the marginal buyer or seller, I guess. I just like your reaction to how the market composition today versus what it used to be. And, you know, again, is it speculators that are driving the market or is it this institutional adoption that we're seeing? Um,

Willy Woo: (09:30)

Yeah, the market's completely different from 2018. Um, maybe, well, 2018 was a bear market. Right. So then I'm sorry. So in 2017,

John Darcie: (09:40)

I mean, when I, when I say that

Willy Woo: (09:43)

[inaudible] was, um, you know, Bitcoin had a lot of, um, exchange activity, but very little of it was, um, leave it. Um, we didn't have well-developed, um, futures markets, uh, the leverage you could get was on margin, so borrowing rather than, um, derivatives. And so, um, the, the, the price was more or less, um, yeah, I would say it's less, less leave it. Um, but I'd say also right now, um, you know, we've got this very large dominant derivatives market. Um, like the I'm just looking here. Um, the normally derivative director's market is, was much, much higher than spots, sometimes five to 10 times higher. Um, we've just flushed out a lot of the duress of traders. So, uh, even now post that flush, um, the, to volume is 50% higher than what we're seeing on spot volume. Uh, I would say, you know, you'd say you might think that, um, the derivative market has a lot of price control over, um, Bitcoin, but actually that's not entirely true.

Willy Woo: (11:03)

It has a very, um, like short term dominance, you know, because like, if you're going to buy Bitcoin on margin or, um, it's, you're, you know, you're there, whatever you buy, you're going to have to sell out sooner or later because it sets a short term trade. And so ultimately what's really important. And, um, this, um, it is the long-term investors who are coming into buy and hold, whether they're coming into buy and accumulate or whether they're selling. Ultimately, when we're looking into the weeks and months ahead, that's going to determine the price of Bitcoin, essentially the demand and supply this, that, um, dominated by the long-term investors. And this is what we're looking at on chain. Um, we can actually see what's happening so much in terms of the trade positions on chain. We can't see any of that. You have to look at data coming off the exchanges, but, um, whatever happens in the short term, even if traders are shorting. Um, and when you see, uh, like long-term investors coming in to buy and accumulate, you know, that it's going to be the traders that are going to get ripped. Um, they cannot, um, continue to short and sell off into the demand that's coming from long-term investors. So

John Darcie: (12:28)

You, you raised an interesting point. Um, you know, there's a lot of discussion that the influx of institutional capital is going to reduce the volatility of Bitcoin. I actually don't happen to share that view, which seems to be consensus. And I hadn't really thought about what you just said, which is that we have much more leverage in the system today than we did in 17. So that makes me feel more strongly that, you know, we're a ways away before Bitcoin between us becomes a less volatile asset. We're w what's your view on that?

Willy Woo: (13:06)

Yeah. Um, I've run a projection on volatility. I've got the volatility of Bitcoin since the markets first opened in 2009. Um, and if you plot there on a log scale where, um, you know, originally the volatility was over a hundred percent over a 60 day period. Um, the, it is coming down, there's coming down, it's a decay, there's kind of like a half-life of decay and most people will not notice it, um, because they're only looking in the last few months with last year, but if you plot this over the long-term scale, we're looking, um, I carry number off hand. I think it's about an a decade give another dozen years. Um, that's actually on track to cross under the peak volatility of USD Euro, um, which is quite surprising. Um, but that's, that's what happens when you, you met this over the long term, um, this, this asset classes still very, very much in its infancy. Um, you know, like it's taken us 12 years to get to some, somewhere between two and two and a half percent of the world population having exposure to it. We've just broken $1 trillion of capitalization. Um, it seemed to get a lot bigger and as we get that kind of scale into the system and that kind of capital, it will reduce and volatility. And we have seen that for 12 years. Yeah.

John Darcie: (14:49)

I, I guess, I guess when I say the volatility not being reduced, I I'm speaking more in a noticeable way in the next one to three years. I definitely agree with you, you know, when, if you scope out the time to a decade, you know, I certainly agree. Um, well,

Willy Woo: (15:07)

I I'd say I've been seeing the volatility over the last say three years reduce as well. Now, the reason for there is there, I think I'm very, I think very strongly, like in 2018 we had very high volatility because, um, all of the leverage was essentially one exchange. It was unregulated called BitMEX and there was a lot of, um, kind of a few being trading that market. You could see a lot of, um, maybe call it trader games where, um, you know, the stock positions, you know, the defensive lines where people would exit the positions they were being hunted, um, through, uh, essentially, um, you can either call it manipulation or you could, you could call it game theory, like trading, where you're pushing the price in a particular direction to, to, um, take out traders. Um, that was very evident. Um, I used to say, um, the short-term price section of Bitcoin was essentially a random walk, um, to liquidate the most traders on BitMEX.

Willy Woo: (16:17)

And, um, obviously in their kind of here, you would see this ridiculous amount of volatility where you have these works of price going up, um, you know, whatever, it was hundreds of dollars in minutes. And then I would revert back down as traders were being liquidated and the price action was the, it's like a square wave, like these bats that would go up down and very choppy. And, um, now we're in the Sierra where, you know, you've got like 20 drift of exchanges and most of them are playing very nicely. Um, but Nick's, um, now a very much minority of it. You've got the CME, which is wholly unregulated. Um, so there's less volatility just in the sheer mechanics of, um, the, um, the industry, um, the infrastructure there for, for, um, for trading these derivatives. Um, and then when you add to that, um, this, this kind of 20, 21 year telling a 2020, where we've had very, very large spot demand coming in from institutions.

Willy Woo: (17:25)

Um, we're yeah, we're, it's, it's, it's limiting the downside, um, sell off from, um, what you'd normally expect, um, from derivatives. Um, so, you know, I, I keep in mind, you know, this kind of idea where you've got an organic price of a bit coin supported by a investors, and that can be modeled using on chain data, and you can model that quite closely. And then you can measure the actual price of the coin, which is really, um, the Terman and pat, um, by the speculators. And so you've got the speculative, um, premium that, that happens. And whenever the price gets close to that floor price at organic price, um, it's very difficult to squeeze the price below that valuation. The only time I've seen that happen was in, um, you know, the early part of last year when we hit the COVID of the event where all Mac had sold off. And it, it did momentary drop below that for a few weeks until all of a M deleveraging had completed. Um, so, um, yeah, I think, I think the volatility is dropping, um, and it's just from the sheer amount of demand coming in from, um, institutions currently. Yeah.

John Darcie: (18:50)

I think, you know, we have a, we have an ETF application before the sec, so I'm sort of conversing in some of the terms that are important to them. I think they would use a less polite word and say that the market was subject to manipulation years ago. And of course we're arguing that with the maturation of the market, um, that, you know, it's just not as susceptible to it as it was, you know, when it was cause I, I concurrent still, we're still in, you know, a very young asset class, but, you know, it's growing up a lot, you know, over the last four or five years. Um, can you speak to sort of the, just the state of the market today, and maybe you can tie in why I opened our session with a 1987 song by Rick Ashley, and maybe, uh, maybe tie that to, you know, what your forecast is, which I think, uh, I think our listeners would, would enjoy hearing.

Willy Woo: (19:49)

Yeah. It's, um, we're seeing currently and unprecedented supply shock. Um, so normally you see this kind of, um, this kind of depletion in inventory on spot exchanges is, um, essentially like the long-term buyers come in and accumulate and move those coins into a cold storage. Um, and this kind of buyer is kind of the smart money buyer that buys in early, um, before, you know, the price starts rocketing, you know, when you take a lot of the supply out of the market, it does rock it up. And that happened in 2017 and the sort of one to two and a half thousand dollar ban before we rocketed up to 20,000 and the, the following three quarters of 2017 and, you know, their depletion of the smart money coming in, um, that lasted no more than five months. And like this time we're at, what is it?

Willy Woo: (20:54)

I don't know, is it 13 months already? There's just so how much coins are being scooped off the exchanges and, um, you know, no who do a lot of the on chain metrics. And, and they've got a metric where we look at the, um, the wallets on the exchanges. I mean, not while it's on the network and we cluster them and we figure out, um, essentially who are the different participants and we look at them and we go, is this person a highly liquid person who seems to buy and sell, buy and sell. And then we have the, what I call the Rick Astley's of this world who buy their Bitcoins and we'll never let it down. You know, they just keep buying and buying with value, much history of selling and very similar to their supply shot. We're seeing of coins moving off the exchanges.

Willy Woo: (21:45)

We're seeing these Rick athlete, um, genre of, of, of accumulators, of, of investors that are buying and holding, um, coming in very strong. So we're seeing a net flow of coins from, um, participants that there have been traditionally more or less speculating or buying over the short term and in selling, um, maybe they are like traders that trade in and out of old coins. Uh, but essentially these new people, the Ric athletes are coming in and they're just buying a locking up the coins. Um, and so that's been a very big driver of this bull market that, um, there's been strong buying, um, and even like we can measure the size of the purchases and the movement of their capital. And, um, you know, a lot of the conversation has been about institutional investors. Um, that's true. Yeah. Also, um, I am thinking that there's a lot of high net worth investors coming in here coming to buy it.

Willy Woo: (22:49)

And, you know, slugs are $1 million at a time. Um, and we saw that, um, very stressful in the sort of first two months of 2021. Uh, so yeah, I think it's these guys institutions, the, um, high net worth guys that are coming in and scooping it up. They tend to store on, um, into Coldstone wallets, which I'm a very visible on chain. Um, whereas retail, um, which, um, you know, that just started to come in the last two to three weeks. Um, lot of retail numbers are going up, um, retail teams to store the coins on exchanges. Like the Coinbase is of this world. Uh, and that's less visible on the blockchain obviously because they don't take off the exchanges. Uh, but we are seeing, um, a lot of numbers claim lately with, um, more retail type. So

John Darcie: (23:46)

You, um, uh, recently raised your price target from two 50 to 300, um, I guess, can you put a timeframe on that? Can you talk about, you know, how you get to that, how you derive that and you know, what drives that?

Willy Woo: (24:03)

Yeah, it's a, it's a very, um, kind of dynamic, um, like model and there, um, it uses, you know, what we called mean reversion, essentially a moving average, and also I'm moving average of, uh, of the price of Bitcoin. And, um, if you do that every single top that, um, Bitcoin's experienced and it's 12 year history, um, it's, it follows a particular trajectory and, um, you know, to get a target, you kind of have to get an idea of where the top will be, um, when a real hit that, um, that they align essentially the all time moving average across a multiplier, their model, um, is looking like it is shooting for three to 400, even higher. Just really depends how the price section of the coin acts over the next, um, you know, half, half of the year. Um, but so perfectly we, in all past cycles, we've seen Bitcoin top out around the December, um, at least the fourth quarter of, of the year after the havening.

Willy Woo: (25:19)

Um, and you know, like Bitcoin is like this assay that's very, very much locked into an algorithm where every four years we have a happening, um, where the inflation rate of the canoe coins minted into the supply gets halved. And that creates this, um, like reduction in south pressure by one half and so seamlessly that gives us a little shove on the price. If you've got half of them out of S sell power from new coins being mined, um, you get a bullish in pulse and, um, in all the past cycles that it seems that that bullish and pulse manifests into this crazy Brenner. You know, the last one was, um, 29, 2017, took us from a thousand to $20,000, um, and tends to Peter out around the fourth quarter, around December. So ballpark in December, um, that top cap model of mine, um, it could be anywhere in the three to 400,000 range and might even go higher, but we need to see how it performs over the next six months.

John Darcie: (26:31)

Okay. I want to dive on into this ruling. So I'm going to challenge a little bit here. Um, so, and I'm wearing a Bitcoin hat, so, you know, just remember I'm super Polish as I challenged you, but it seems to me whenever I've seen a great trade, that's so obvious they eventually go away. So just as an example, last summer, we look very hard at the grayscale arbitrage, which was a fantastic trade and we passed on it, which was probably a little bit of luck, but it just seemed too obvious, felt like everyone was doing it. And whenever I've seen that, it just means that you're sort of late in the cycle for that, that sort of trade, the obvious trade in Bitcoin that everyone seems to have is, well, this cycle is going to be like a last, like, when are you going to sell, what is it going to be December?

John Darcie: (27:20)

Is it October? And my experience tells me that this cycle is going to be different one way or the other, like maybe we've taught maybe we'll top in July, or maybe we're going to just blow through December and just keep going higher and higher. And this cycle from a time and price standpoint, we'll look, I think that the cycle, if I were to put odds on it, the likelihood that this cycle looks like the past one, I would have very, very low. Um, and obviously I would skew to a longer a bull market with higher prices because I'm wearing a Bitcoin hat, but I actually would think a shorter bull market to me is more likely than just a repeat of history. I just would like your reaction to that because it's just, there's, there's so much discussion about, you know, where are we already, Paul talks about while we're in the fifth inning and he's basing it on prior history, and if everyone's got the same trade on it, it's going to be different than that.

Willy Woo: (28:21)

Uh, I kinda agree with you

Speaker 3: (28:24)

Actually. Um, you know, I, I, I've seen a lot of templating of the cycle past cycles. Um, I don't think anyone would have guessed that the cycle would be ripping up so quickly. So, so had, um, and I know a lot of the team traders have been like, this is overboard and it's just been on the red line consistently until the last, you know, I guess month and a half. Um, and

Willy Woo: (28:55)

My approach really is like,

Speaker 3: (28:58)

You know, we got all these models, um, the status of you trading a model, um, I ran the 2017. We hit like $10,000 and everyone said, this is tall. And I looked at the back trace and I look at the on chain analysis of it and it, it could have been a talk, it was touch and go. Um, and then it ripped and doubled, doubled to 20,000 in a matter of weeks. Um, and so everyone's got this plan, um, beautiful plan. And so thing happens and, you know, I get people asking me, can you let me know when we get with them 25% of the top? And I think back to 2017, I go, you know what, well, didn't, we just like, we, we, we doubled and I think just barely over two weeks in two weeks, we went from 10,000, but like, there was something like, we went from 10,000, 20,002 weeks.

Speaker 3: (30:08)

And, um, every day the prices running up thousands of dollars and you think, can I have a nice, um, wanting 25% of the way to the top? And the whole thing is Maine. Um, and so when you're in there, mania phase of the market, anything can happen. The fundamentals have gone out the window and it's just highly speculative. You'll see the price rise way about what on chain. Um, valuations will go. The, um, I mean, you just don't know, it's like you're playing chicken off a freight train, speak of FOMO. So, um, I think that's gonna come into it and we'll we're to maybe the models where maybe they die. Um, but everyone's going to be in complete disarray when, when, when we approached the top, that's, that's always happening at that point. Um,

Willy Woo: (31:03)

I don't know if we're going to top out early. Um, I think there's a fair chance. Um, there's a fair chance we might might just looking at some, some of the, the rates of climb. Um, you know, I look at, I look at the, the capital coming into the network and I look at these bounds, you can put on it based on the back trace. Um, it's like, while the price can go beyond this part or this, this price target, because, um, historically, you know, we haven't been able to break there with this amount of capital on the system, so there's, there are bounds. Um, and, uh, I, you know, you predict them for, it seems like, well, we're gonna close out this cycle earlier. Um, but having said that fundamentally, um, you know, looking at the institutions coming in, um, which maybe you have a better idea of, it looks like a lot of money's still coming in.

Willy Woo: (32:05)

Um, and, and it's kind of, yeah, I do get the sense that if their money is coming in and it's coming in near the later into this year, um, the, it could change a lot. And I, the, you know, the top, the top model I have, it's a moving target based on essentially the price section that's happening throughout the year. Um, so having said this, this target out there, and there's a very broad gin near target. It's very dependent on the time signature of there happening around December. Um, so I have, for anyone who's trading this and thinking of your hundred thousand, that's a hard and fast target. Um, it changes, you know, I see 300,000 year, January of this year, cause that was where, and there was conservative because it was based on past curbing of that model. Um, but I think it's very subject to, to, um, change. Um, it's certainly not like plan B's, um, stock to flow model where he's got a line on the same where this amount guests, the models, this price, this, this regulation. Um,

John Darcie: (33:23)

And by the way, I don't mean, you know, my approach to models is it's sort of like, it's like riding a horse, you know, you ride it till it bucks you, you know what I mean? So, you know, I, I'm just wondering if this is the year we break the book, the model, in fact, John and I spoke with someone who runs one of the larger institutional businesses in Bitcoin, and he believes that that will happen for the reason you just said. He just said that the, the, the March of institutional capital is so large and, uh, it takes these folks time. You know, it just takes them time and, you know, if they're going through their committees now and they're coming in in the fall, like they're, they're not worried about the cycle. Right. You know, and they're not going to be saying, well, it's late in the cycle. Let's not invest there. They're going to be buying. Um, and that's where you could get, you know, sort of a, um, a busted cycle. I'm not on board with Dan held Supercycle. I said, I do think we're going to have a, a bear market. I think that's just nature of, of everything I've ever traded. Um, but I just think it's going to be different this time, but who knows we'll find out. Um,

Willy Woo: (34:35)

Yeah, I agree. I thought, I think the whole thing's on a, um, you know, it's a, it's, I feel like it's like, uh, it could go either

Speaker 3: (34:44)

Way. Um, we could, like, if we get an influx of this very large capital from the very large institutions that could change, um, but then also there's so much leverage in the system on the cycle. And we haven't seen that in 2017, like just the amount of people I've heard that are like mortgaging their houses to buy more Bitcoin or

Willy Woo: (35:14)

Collateralizing their Bitcoin on a block fire line to get fear, to buy more Bitcoin, um, even funds are doing there. Um, so, you know, once the price starts to Teeter, I could see, um, a very large sell off in a large deleveraging event there that throws us into, uh, a BMI market. But if this capital comes in near the tail end of this year, that's going to stop that from happening and it'll just run up higher, um, cause then deleveraging might happen. Um, so,

John Darcie: (35:53)

So th th there's one factor that, that I don't hear people talking about, which I think about a lot, which is, as, as we know, there are 900 Bitcoin new Bitcoin mined every day, right? So in fall, let's say when the Bitcoin price was 15,000, that represented 13 and a half, a million dollars a day. And, you know, PayPal and square and grayscale were able to scoop up that much just based on their, their daily inflows and buying, you know, today we're up to 49 and a half million dollars. Right. And, you know, w w we have a fund we're buying Bitcoin every day. There are other people, right? So, you know, that that's an absorbable amount, but when you start get to bigger numbers, right. You know, it's 90 million at a hundred thousand. I mean, this is just basic math, but th you know, when you say the numbers are, you get to 250,000 Bitcoin, right.

John Darcie: (36:49)

That's 225 million supply. And, you know, I love Michael sailor's idea of Bitcoin miners holding the Bitcoin on balance sheet. But most of them, you know, don't have access to the capital markets yet we don't have, as a percentage of the miners, a very small amount of them, right. Are trading on public exchanges where they can raise debt and equity. So I think we have to assume that that's, that is supply, that, that will come onto the market. That's just a lot of incremental demand just to sustain the price, I guess. What are your thoughts on that and how does that affect your model? Right. Again, we get to two 50, right? That's $225 million, then that new flows have to come in just to keep the price add 250,000. Am I thinking about that wrong?

Willy Woo: (37:40)

Yeah. I, I really don't think the minor cell offers anything that significant. A lot of people look at the charts of, of minor, um, outflows into exchanges. Um, and I look at them every day. Um, you know, I've got it, the whole chart here every day, I'm looking at it and I don't even look at it because it's so minuscule against, um, genes, the buying power of, um, of, of a full-blown bull market. Like we're saying, um, currently at least on Shane it's 50,000 people are buying Bitcoin for the very first time. That means that, uh, by my estimates multiply by three, roughly, um, we're seeing 150, 50,000 people that are buying Bitcoin for the very first time, um, at the exchanges Naval, nevermind, just looking on chain. So, um, gosh, even excluding the institutions, just talking retail, um, that's like less than a 10th of a Bitcoin, um, per day, like, like for each one of those new participants, that's very minuscule.

Willy Woo: (38:58)

Um, uh, not, not very much talked about as, um, the actual real self power, um, in this cycle is really the, the, um, the fees that are generated on these derivative exchanges. Um, like I was talking to one of the very large OTC desks. Um, the head was giving me an estimate of the sell off by exchanges from, you can think of it as a tax on trading. And then that gets dumped into the market converted to fee, to pay salaries and, and, and whatnot. Um, he, he estimated, um, 1200 Bitcoins per day, um, in 2020, um, is being dumped onto the market. Um, so you can think of that as a sell pressure and other kind of minors. Um, so appreciate, it's like the exchange mining fees and dumping that on the market. Um, we've got a lot more bullish activity, a lot more trading volume, 2021. Um, that's the one to look at, um,

John Darcie: (40:07)

Just to be clear. So you talking about, like, for example, a Binance is making their money in Bitcoin and they need to pay employees. So they're selling some amount of the Bitcoin that their revenues come in to pay employees. Is that, is that what you're saying?

Willy Woo: (40:24)

There's an example. I, I posted this, um, last year CZ mentioned that they, um, pay the employees and being, and they don't sell off to cash match. Um, but, uh, we're talking a heck of a lot of volume, you know, um, we're talking, um, you know, easily quarter of a trillion dollars a day into volume, um, most days. Um, so, uh, you, you take a small fee of that. It's gonna, it's gonna pale, and it's gonna make the, make the miner's fee tiny, absolutely tiny compared to what these exchanges are doing. And a lot of it does depend on whether they are, um, stacking sets, essentially stacking those Bitcoins and holding it. And how are they paying their staff and Bitcoin, or are they selling to fear?

Speaker 4: (41:13)

Um,

Willy Woo: (41:15)

And so that that's, that's not analysis I've done that comes from OTC desk. Um, I think to get a really good handle on it, you'd need to know exactly what the behavior of these changes are, but coming from an OTC desk, um, I think they've got a pretty good handle on exactly what's coming out.

John Darcie: (41:35)

Um, that's interesting. I wasn't aware of that. Um, I guess, relatedly, so we've been in this sort of 50,000 channel now for two months or so give or take, and, you know, there's a lot of talk of the institutional buying, right. You know, there's been a lot of good news thrown at Bitcoin over the last two months. Right. We had Brevan Howard, a big hedge fund announced they bought Dan Loeb, Ray, Daleo just in the last week, right. Ben opened up, um, and we're at 54,000, which again, we're up 80, 90% for the year, but where's this outside of, you know, the miners, which are sending us in substantial. And, you know, let's say exchange fees to pay compensation, where is all the supply coming? Right. Cause there's, there's a lot of talk about all the influx of demand and, you know, and how we're holding this trillion dollar level right here at 52 50 3000.

John Darcie: (42:30)

But it I'm an equities guy traded equities for my most of my career. It feels heavy to me. You know, Bitcoin feels heavy to me, you know, inequities trading. They say when a stock gets lots of good news and it, and it stops going up on that good news, it's a good time to sell. And, um, again, I'm, ragingly bullish on Bitcoin, but you know, for the last couple of weeks, that's how it's been acting as like a stock that gets hit with a lot of good news, but can't seem to break out. Um, so just like your reaction to that in terms of who is selling based on your analysis, um,

Willy Woo: (43:08)

Let me just zoom in. I want to pull up a chat so I can get my bearings on the dates here. Um, so, you know, typically, and you see it on the blockchain, you see the age of coins that are moving, um, Asia coins that are moving out of wallets. Um, when you see coins moving out of wallets and moving to new participants, um, that's a sale. And so we measure the age of those coins and the size of those clean movements. Um, we we've seen since the entire history of Bitcoin, um, the OGs, the, the whales that bought from early days, 2012 and earlier when things were like under a hundred dollars, those guys are divesting and every single bull market rally, they divest a little divided dailies, but, um, and we saw that, um, interestingly,

John Darcie: (43:58)

Well, I talked to a lot of those guys and they all deny it. So I believe your data and they're probably lying to me, but none of them say they're selling,

Willy Woo: (44:07)

Maybe not recently. They certainly did. And, um, you know, they certainly did up to match and they stopped selling when Elon Musk started buying, which was very interesting. And then the sell is, um, since then, um, you know, they are away or sellers that have been selling, um, that have been selling, um, since, um, the OGE stopped selling. Um, the age of coins have been, um, much younger and, um, we saw a lot of that hitting into the tail end of match for the quarterly rebalance. So, um, my guess is really the, the hedge funds that bought in, um, in the 10,000 ban took a lot of profit. Um, I think Rafa was one of the funds that went on record. Um, so

John Darcie: (44:58)

Yes, we're seeing,

Willy Woo: (44:59)

I think a lot of these, um, trading funds that are buying in for, um, shorter term, um, live positions that, that, that taking the five to six X. Um, and, and that's, that's creating a bit of a cap and the same here. Um, so yeah, I, those are the sellers is what I'm seeing. Um, very clearly based on the date of the coins that are moving into the exchanges.

John Darcie: (45:27)

Got it. I guess that makes sense. Um, so something that's happened is that over the last six months, that has surprised me is, um, like the doge coin phenomenon, you know, I, I, it, the ICO craze and the all coin craze of 17, 16, 17 felt again like, you know, the sort of speculation you see early in a market. And we had Bitcoin back to approaching what eight 80% or so of the overall cryptocurrency market in the fall Bitcoins. Now down to 50% of the cryptocurrency market, right? Doge coin is 58 billion. And I'm only using that as a stand in, right. There are a lot of other, um, coins and defy tokens that, you know, are trading advantage. It really big numbers. I, I guess I'd like your thoughts on that in terms of the overall market and what does it mean for Bitcoin good, bad or indifferent?

Willy Woo: (46:32)

Well, you know, like, um, the altcoin market, there's many ways we can look at it. Like the, the, the, the, the age old way of looking at it is, look, these are, these are, um, alternative assets that you can trade in and out of, um, you do a back trace on them, and I bet traced what nearly 2,500 of them across all the history that there was. And, um, more or less these assets it's trimmed down over multiple cycles. But the interesting thing about these ACS is that they, um, they provide, uh, um, you know, I kind of beat her. Like, it, it, it, um, in a bull market, they can go a lot higher than, um, Bitcoin and outperform Bitcoin and, you know, be a market underperform and they go through oscillations. So, um, a lot of traders will, will, um, particularly the crypto native traders will trade in and of altcoins in different phases of the market, particularly when the Queensland or sideways band.

Willy Woo: (47:35)

So while you've got the sell off coming from, um, initially the whales from the OGs, and now the hedge fund selling off in the quarter, you're rebalancing, um, it's trapped Bitcoin in a sideways band. Um, and then, um, when you're in that zone and you also get these native traders that are like crypto native traders, they're like going, okay, this is my opportunity while Bitcoin's going sideways, I'm not going to get any gains on that. So I'm going to move capital out of Bitcoin and into these coin assets and that tiny little market caps. So they go weak all the way up, um, on very small amounts capital. Um, so yeah, you get that kind of a fit. Um, that's the traditional way of explaining it, that is definitely happening. Um, we're in a, kind of a 20, 21 phase of the market where there's a lot of experimentation happening on, um, defy.

Willy Woo: (48:30)

And so, um, you know, there's a lot of, some of the, you know, a lot of legitimate experimentation, um, a lot of, um, complete scams, um, uh, there's some very well engineered devices projects that are, um, well engineered in the economics to go upwards, um, striking a lot of capital. Um, and then you've got, um, a lot of interesting projects there. Um, actually we didn't have in 2017 then look like, um, you know, they can hold the future of defy. Like, um, you know, I, for example, FTX is a shining star or one of these derivative markets and, um, the, of being creating serum decks and that built their own salon owner. And, you know, we've, we've got exchanges there. We can trade on now where the transaction fees are sub sub one, penny, um, and all secured on a private key with no counterparty risk when less counterparty risk, maybe a little more, a little bit more risk on that technology stack, but, um, who doesn't want to trade, um, without counterparty risk, you know, these, these are very exciting projects.

Willy Woo: (49:44)

And if you were to think about how that looks like in the nutritional world, um, the amount of capital in these, these derivative markets is huge. So, um, these projects are really wanting to get a slice of, um, essentially the future finance, taking a lot of trade fire moving onto defy. It's a big, that's a big, um, there's a big market right then. So there's a lot of speakers, a lot of fervor, um, between even investors, as much as, um, traders that are like taking a ride on some of these, um, you know, more scalable next generation platforms. So I think that that's, it's a, it's a little bit more mature than the 20, when we had no technology, you could raise money on it on a white paper and a woman, a good story. Now we're seeing some interesting technologies that may be able to carry, um, some of the world's finance, maybe in four years, once it matures, once we get the bugs out of it. And, um, a lot of people want to get in on the ground floor of that stuff, you know?

John Darcie: (50:49)

Right, right. You know, it's been, it's, uh, it seems though very early in terms of the real use cases for these [inaudible] tokens, you know what I mean? Um, in terms of, you know, there being long-term sustainable business models, I haven't seen many that have them yet, or at least in operation. Um, but I do agree. I do agree. It's super exciting, John, since you're dressed like a Bitcoin, or do you want to bring us home? Absolutely. I have a few just big picture questions. I'd love to hear your answer to Willie. And one is the price of Bitcoin in 2030. What do you think it will be? And what will Bitcoin's role in the global financial system be? Is it going to become the default global store of value around which every other Fiat currency and digital currency and the global economy revolves around? Uh, what are your thoughts on those two questions?

Willy Woo: (51:43)

Yeah. I approached Bitcoin as a technologist, um, and I do track the growth rate. Um, I've been on record from the data. I'm seeing that in the next four to five years, 20, 25, we'll have 1 billion people with exposure to a digital asset being Bitcoin or any other one. Um, so what I'm saying is, um, essentially, um, software eating the world. Now it's, now that we'll figure out how to do scarcity on the internet, which we never be able to be able to do before. Um, software's eating the finance world. And so I can see 'em in 10 years, that's plenty time to take big chunks. Um, maybe even majority chunks out of traditional finance and putting that onto blockchains, um, Bitcoin being the leading store of value. Um, so, you know, um, we're like, yeah, w w we're in this, this kind of transition to a digital age? Um, I I'm seeing that like crypto assets is going to eat everything, um, eventually is there's teen years enough to do that and maybe, um, Bitcoin itself, uh, I think it's going to eat gold in that time. Um, I think it's going to eat some of the store of value and equities, which is like, what is it, a hundred trillion? Um, I think, I think that conservatively, we're going to be in the 10 to $50 trillion market cap and 10 years. Um, you know, so yeah, whatever that works out is,

Speaker 4: (53:32)

Um, right, so

John Darcie: (53:36)

10, 10 to 50 X from here. So we'll let our viewers do the math there, but, uh, not, not a terrible return. Um, do you think Bitcoin and cryptocurrency in general, you're talking about software eating the world. So I think I might know your answer to this question. Do you think it poses a legitimate threat to us, dollar hegemony? Uh, you know, the idea that the us dollar is going to maintain its role as, as the dominant asset through which the United States government can pull all kinds of different levers related to sanctions and its other geopolitical goals.

Speaker 3: (54:05)

Oh, that's a tough one. You're probably asking the wrong person. I don't actually think that Bitcoin's gonna be completely dominant. I think that the future is the basket. Um, I think the U S dollar is going to be, um, more or less digitized. Um, and you know, in terms of

Willy Woo: (54:24)

Like, you know, the U S is very, very much a large economy. I don't think that's going away. So there is such a thing as, you know, a nation state currency backed by a very large economy with a big, um, defense force. So I don't think that's going away, but I do think that, um, the future of, uh, like money, um, will be backed by a basket of assets. And I do think Bitcoin will be a major paddle there. And, um, and so I don't know if they asked us the question. I don't think we're, I'm not a Maximo. So I think that, um, Bitcoin's going to be the money for the future and the only money that's going to swell everything. I think it's going to be a lot more nuanced and more complex. Um, so yeah, you're,

John Darcie: (55:11)

You're sitting in Hong Kong right now. Uh, China's relationship with Bitcoin has been, uh, interesting and mixed over the years where you have a lot of global Bitcoin mining takes place in China, but four years ago they banned the transfer and issuance of cryptocurrency, but in the last a week or so, the deputy at the people's bank of China, the central bank of China came out and said, Bitcoin is not a cryptocurrency in his eyes. And obviously he speaks on behalf of the government. People don't speak out of turn in China, uh, but he thinks it could be an investment alternative. And that marks a significant shift in tone from the Chinese government. Obviously, if China were to open things up relating to Bitcoin, that opens up a massive market of buyers for Bitcoin and Metcalf's law and the derivative network impact to that. Do you think China is on its way to liberalizing the way it looks at Bitcoin?

Willy Woo: (56:04)

Oh, I don't know. I actually, there's one thing I do not know. Well, I do not know how to read China. Um, I don't know what the strategy is, um, whether or not they want the people to, to expose to this se it, um, it does make sense that they would, I think there was a paper put out by someone and w in, in Chinese, um, and inside China that hit hit Wade. I can't remember. It was many years ago. They did say it made sense for, um, the citizens to have exposure to this. If it got big. Um, it seems, it seems, it seems like a, um, a good move, but, uh, I'm not an expert of China inside China. So again, I don't, I don't think I have any, any kind of smart thing to say about, all right.

John Darcie: (56:52)

Well, we know Willie, he specializes in on chain analysis. Anything related to the data, uh, on the chain is where Willie, uh, you know, it really specializes. So look forward to continuing to reading your analysis on your newsletter. Please tell us again about your newsletter, where people can subscribe to it and find it.

Willy Woo: (57:10)

Yeah, the newsletter is my take a read of the blockchain. I look at demand supply, so essentially looking at what's happening and what it's projected to happen. Um, so you can make kind of forecast, so ma mid macro directionality. Um, and so if you, if you want to subscribe to that best way to look it up is to go to my Twitter profile. Uh, we NAMEC on Twitter and I, there's a link on my profile page to, to the newsletter. You can subscribe. Yeah.

John Darcie: (57:38)

All right. Woo NAMEC on Twitter. You can go find Willy woo. Uh, his sub stack newsletter, which is fantastic. Again, we'll share a link to it when we send a, this episode out to all of our, our community at salt. So, uh, thanks so much for joining us, Willie, uh, Brett, you have a final word for Willie before we let them go. No, just, just again, I'm a fan. This was really fun. Thanks for joining us for way. I really appreciate it. Okay.

Willy Woo: (58:01)

Thanks guys. Enjoyed it too. Okay. Well, thank

John Darcie: (58:04)

You everybody for tuning into today's salt. Talk with Willy. Woo. Just a reminder. If you missed any part of this talk or any of our previous salt talks, you can access them on our website. It's salt.org backslash talks or on our YouTube channel, which is called salt tube. We're also on social media. Twitter is where we're most active at salt conference, but we're also on LinkedIn, Instagram, and Facebook. And please, if you don't mind spread the word about these salt talks, particularly if you have a, an uncle who rails on the fact that the Bitcoin is some type of imaginary currency with no utility or value, send them to Willie Woo's newsletter his sub stack as well as have them watch this episode. And I think it'll go a long way towards helping to change their mind, but on behalf of Brett and the entire salt team, this is John Darcie signing off from salt talks for today. We hope to see you back here against them.