How COVID-19 Reshaped the Advice Industry with David Bahnsen, Founder, Managing Partner & Chief Investment Officer, The Bahnsen Group. Karen Firestone, Chairman, Chief Executive Officer & Co-Founder, Aureus Asset Management. Josh Brown, Chief Executive Officer, Ritholtz Wealth Management.

Moderated by Sean Allocca, Deputy Managing Editor, InvestmentNews.

SPEAKERS

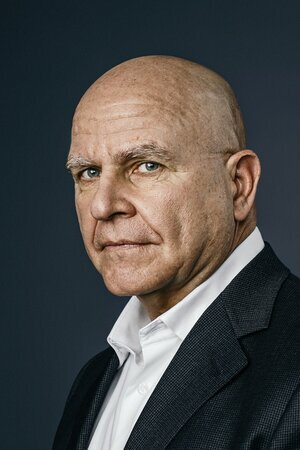

David L. Bahnsen

Founder, Managing Partner & Chief Investment Officer

The Bahnsen Group

Karen Firestone

Co-Founder, Chairman & Chief Executive Officer

Aureus Asset Management

Josh Brown

Chief Executive Officer

Ritholtz Wealth Management

MODERATOR

Sean Allocca

Deputy Managing Editor

InvestmentNews

TIMESTAMPS

EPISODE TRANSCRIPT

David Bahnsen: (00:07)

New York was slightly different story, we reopened last summer, but we have a smaller presence in New York. We've doubled in size out here since, but it was easier to get away with kind of what was going on in New York than it was California, particularly Newport Beach where there was much less of a hysteria about things versus LA County. But I agree with Josh completely that all the technology apparatus pre-COVID was a very natural segue into what ended up taking place. We were big Salesforce users, we're big WhatsApp users, so there was the ability to use cloud and use digital communications internally where we didn't skip a beat.

David Bahnsen: (00:48)

The difference for us is... And I think there's a huge advantage for us right now versus all the wirehouses that aren't reopened and don't appear to have any intention of reopening their branches anytime soon... the client-facing aspect of the business. We have clients in 40 something states. We always have. There's a lot of remote communications, just like what Josh was talking about, when you have a national footprint, but to the extent that we have local presence, we really want the face-to-face. And we think it was a huge advantage for us last year that we were able to get in front of prospects and clients both through the second half of last year and all of this year, and we've reaped a lot of dividends from that.

David Bahnsen: (01:31)

This is something I remember when I was in training, coming out of dotcom, I was at a firm called PaineWebber, they got bought by UBS, and the then CEO, Jo Grano was giving us a speech about why we didn't need to be afraid of the e-trades and Schwabs and all this. And he said, there will never be a time in your life ever, where the really truly high net worth are... that you're going to be dis-intermediated. There's always going to be an industry for advice. And people were worried about that at the time, what they thought was cheap trading. I think it was like 20 bucks a trade or something. I remember throughout COVID thinking the same thing, the idea that we'll get to a point where this very well-established desire from high net worth people to have communion with their advisor, to have a face-to-face communication, to have events.

David Bahnsen: (02:22)

Events are a big part of our business too, like Josh was saying. We've started out doing them again. We had 250 people at a client dinner a few months ago in California, so we're back up and running our first event here in New York, it will be in another month. Larry Kudlow is an advisor on my team and he and I are going to speak together and that'll be packed out. And so those are the things that make you feel like you're getting back to normal. But the key issue for us is the face-to-face with the client where it's possible. I do not believe that can go away, I think people desire that personal relationship.

Sean Allocca: (02:57)

And so what have been... I mean, we'll give this one to you, Kari... some of the pain points that you've seen in the last 18 months in terms of the pandemic and how we overcome them at your firm? Have you seen similar things to Josh and David, or was your experience a little different?

Karen Firestone: (03:11)

Yeah. It's interesting to refer to it as pain points because I definitely feel that on March 17th in Boston, happened to be my birthday, when they closed the city because it was St Patrick's day and they said, "Everybody now, no restaurants, no bars, go home." It was painful to suddenly realize that we weren't going to be able to see each other. My office had not been virtual in the sense that Josh's, we worked together in the financial district in Boston, and that comradery was a big element to the company. And what we felt was sort of our cohesiveness and our clients often would come in... We have clients all around the country. We have clients in other countries, but we saw them frequently and we would talk to them sometimes. But coming into the office was something that they seemed to enjoy, or going to visit them. And suddenly having none of that and people working virtually was something to adapt to. We had the technology for it. We were all ready to do it. We had been using Zoom a little bit. We began obviously to use it all the time.

Karen Firestone: (04:22)

I found that... I have two very active dogs who were scratching on my office door at home. I said it's very hard for me to work here. And I began to ride my bike into downtown Boston every day, and there was nobody on the streets. There were no cars and there were no people when I got downtown. So I was in the office, I said, I'll open the mail. I can do wires. I mean, hadn't done anything like that for years. But I was there... Everybody was at home and we just progressed and we had to learn how to connect in a different way. That I think has been hard. Some people prefer to be in an office, prefer to talk to each other face-to-face, the clients or my colleagues.

Karen Firestone: (05:05)

I don't know if there are people who really work better in a sort of close knit relationship type environment, work better when they're not in the office. Yeah, there are some people who might, but it's hard to have that type of camaraderie, spontaneous discussion about investing as much when you can't sort of grab people, "Come on over into my office or into this conference room and let's chat about an idea." So that has been a part of what we've missed and part of the pain, but we've done well. We persevered. We started to come back. July six when everyone was vaccinated, that's when everybody was welcome to come back. And there are many days that everyone is back and some of the people or partners with small children have been home more, and some clients have asked if they would be able to come into the office. I think it's more a social thing, they're not seeing anybody so we're somebody to see, which we like. We hope it's fun for them.

Karen Firestone: (06:12)

But it's been a big adjustment. We can do it virtually. I don't think it's as much fun and this will change, of course, the way in which we do business forever, I think.

Sean Allocca: (06:27)

Sure. Interesting. So I think that's a good segue into another question that David kind of pointed to as well, which is when do we bring back employees into the office? Wall Street has postponed their plans, although they're pretty adamant that they want to get butts back in seats. Some of the other firms have been a little more lax about it and have a little more ability to work from home. What are your thoughts? What are the pros and cons? Do you want to start off, David? I knew you had a interesting take.

David Bahnsen: (06:53)

Yeah. But look, I have really strong opinions on it. I wrote an article in the New York Post last summer, and I sent a letter to the CEO of 25 firms in New York. A couple of them responded to me. I feel-

Josh Brown: (07:06)

I've been meaning to. I will.

David Bahnsen: (07:06)

Yeah. Josh and I had a great interchange on it, and there was some cussing and... No, look, the fact of the matter is, I think every firm has their own problems to solve. It's a lot easier... My firm now has 35 employees. When you're talking about JP and Goldman, so forth and they have hundreds of offices, let alone tens of thousands of employees. I think JP's case, it might be a million employees. I'm kind of more old school in the way that apparently Mr. Diamond and David Solomon are about this. But to the extent there's some that feel differently. I get it. It's just, I do believe I've built the firm around a certain culture and so that brand matters. And I think Karen's alluding to some of this, the inner action in the office is important for us.

David Bahnsen: (07:53)

I've also spent a long time in my career in branches. I was a managing director of Morgan Stanley for many years, and I never talked to anyone in the branch. First of all, they were all gone by two o'clock every day, I never saw them. And I got to know the people at our Chairman's Club trips more than I got to know the people in my own office. So the branches not reopening, might be a different story in the wirehouse world, but for us, it's an important thing. So my strong opinions are specific around what I believe about my company, but then also what I believe about supporting the cities. I couldn't stand seeing Manhattan last year with the coffee shops, and the dry cleaners, the laundromats, the bars, that type of thing, what it was doing economically to the city, I thought it was awful. And I wanted to see the big employers bring people back to support the infrastructure of the city. And I hope that, that will be expedited now here, post-vaccine. That's my take on it.

David Bahnsen: (08:45)

If I keep talking, I'll say something I'll regret.

Sean Allocca: (08:50)

How about you, Josh? I mean, you guys have been across the country already, right? So you have to take on mandatorily bringing back people to office, or...

Josh Brown: (08:56)

No, we're not mandatory. We kept the office open last summer like David did, but for a different reason. I was not there, but I have many millennial employees living in Manhattan and Long Island City in Brooklyn, and they don't want to be confined to a 1200-square foot a room all day. And so we had a clean, air conditioned, 5,000 square foot space on Bryant Park. They could get in, they could get out. They could be there with three other people and just hear someone else breathing, right? Like that stuff is meaningful, I think, just to have somewhere to go. A lot of these people... It's a 100 degrees outside in Manhattan in the summer, so you can only spend so much time out the element. You need a second space that's not your house, and all the Starbucks are closed.

Josh Brown: (09:48)

So I said, let's just reopen. I'm not worried about the liability. I don't think we're going to have a super spreader event with three kids sitting at laptops. So that's why we reopened and I've kept it that way. And what I've noticed.... Every week I go in on Thursday, we do a podcast, YouTube video there, we have guests, we made it vaccine mandatory to visit the office, whether you work here or not. But every week I see more people that work for us, and I even see people that work for us in other states, visiting New York just to spend a few days at the headquarters and just see each other. So I agree with what everyone said about, there is something important culturally about getting together in person. I just think we have to be realistic, the genie's out of the bottle and nobody is thinking, "I'm going back to exactly the way things were", especially people taking the Long Island railroad like myself every day.

Josh Brown: (10:51)

So here's one of the lesson I want to say, and this-

Karen Firestone: (10:54)

No, impossible.

Josh Brown: (10:55)

Yeah. Probably not.

Josh Brown: (10:56)

... this applies to client meetings too. It's not that no one's ever going to want to be together or meet, it's just that when we do do it, it's going to be really meaningful. People are really going to appreciate it. When you go see a client, now it's not obligatory. Now it's an event let's do lunch and we'll spend the first 30 minutes, "What vaccine did you get? I got Pfizer. Oh, I got..." We'll all do that, but so what? It's going to be like a powerful moment that you actually put on pants and left the house for me.

Karen Firestone: (11:27)

[crosstalk 00:11:27].

Josh Brown: (11:27)

So I think, on the whole, it's going to be a positive thing because now we're going to appreciate each other and each other's time more than we used to when it was just taken for granted and obligatory.

Josh Brown: (11:40)

Little applause for that. What's up? I appreciate you guys.

Sean Allocca: (11:42)

I felt it. I was feeling that.

Josh Brown: (11:42)

Happy you do feel.

Sean Allocca: (11:46)

You said Long Island railroad... New Jersey transit's probably way worse, but similar situation, so.

Josh Brown: (11:50)

It all sucks. Right.

Sean Allocca: (11:52)

Yeah, in both states, subsidized.

Sean Allocca: (11:55)

How about we switch gears a little bit and talk about maybe portfolio management and see if there's any trends or things that we saw there. It's been a-

Josh Brown: (12:06)

Did anyone mention crypto with this conference yet?

David Bahnsen: (12:07)

I haven't.

Josh Brown: (12:08)

Has that come up?

Sean Allocca: (12:08)

We're trying to stay away from it.

David Bahnsen: (12:10)

They have a breakout on it tomorrow.

Josh Brown: (12:11)

Okay.

Karen Firestone: (12:12)

Yeah. But I'm wearing something, so.

Josh Brown: (12:13)

I won't spoil it then.

Sean Allocca: (12:16)

So what have we seen there? We've seen some unprecedented market conditions and certain low interest rates never seen before. Were there any different trends you saw over the 18 months? Of course, we're going to get into crypto. But before we do that, how about, Karen, do you want to start us off?

Karen Firestone: (12:34)

So if we're talking about trends, well, what we've seen the last 18 months... This isn't just the last 18 months, but because interest rates have essentially been zero, we've all had to invest in a way assumes that fixed income, or cash, or the equivalent is really only for what you need to have available if you're spending money or you need to buy a house, and its other assets are going to fill the entire pot pretty much. I mean, that's the way I look at it. You're not going to get any return, how can we charge people a fee when they're making so little money. The fee is more than what you're earning on treasuries or whatever the high quality is that you're putting them into [inaudible 00:13:27] market. So we have done more investing over the last couple of years in assets that are alternative, whether it's more venture capital...

Karen Firestone: (13:39)

We've done venture capital since 2010, that was the first investment we did in venture. And private companies, we've seen more private companies. There are more opportunities that have come to us. We've done some private equity. We've done some real estate, real estate developments that groups have shown us.

Karen Firestone: (13:59)

And we used to have... And all of us who've been in the business for a while have understood that fixed income would be a reasonable proportion of people's portfolios... Elderly people who were retired, definitely, but much less now. And as the safety portion of the portfolio, no. So now we have other assets. There's more of that... We have had to spend more time devoted to learning about that they have more people in the company who look at non-equity asset classes. And I think that will continue as a trend. I mean, that's what all this is about. But it has never been as important, I think, as it is now, for nothing more than the fact that you can't have all the money in just equities as one might, unless you really just want to say that's the only asset class that we think is going to work and that's not been the case.

Sean Allocca: (14:57)

So I guess we have to jump into it then, digital assets. We can just go in a line here and just give our opinions. Obviously advisors need to know about it, even if they don't want to touch it. What say you, David.

David Bahnsen: (15:09)

Well, let me answer the other question because I don't have anything to say on the digital asset stuff at all.

Sean Allocca: (15:16)

It's okay.

David Bahnsen: (15:18)

It's really interesting to hear Karen's answer because I agree completely. We've done a lot more with private investing, we've done a lot more with venture, but I'm not sure that any of that is related to the events in the world of the last 18 months. In our case, I think that we just have had a migration of larger and larger clients that have needed those types of asset classes more. And there is a great deal flow out there. We've done a lot of direct deals, real estate, things of that nature. But I wouldn't associate that with the COVID moment. One of the things that's difficult for us, we have a high conviction, equity investing. We're never owning more than 25 to 30 stocks, all actively managed in-house at our firm, but we're dividend growth investors and dividend growth was very out of favor last year. And there's have been periods post-crisis where it's been in favor.

David Bahnsen: (16:12)

And it doesn't matter if I think it's about coming back in favor or not. You could make a yield spread argument, some other things, but it's never going to be tactical for us. It's always going to be evergreen. So whether or not, I think it's particularly appetizing this time or another is not really the pitch I'd want to make around it. We believe in it because of the recurrence of cash flows and the higher quality underlying investments.

David Bahnsen: (16:37)

In all seriousness on digital asset side, it isn't that I have any issue with those who are very interested in it. It's that, for us, we have a heavy focus on cashflow generative investments. We manage 3.2 billion at our firm, and we have roughly 85% of those in cashflow generative investments, either on the dividend equity side, or in credit, or even in alternatives and real estate, has a heavy cashflow bias.

David Bahnsen: (17:07)

We definitely have younger clients that ask about it. We have folks ask about it. I'm well aware that there are other firms that are building an incredible niche around it, but for us, it doesn't fit into the principles we built the business around. And so it's not something that has a big focus for us, although we do own some SkyBridge and so I guess we kind of got stuck with some of it. It's fabulous.

Karen Firestone: (17:28)

Yeah. Series G.

David Bahnsen: (17:28)

Yeah. But no, I'm kidding. They obviously have a bit of exposure in there. That's our take on it. I think my colleagues up here have a different approach than I do.

Karen Firestone: (17:38)

Well, it's interesting. I did a panel for Anthony once about cryptocurrency and Bitcoin and he asked me which side I wanted to take? And I said I didn't have a particularly strong point of view. Which side would you like me to take? He said, "Well, you can be against it." And I said-

Josh Brown: (17:59)

And then he pummeled you [crosstalk 00:18:00].

Karen Firestone: (18:01)

And I said, well, I'm going to have to read a lot about Bitcoin to come up with something, articulate to say. And my conclusion was that it's a risk asset. I think it's very little connected to inflation. I don't think it's particularly connected to gold. I think in terms of the safety and storage of value, I'm not sure that Jeff Bezos has decided that his money at JP Morgan, if it's there, isn't safe. I'm not sure that you need it as a [inaudible 00:18:33], but it's safe. And I understand it, it's a risk assets that people can play as they do other asset classes that have a high level of beta risk attached to them. Do we invest directly in Bitcoin? No. We have an allocation to some external managers that own Bitcoin, including SkyBridge's multi-strat fund.

Karen Firestone: (18:56)

We have a portfolio like David, 35 names. That's our sort of love and the background that we're from. I spent many years at Fidelity. I managed an equity fund. It was a growth fund. We're growth investors primarily and that's where my heart and soul is. But we, as I said, invest in a lot of places. If there's a place for digital assets cryptocurrency, I can see that for young people in particular who feel that's very important to them as long as they understand we cannot analyze it in the way we analyze any other assets. It is not a confidence of ours. It may be for other people. I don't feel that I'm particularly competent, but I can see the appeal and haven't denied including it in diversified portfolios.

Josh Brown: (19:51)

I think that when you look at the wealth management industry, the average age of a financial advisor is 59. We have a very old industry relative to almost every other industry there is other than let's say Walmart creator. There's very few industries this old. My average certified financial planner working at my farm is in their late 30s. We're also bringing in a majority of our clients from things like YouTube and social media. And so we're attracting young millionaires and young almost millionaires, and in some cases, young quinta-millionaires, deca-millionaire. Without a doubt, if your answer to these people is, there's no cashflow so I can't even have a conversation about it, you're not a candidate for their wealth, not their current wealth, definitely not their future wealth. And so it's very important, I think, for an advisor to not roll their eyes... Which I don't think anyone's doing anymore, but as recently, as two years ago when the price had plunged from 18,000 to 3,000, it was derision at advisor conferences. That part's over.

Josh Brown: (21:05)

So now the question is, our question, we call ourselves evidence-based investors. Very hard to be an evidence-based investor in a realm like this. So then the second question is, okay, if there's no evidentiary way to do this, what's the least bullshitty way to do this for clients? That's a scientific term.

Karen Firestone: (21:24)

Thank you.

Josh Brown: (21:25)

So then you're getting into questions like, well, are we really analyzing coins and tokens? Obviously, you're not doing that with a straight face. The people who created these things don't even know what they've created. So that's out. So the notion of us actively managing a portfolio of crypto is ludicrous. Right? Okay. So let's move that off the agenda. So then what's the next question? Well, do we think that people should have exposure? And the answer to that is actually more behavioral than anything else. If they feel they need to have that exposure, then the second part of that is, well, who should provide it? Should it be us, or should we tell them, go do it yourself at Coinbase?

Josh Brown: (22:07)

And there may not be a definitive right or wrong there so you might actually want to have two different approaches, give them permission to do it themselves without hanging their financial plan out to dry, right? Or, okay, we will do this in-house for you, but here are the parameters around which we'll do this, and here are the software providers we're comfortable using, and here's what we're doing on the cybersecurity side so that we don't wake up in the morning and somebody from Japan stole... You've got to go through this process and speak to the vendors. And in many cases, the vendors you encounter are in their infancy, right? You're not working with BNY Mellon, at least not yet. We'll get there.

Josh Brown: (22:47)

So there are all these considerations that have to take place as you go through this process to find the least bullshitty way to do crypto for a wealth management client. And then of course, fees, cost, trading cost, hidden costs. So you go through these iterations and then you say, well, do I want to be market cap weighted? Here's the problem with that? The back test looks fucking great, right? But you know intuitively Bitcoin's not going to go from $500 to $50,000 ever again. If it gets back to 500, you've got real problems, right? So you know the Bitcoin back test, throw it out.

Josh Brown: (23:26)

So what do you have? You don't have any cash flows. So then you say, well, there's a 100 other tokens and coins and various... So maybe I want an equal weight these things, because the next 500 to 50,000 might be among coins five through 10 by market cap. If I market cap weight, I end up with 70% Bitcoin, 25% Ethereum, and 5% all these other science projects, and maybe that's not the way to get true future upside in the asset class. So you've got to really, as a fiduciary, go through this in order, starting from how can I, with a straight face, say to clients, "Okay, I'm a certified financial planner. Now I'm ready to manage your cryptocurrency." It's very, very hard time right now for wealth managers trying to keep up with what's going on in the culture and in the markets, but also not end up making a huge mistake for the people that trust them with their assets.

Josh Brown: (24:30)

So I don't envy any CIO at any RIA in this country. And mine happens to be my partner and I always say to him, when I overhear them talking about this stuff, "Thank God, that's your problem." I'm paying the electric bill, you deal with that. So that's my take on what's going on right now, and I think it's a fascinating time and a challenging time because of those factors.

Sean Allocca: (24:56)

Interesting. Yeah. Once it matures a little more and some of the bigger custodians get more involved, we might see some more acceptance or something. But yeah, it's certainly challenging for sure. Thanks for that. I know it was painful for you to answer the crypto, David, but I appreciate it.

Sean Allocca: (25:08)

How about this one, and Josh alluded to it, digital marketing, digital prospecting, all of these things came online. And just speak to the importance of maybe social media, blogging, content creation for advisors. It's obviously hugely successful for Josh. He just mentioned a lot of his clients are coming onboard through YouTube and other social media platforms. What's your take on how can advisors really [crosstalk 00:25:34] about this?

David Bahnsen: (25:34)

Yeah. So this is I'm real passionate about, Josh is a master at this. He's been incredible, but I disagree with every everyone who tells me how well Josh has done because of the medium. I disagree. I think it's the content. The shit Josh puts out is super good. It always has been.

Josh Brown: (25:48)

Thank you so much.

David Bahnsen: (25:49)

And if he was putting it out typed on a piece of paper and mailing it to people, it would still be compelling to read.

Josh Brown: (25:54)

Thank you.

David Bahnsen: (25:55)

Those 1970s newsletters were kind of big, you may recall.

Karen Firestone: (25:58)

He doesn't recall.

David Bahnsen: (25:58)

And so it's the content. It's not the medium. Now, of course, he's kept up with the times and has found the right delivery of it. I built my practice, previously the wirehouse, now as independent RIA through content creation as well. It's different, but we have a point of view, there's things I'm passionate about, I want to speak them to the world and then I have absolutely no care in the world who likes it and who doesn't. I just let the chips fall where they may, and I'm very comfortable with that. And so, yeah, social media, YouTube television, books I've written, there's a lot of different mediums out there, but this is all pre-COVID, just like it obviously was for Josh.

Josh Brown: (26:36)

David, do you agree that this is no longer a choice? It's essential because if we position ourselves as being partly.... or the psychological component being really important to whether or not our clients can stick to the investments we recommend. If we don't start off with people who are aligned with us philosophically in some way, and you're just randomly meeting people and putting them into portfolios, it's going to be way too hard to get them through periods of time, like 2020, for example. I feel like you have that as part of your secret sauce and some of the best RIAs today, they have that baseline of people came to me because of my ideas, not because I threw a steak dinner and they want it to look the plate, like [crosstalk 00:27:26].

David Bahnsen: (27:25)

There was a point at which I realized that people were not coming to me for my good looks.

Josh Brown: (27:29)

Right.

David Bahnsen: (27:30)

And that shared alignment of values, of beliefs, of whatever it may be, it's incredibly important because we all are in a business that requires trust and the stickiness of the client is that they trust you through hard times, not through good times. The secret of the business and the great multi-trillion dollar, I think, problem out there is that a ton of clients do not move from their advisor only because the markets have mostly been good. There's a ton of vulnerability and relationships out there. The ones that aren't vulnerable, it's because there's a connection and that connection comes out of trust. For us, we build a lot of our trust out of what Josh was talking about, people believe in what we believe in. And I think that's very important.

David Bahnsen: (28:11)

There are people that maybe are... Like not everyone should go on television, not everyone's real good at doing that. Not everyone should necessarily write. But maybe someone in their firm, someone who has a passion and authenticity... I remember at Morgan Stanley when they first said we're going to allow our advisors to do social media, but you had to tweet someone else's links out. So they'd have like a David Doris who... He's a buddy of mine, writes good stuff... But you were like a mouthpiece for the firm's content or something. And I thought, okay, I don't think that's what Twitter is really all about. That didn't seem to do a lot for me. When people could start putting out their own stuff, and you can just have a point of view, you can make people upset. You can make people not like you. But you then have that chance to build that connection, that trust, I think is very important to what we do. Content as a service is not going away.

Sean Allocca: (28:59)

Awesome. Thank you for that. We have about two minutes left, so we need to do a quick lightning round, just some final thoughts. Maybe we'll start with you, Karen, what's the big takeaway for advisors moving forward?

Karen Firestone: (29:09)

Well, I'll tell you something that I think is increasingly important, which is that when people come to look for you or a firm, they, more than you think, look at who's at the firm. And I mean, I'm obviously a co-founder, I'm a woman, Co-Founder, I'm the CEO and Chairman of a company. We're five billion in assets. It matters to me, it's important to me that Aureus is a firm with a woman CEO. It also matters to some of our clients. It matters who are the people there? I know this sounds like I'm spewing ESG. That's not what I'm saying. I just think that it is now a factor, people will say, oh, it's really great that you've got a woman who's a founder. I think having a mix of ideas and people in a company is important, but I think that the clients also increasingly think it's important... Individuals, families, and institutions. So I'd keep that in mind.

Karen Firestone: (30:17)

I would also say in terms of content, because it's something we've talked. Digital, Josh is a master. David writes, I write. I've written a book. I write for Harvard Business Review, for cnbc.com. I'm on CNBC. I think all of that helps. I don't have time to do any more of that than I do now. And if I had more time, that might be more helpful. It has to be mostly performance. We have really good performance, that's what brings the clients to us.

Josh Brown: (30:45)

There goes your lightning round, by the way.

Sean Allocca: (30:45)

Yeah. [crosstalk 00:30:48].

David Bahnsen: (30:48)

A takeaway for a financial industry is advice is not going away, the need for relationships is not going away, comes from establishing competence and likability. I try to at least do one of those.

Sean Allocca: (30:59)

Awesome. Thanks.

Sean Allocca: (31:00)

Josh, we'll end with you.

Josh Brown: (31:02)

I would just like to say, it's been a pleasure of seeing David and Kari again and meeting you, Sean.

David Bahnsen: (31:08)

Five.

Karen Firestone: (31:08)

Right on.

Sean Allocca: (31:08)

[crosstalk 00:31:08].

Josh Brown: (31:08)

And thank you guys all for coming to our session. Thank you.

Karen Firestone: (31:11)

Thank you.

Sean Allocca: (31:12)

Give it up for these guys.

Sean Allocca: (31:12)

Thank you so much.