“Bitcoin is the only asset in the galaxy that actually has a fixed supply and no technological breakthrough will change that.”

Cameron and Tyler Winklevoss co-founded Gemini, a cryptocurrency exchange and custodian, to empower the individual through crypto. Gemini is a New York Trust company that allows customers to buy, sell, and store cryptocurrency such as Bitcoin, Bitcoin cash, Ether, Zcash, and Litecoin.

While being identical twins, Cameron is left-handed and Tyler is right-handed. This seemingly creates a complementary skillset between the two. Utilizing the unique partnership has led to a life full of start-ups that always seek to solve for a problem. This started with the creation of the high school rowing team, then with roles coming up with the idea for Facebook, and ultimately forays in the crypto asset space. Predicting global currency inflation caused by money printing and stimulus spending, investors will need to find protection. Gold was historically the best way to guard against inflation, but Bitcoin offers an even better solution. “Bitcoin is basically the expression of gold in that digital sense. When you line up all the properties, it's not really a fair fight. Bitcoin is far superior to gold across the board.”

The growth of Bitcoin is inevitable as it lives on the Internet and is accessible wherever someone has a connection. Bitcoin will be able to coexist alongside existing government-backed currencies and will ultimately see its mainstream acceptance. Gemini serves as a crypto platform where individuals can more easily access this new alternative asset class.

LISTEN AND SUBSCRIBE

SPEAKERS

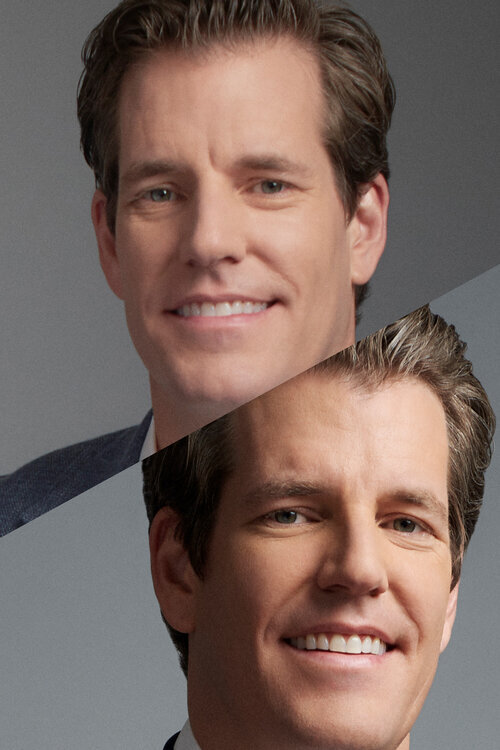

Cameron Winklevoss

Co-Founder

Gemini

Tyler Winklevoss

Co-Founder

Gemini

EPISODE TRANSCRIPT

John Darsie: (00:07)

Hello everyone, and welcome back to SALT Talks. My name is John Darsie. I'm the Managing Director of SALT, which is a global thought leadership forum and networking platform at the intersection of finance, technology, and public policy. SALT Talks are a digital interview series that we launched during this work-from-home period with leading investors, creators, and thinkers.

John Darsie: (00:29)

What we're trying to do during these SALT Talks is replicate the experience that we provide at our Global SALT Conferences, which we host annually, one in the United States and one abroad. Obviously, this year has been a little bit challenging for the conference industry, so we've been doing these SALT Talks instead. They've been a lot of fun and a massive success. Thank you, for everybody who's been tuning into the talks. What we're trying to do on these talks and at our conferences is to provide a window into the mind of subject matter experts as well as provide a platform for what we think are big ideas that are shaping the future. And perhaps there's no idea bigger right now that's sweeping into the mainstream than Bitcoin and cryptocurrencies.

John Darsie: (01:08)

So we're very excited today, on a day when Bitcoin is crossing its previous all-time high, to welcome Cameron and Tyler Winklevoss onto SALT Talks. Cameron and Tyler Winklevoss co-founded Gemini, which is cryptocurrency exchange and custodian to empower the individual through crypto. Gemini is a New York Trust company that allows customers to buy, sell, and store crypto such as Bitcoin, Bitcoin Cash, Ether, Zcash, and Litecoin.

John Darsie: (01:36)

They graduated from Harvard University with degrees in economics in 2004, and earned their MBAs from Oxford University in 2010. Together, they represented the United States at the 2008 Olympic Games in Beijing, in China, placing sixth in men's pair events. Cameron and Tyler have been angel investors and entrepreneurs in emerging technologies since 2003. Most of you probably know the backstory about their involvement in the founding of Facebook, which we maybe will get into a little bit during today's talk as well. They began investing in Bitcoin in 2012, and launched Gemini in 2015. So they were early on in this Bitcoin wave that we're seeing today.

John Darsie: (02:18)

Just a reminder, if you have any questions for Cameron or Tyler during today's SALT Talk, you can enter them in the Q and A box at the bottom of your video screen on Zoom. Hosting today's talk is Anthony Scaramucci, the founder and managing partner of SkyBridge Capital, a global alternative investment firm. Anthony is also the chairman of SALT. And with that, I will turn it over to Anthony for the interview.

Anthony Scaramucci: (02:39)

Guys, I appreciate you greatly being on. It's fun to get to know the two of you. I can tell you have our combined sense of humor, which is very dangerous, I might add.

Anthony Scaramucci: (02:50)

I usually ask the question of, what do we need to know about you guys that's not on the internet, what do we find about you on Wikipedia? What's something that your mom would tell us about you that she hasn't told anybody? You want to start, Tyler?

Tyler Winklevoss: (03:13)

Sure. You might be able to find this on the internet, but I'll start with this anyway. I am a righty, Cameron's a lefty. We're mirror image twins, we use different sides of our brains. I think that's why we've been such a good team for a long time. We grew up playing piano. Cameron now plays electric guitar. I continue to play piano, so that's sort of a difference. For better or worse, a lot about us and our life is actually out there on the internet. It's very public.

Anthony Scaramucci: (03:45)

That's interesting. You're identical twins, but you're powered up on different sides of the brains. Pretty interesting, I haven't heard that before about twins. But that obviously gives you complementary skillsets.

Anthony Scaramucci: (03:58)

If you had to describe... Let's say this was a job interview, Tyler, not that you guys need real job, God forbid. You've had two of the more amazing careers in America. But let's say this was a job interview and you are both coming in at the same time. What are your skillsets? What's Tyler Winklevoss's skillset as opposed to Cameron's?

Tyler Winklevoss: (04:19)

I probably gravitate to more strategy vision type stuff, so a little bit more higher altitude. And Cameron sort of gravitates towards more operational stuff, a little bit lower altitude. But to be frank, we definitely go back and forth and trade place on where we're flying. But I would say I'm a little bit more, I guess left-brained, because I'm right-handed. I tend to maybe be a little bit more organized, a little bit more OCD, like shirt tucked in. And Cameron traditionally has been a little bit more of the goofier twin and a little less shirt tucked in.

Anthony Scaramucci: (05:02)

I can tell that just by the way the bed is made behind you. I know that's a hotel room, but Cameron told me off-air that you made the bed yourself without the maid.

Tyler Winklevoss: (05:10)

I wish. If I could, I would. Yeah.

Cameron Winklevoss: (05:14)

I categorically disagree with all of that. No, I'm kidding. I think Tyler captured it pretty well. We're both flying at slightly different altitudes, but relatively pretty close. If Tyler's at 30, I'm at 25, and vice-versa. But I think we, because of the differences, we do tend to complement each other pretty well. So we don't find ourselves just ratifying each other and coming to the same conclusion. If we do come to the same conclusion, it's maybe from different angles or different paths. It makes it pretty interesting and a good sort of discourse in debate, and keeps things lively, for sure.

Anthony Scaramucci: (05:55)

Well, you've been in two pretty famous books and one reasonably famous movie. Ben Mezrich, who I think you guys know, has spoken at the SALT Conference. A few years ago, he handed me his book, Bitcoin Billionaires and insisted that I read it. You guys were kind enough to come to the SALT Conference. I like Bitcoin Billionaires better than the first book. I think all of us would probably agree on that. What is it about the two of you that you were able to see the future, both in terms of Facebook and where we are right now with the cryptocurrencies?

Cameron Winklevoss: (06:33)

I think it often comes down to looking at something and then being dissatisfied with the answer, or frustrated. We actually sort of joke. Our first startup was in high school. We wanted to try the sport of rowing, but there was no rowing team at our high school. So we looked around and found a club. We grew up in Greenwich, Connecticut, but we found a rowing club in Westport, Connecticut about 45 minutes away. We just started to learn how to row there. And then we went to the headmaster and asked if we could start the rowing team, and we did. Today, I think there's probably at least 500 or more kids in that area who row every afternoon. Every high school in the area has a rowing team. We simply asked this question, "Hey, why isn't there a rowing team?" There wasn't really a good answer for it. There's a lot of rowers in Greenwich, or former rowers. But I think a lot of times people just went to boarding school or did whatever, and just assumed the status quo, that was it. We sort of didn't accept that answer.

Cameron Winklevoss: (07:37)

Fast forward to when we got to Harvard. We were juniors and basically found ourselves almost done with college and barely scratching the surface in terms of meeting people and all the amazing things that you set out to when you first get to an amazing place like Harvard, and then you find it's almost already done. Harvard is in Cambridge. There's many schools and all these people, but you never really cross paths. You sort of get stuck in your lane. So we said, "Is there a way to create a technical solution where our fingers can do the walking and we can basically solve for time and geography and create a social network?" That really came out of an authentic frustration or problem local to us or true to us, that then had scale well beyond.

Anthony Scaramucci: (08:34)

I'm an old-timer, unfortunately. We've had two or three Bitcoin maximalists on the air with us, and I'm starting to believe in Bitcoin. But I have still levels of skepticism that I think old-timers have with Bitcoin. I'm not the Ray Dalio level of skepticism, but I'm not a Bitcoin maximalist because I don't understand it. I want you to explain it to me because you've got incredible audience participation. I might add that this could be the highest rated SALT Talk that we've had, so congratulations to both of you.

Cameron Winklevoss: (09:11)

Cool.

Tyler Winklevoss: (09:11)

Wow.

Anthony Scaramucci: (09:11)

You've got a ton of people on. Some of them know about Bitcoin, some of them don't know, and some of them are not sure. Take it from the top, guys. Why is it such an important asset, and why is it the asset or one of the big assets of the future?

Tyler Winklevoss: (09:29)

Sure. Well, we think of Bitcoin as gold 2.0. If you look at the characteristics that make gold valuable, the fact that it's scarce, that it's portable, divisible, all of the money characteristics of gold... and then you place Bitcoin against it side by side, Bitcoin either matches or does better. The supply is actually known and it's fixed. You can send it around the world. You can send an email. It's the first form of money that was purposely built for the internet, so it's internet gold. We think that that's a super big idea. And in the backdrop of all the money printing, the stimulus spending, the debt accumulation of governments in fiat regimes around the world, inflation's coming. I think everyone agrees with that, very high inflation. And so, what is your best protection? If it was the 1970s, like Paul Tudor Jones said, he would buy and did buy gold. That was before the invention of the personal computer and the internet.

Tyler Winklevoss: (10:34)

Today, we have Bitcoin. It's actually better than gold. The supply of gold is actually increasing. Two-thirds of gold has been mined since the 1950s. As technology increases, similar to what fracking did for oil and natural gas, the same can actually happen to gold. It's still precious, but it's not fixed. Bitcoin is the only asset in the galaxy that actually has a fixed supply and no technological breakthrough will change that, and it works on the internet like your email. When we came across that, we're like, "That's a really big deal." Money is the greatest social network of all time. The idea of a gold 2.0, Bitcoin being gold 2.0, seemed like a huge idea.

Anthony Scaramucci: (11:23)

The skeptics would say that it's a code on the internet, it's a blockchain, it's a mathematical code. It's not backed by a government. It's not backed by an army. It's not tied to somebody's sovereign nation. And obviously, I know all the travails and potential tragedies of fiat currency. So then why is it valuable as a device? Is it the ledger aspect of it? What creates the value in your mind?

Cameron Winklevoss: (12:00)

Well, that's an interesting point. Bitcoin is not actually forced upon anybody. There's no legal requirement, unlike fiat currencies which I think makes Bitcoin's growth over the past decade even more impressive. Because there's nobody saying, "Hey, you need to pay your taxes in Bitcoin. You need to use Bitcoin in commerce." People are buying it for the properties that Tyler outlined.

Cameron Winklevoss: (12:27)

In terms of backing the currency, the Bitcoin mining network is the strongest computer network in the world. And they basically audit and verify transactions, and act as sort of the referees in the Bitcoin ecosystem. So it's a very powerful computer group or army, if you will, that's not to be underestimated. But if you look at the ability, it's basically programmable money, and everything's going digital and streaming. The idea that people would want a piece of hardware like gold today or even in the future, seems really antiquated. Everybody's looking to get software and money that moves like email. Bitcoin is basically the expression of gold in that digital sense. When you line up all the properties, it's not really a fair fight. Bitcoin is far superior to gold just across the board.

John Darsie: (13:27)

It's the Netflix to gold blockbuster.

Cameron Winklevoss: (13:30)

Exactly.

Tyler Winklevoss: (13:30)

There you go.

Anthony Scaramucci: (13:31)

No, no. I like that. I want to keep going on this if you guys don't mind, because I'm hoping that by the end of this conversation, we're going to convert more people to where you guys are. I think I need to confess to you that I'm probably less of a skeptic on Bitcoin than I'm leading on right now, but I just want to play devil's advocate for the purposes of the beginning part of our conversation.

Anthony Scaramucci: (13:54)

Let's talk about regulation and the potential specter of regulation for Bitcoin. Some countries have said, "Okay, no Bitcoin in our country." Other countries are worried about Bitcoin taking over their ability to... let's use the word manipulate their currency. Or in the case of fiat currencies and the production of money and money supply, Bitcoin coming up against that could disrupt governmental policy in certain countries. And so, are you worried about any of that? Are you worried that somebody could say be decree, "We ban Bitcoin in our country."?

Cameron Winklevoss: (14:35)

I think some regimes are definitely going to try and stop Bitcoin. But to stop Bitcoin, you really have to stop the internet. I think that's a losing proposition. I think that it's really an alternative. Bitcoin's not trying to really disrupt, it's just offering this other system. Bitcoin didn't force the federal government to run deficits over the past decade, or run a debt to GDP ratio of 135%. That's the US mismanagement, our own doing. At least now we have a hard money alternative like Bitcoin. Previously it was of course, gold. Bitcoin's different because it has the emerging properties and it could overtake gold which gives it just a much bigger asymmetric payoff over the next decade than gold. Gold wouldn't be a bad investment, it's just not going to be anything close to what Bitcoin is.

Cameron Winklevoss: (15:31)

A lot of people, at least the early days, there's a lot of rhetoric around disrupt the banksters and all that stuff. At Gemini, we're a New York Trust company. We're regulated by the New York State Department of Financial Services. We also have licenses and approvals in all the other states. So we work actively with the government and regulators. We're a financial institution and we're engaging. We also partner with banks like JPMorgan. We really want to work with banks. We're not trying to be a bank, we're just a crypto platform. That's kind of our viewpoint, but sometimes the rhetoric makes it like us versus them and this fight that I don't think is there.

Tyler Winklevoss: (16:14)

The risk of trying to clamp or quash Bitcoin is too great, as Cameron mentioned. You have to become like North Korea and basically cut yourself off from the internet. Bitcoin even can permeate the great firewall of China. Because it's so decentralized, it works on the internet. And to shut the internet off, you'd shut so many drivers of the economy like big tech, that it's just to risky. So regulators decided, at least in the US and a lot of other jurisdictions, it's better to work with it and work with companies who want to get compliant like Gemini, and do things the right way.

Anthony Scaramucci: (16:51)

My product development team wanted me to tell you that at SkyBridge, we're operating Node. Apparently, that makes us very cool. So I just thought I would mention that to you guys.

Cameron Winklevoss: (17:03)

That's awesome.

Anthony Scaramucci: (17:04)

I'm not exactly sure what it means.

John Darsie: (17:07)

We're part of that army defending the network that Tyler was talking about.

Cameron Winklevoss: (17:11)

You guys are contributing to the Bitcoin ecosystem by running a node. That's really cool.

Anthony Scaramucci: (17:17)

All right. We're out there with our Node. I want to keep going on this line of thought for a second. Peter Thiel... there was a book I read 25 years ago called The Sovereign Individual. It was written by James Davidson and Walter Rees-Mogg. Peter Thiel repurposed the book recently. It's in paperback, you can buy it on Amazon. He wrote in the preface that AI to him is about hegemony and it's about totalitarianism and control, where you can actually see the facial cues of your citizens and then you can socially score them... and Bitcoin is about liberty and libertarianism and decentralization. Do you agree with that? What are your thoughts on that?

Cameron Winklevoss: (18:06)

I agree. Bitcoin, the technology, is obviously apolitical. But we believe that it empowers individuals and gives them greater independence, choice and opportunity. That's a big part of Gemini's mission, is helping people get into crypto so they have more opportunity.

Cameron Winklevoss: (18:24)

There's a place in crypto called decentralized finance, which is trying to build permissionless pieces of the financial system like lending, borrowing, trading. It's really exciting. It's obviously quite new. But it's really about decentralizing and creating permissionless and trustless financial services, unlike the current system which is centralized and you basically are dealing with a lot of gatekeepers and there's access problems. If you want to invest, you have to be an accredited investor to invest in a lot of interesting deals. There's plenty of people who are sophisticated who don't have $1 million to their name that I'm sure would like to invest, but they don't have access to capital markets in that way, whereas crypto doesn't have that access problem.

Cameron Winklevoss: (19:12)

It's very liberating and it's very much a movement as much as a technology. Obviously, there's elements of it that appeal to libertarians. There's elements I'm sure that appeal to other groups. But in general, this is a movement about the individual and decentralizing what are traditionally centralized stacks in the financial sector.

Anthony Scaramucci: (19:39)

People, as of right now... I mean, some people would say, "Well, gold, you can make into jewelry." Or there are some manufacturing aspects to gold. It doesn't seem to be the case for Bitcoin. I'm not sure if that's a big deal one way or another, you could address that.

Anthony Scaramucci: (19:57)

But the secondary issue in addition to that, that I think people are worried about is it's not really accepted yet. Maybe you can buy a Tesla with Bitcoin, but I can't pay my utility bill with Bitcoin, at least not here in New York right now. One is, the usability of the currency as another alternative. Maybe you can pushback and say, "Well, dollars can't be used for anything else." And then secondarily, when do you think it becomes more available to be used as a tradable mechanism, which is ideally what currency's about?

Tyler Winklevoss: (20:42)

I don't think it necessarily needs to be. If it's gold 2.0 and it's going to disrupt the gold, right? The market cap of above ground gold is nine trillion. Right now, Bitcoin's market cap is somewhere above 300 billion. So if it just disrupts gold alone, there's a 25 to 30 X from here conservatively appreciation.

Tyler Winklevoss: (21:06)

Gold's not really being used as a currency right now. It basically sits under vaults under the Thames River in mostly ETFs. I think even if it disrupts gold, it doesn't have to be spent to have a lot of value and to appreciate from here from now. Because I don't buy a cup of coffee or go to McDonald's with a bar of gold. You can, but you don't. It's a sort of value. You want to spend things that are more like currencies that lose their value over time. The dollar has lost a lot of purchasing power since the '70s, like 90% of its purchasing power. You want to spend dollars because they're becoming less valuable. You don't necessarily want to sell your share of Amazon stock because it probably will go up, or Google. And the same is true with Bitcoin.

Tyler Winklevoss: (21:57)

It's an emergent sort of value, so it's appreciating or holding value. So you want to preserve your wealth in stores of value, and you want to spend things like currencies that lose their value. It's very hard to be both ends of the spectrum with money. It's sort of like LeBron James is an amazing athlete, Nadia Comaneci is an amazing gymnast. They both would be pretty terrible at each other's sports. I think if you pick one part of the problem space and you really excel, I think that's enough. And the Bitcoin gold 2.0 story is definitely enough, I think.

Cameron Winklevoss: (22:37)

Nothing highlights that better than the Bitcoin pizza, which was the... I think it was two Bitcoin pizzas. Basically, it's the first Bitcoin transaction where somebody traded two Papa John's pizzas for 10,000 Bitcoin. At today's prices, I think those are $200 million pizzas, if I'm doing my math correctly. They must have been really good slices of pizza. But that really underscores why you don't really want to use Bitcoin as a currency and spend it. You want to hold it, or hodle is the parlance that Bitcoiners use and people in crypto to say, "Hey, I'm hodling my Bitcoin."

Anthony Scaramucci: (23:15)

Well first off, I want to compliment both of you on you decorum and your gentlemanliness. If I was on a SALT Talk with my brother, I'd be karate chopping him at the Adam's apple and interrupting him every five seconds, but you guys are in perfect syncopation. I feel like I'm in the rowing boat with the two of you. You don't even interrupt each other, which is-

Tyler Winklevoss: (23:35)

You're like the coxswain.

Anthony Scaramucci: (23:37)

Yeah, exactly.

Cameron Winklevoss: (23:37)

Yeah.

Anthony Scaramucci: (23:39)

I say that as an Italian who interrupts everybody. All right, so you're winning me over. You're winning me over now. I'm now thinking I need to own some of this, and so now I want you to tell me about Gemini. I want you to tell me about the value proposition at Gemini. And you've got many thousands of people that are listening to you. So tell us how we do business with Gemini. Who are your clients? Who should be your clients? Let's say that I'm a potential prospect. Pitch me as a prospect.

Cameron Winklevoss: (24:11)

Okay. The easiest way to get to Gemini is gemini.com. We have a mobile app as well as a web interface. We really cater to the entire spectrum of customers. We're trying to make it simple, reliable, and safe to buy Bitcoin and other cryptocurrencies as well as store. We're a platform where you can buy, sell, as well as store. That's sort of the essence of it.

Cameron Winklevoss: (24:36)

We've been operational for about five-plus years, and we're a New York Trust company. Most of our staff is located in Manhattan, or was pre-COVID. Obviously, we're a little more remote posture now. We're also open in Europe, the UK, Singapore and other parts of Asia. That's the core of the business, is building this sort of regulated on-ramp into Bitcoin and cryptocurrency. Because I think a lot of people, they sort of learn about Bitcoin and say, "Hey, look. I get it. I believe in this. I understand what's happening to the dollar. I understand the mismanagement. There is going to be a debt reckoning. I want to protect my value, but I don't know how to do it."

Cameron Winklevoss: (25:17)

There's no Bitcoin ETF yet. And we're trying to create basically a very easy experience like opening up a bank account online or a brokerage account. It's just that simple. You come, you onboard, and you're ready to go. We also have a lot of audits, SOC 2 and SOC 1, so that we can have conversations with institutions and get them comfortable with the necessary compliance requirements and things like that.

Anthony Scaramucci: (25:46)

Okay. So it's an easy solution for somebody to plug into your website, figure out a way to get a long Bitcoin, and they can store it with you guys very safely. Is that fair to say?

Cameron Winklevoss: (25:58)

That's right. It's as easy as going to your brokerage account. You sign up, you place your trade. We also have an execution desk, so we can execute the trade for you, give you that kind of experience. And then we have a cold storage system. If you say, "Hey, I want to go long $10 million worth of Bitcoin and I'm not going to really touch it for a couple of years, I want it in offline storage so it's not internet connected." Literally, a hacker can't even access it. These computer are called HSMs, hardware security modules. They literally never touch the internet. Those store the private keys, which is like your password to your Bitcoin. We have a custodial service where you can basically put your Bitcoin into cold storage and hold it there very securely.

Anthony Scaramucci: (26:50)

Let's say I want to send my Bitcoins to John Darsie. This is obviously a ridiculous hypothetical. Because I just want you to know, John Darsie, I would never send you my Bitcoins.

John Darsie: (27:01)

I'm looking forward to Cameron and Tyler expounding on the idea of you being the coxswain in the back of their rowboat. I want them to explain what that person does and what that person generally looks like.

Anthony Scaramucci: (27:13)

Let me tell you, at my weight after Thanksgiving, we'd be hydroplaning. These poor guys, despite their arms, they wouldn't be able to reach with the level of hydroplaning we'd be doing. But let's get back to the conversation, Darsie. Okay, put yourself back on mute for one more second, okay?

Anthony Scaramucci: (27:29)

Is it traceable? I'm sending my Bitcoin out. I want to pay somebody in Bitcoin. Let's say I want to pay somebody and I don't want people to know about it, is it something that's traceable?

Cameron Winklevoss: (27:40)

The Bitcoin blockchain is an open ledger, and it's very much traceable. We do have to follow the blockchain for compliance requirements and stuff. There was a false narrative for a while around Bitcoin being truly anonymous and only used for illicit activity. I think that scared a lot of people off, but it was really not true at all. That is potentially one of the things about Bitcoin is it's actually very open. It's not a good place if you're trying to squirrel away money or commit bad activity. I mean, there are privacy coins like Zcash that offer commercial privacy and things like that. Bitcoin is very much an open ledger system.

Tyler Winklevoss: (28:26)

Right, but there is one detail there that... let's say you had a Gemini account and you sent it to John, the world would see it leaving Gemini because they know addresses associated with Gemini. But they may not know John's address, so it would just see Bitcoin moving from one address to the other. That's why we call it pseudonymous. Everyone sees the flow of funds, but people don't necessarily whose names are associated with which Bitcoin addresses.

Anthony Scaramucci: (28:52)

It's an important thing to bring up to everybody, because I want to dispel that notion that this is just a funky way for charlatans and money launderers to transact around the world.

Cameron Winklevoss: (29:08)

Yeah. Another point... sorry.

Tyler Winklevoss: (29:11)

Paul Tudor Jones, Stan Druckenmiller, they obviously see something in Bitcoin beyond the illicit activity narrative.

Cameron Winklevoss: (29:18)

I think it's really important to note that the legal classification of Bitcoin, there was an order in 2015 called the Coinflip Order. It was an enforcement order that the CFTC filed against a company called Coinflip. A judge in the Southern District... Eastern or Southern, one of the two in New York, confirmed that order that Bitcoin is legally a commodity under the CEA Commodities Exchange Act. That is the federal legal characterization of Bitcoin, and that was established five years ago. A lot of people still don't know that.

Cameron Winklevoss: (29:57)

I recently read a Twitter stream by Ray Dalio where he listed out a couple of the things that he had issues with, with Bitcoin. One of which that he didn't think it would make a very good currency, which we've addressed a few minutes ago. We don't think it actually needs to be, just like gold doesn't need to be a good currency. He also worried about the legal classification. And as I mentioned, Bitcoin has been legal in the US on a federal level and it's treated as money transmission on the state level, for many years now. We legally operate in all 50 states, as well as many other major Western places in Europe and jurisdictions in Asia. But a lot of people I think just don't know that.

Cameron Winklevoss: (30:43)

So one of the biggest challenges we face is simply, education. When I saw that, I tweeted back at him. I was like, "Hey, here's... Let me address these points here." Because people like Ray Dalio, he understands gold. He understands inflation far better than most people on the planet. If you listen to his talking points, he basically stops just short of Bitcoin. Hopefully, we can get him over the hump if anybody listening, let's just tweet at Ray and get him excited about Bitcoin.

Anthony Scaramucci: (31:17)

That's going to be my last question, and then I'm going to turn it over to John because we've got an amazing stack of audience participation questions here. What do we say to the guys? You mentioned a little bit on Ray Dalio, Nouriel Roubini. What do you say to the people who can't get their arms around this at this moment? And by the way, there were probably people like that guys, related to Facebook or Amazon. I was there when Apple was on the verge of bankruptcy and Gil Amelio was trying to recruit a gentleman by the name of Steve Jobs back to Apple Computer. What do you say to the doubters? What's the overarching thing that you would say?

Cameron Winklevoss: (32:02)

There are some doubters like Nouriel who we call no-coiners. They don't have any Bitcoin, and I think that's what sort of biases them against it. The same with Peter Schiff, he is obviously long gold. They're just very stubborn and not really willing to hear the merits. But for everybody else who's willing and open to have that conversation, I think a lot of the talking points really are what we've laid out in this conversation, which is that Bitcoin is gold 2.0. If you believe in gold and you like gold, you're long gold, you invest in gold, then you should have Bitcoin in your portfolio because it is gold for the internet.

Cameron Winklevoss: (32:43)

I think we have literally be saying these talking points since 2012. We gave a presentation at the Value Investors Congress or Conference. Was that in 2013, Tyler, or 2014? All I know is the price was $132 when we gave the presentation that day. That room was filled with buy-side experts, some of the greatest investing minds in the world. Obviously, we know what the price today is. It hit $20,000. It's the same thesis, the same talking points. We just keep kind of repeating them in different ways, and that really hasn't changed. I think people just sort of have to...

Cameron Winklevoss: (33:31)

I think the aha moment for a lot of people was the pandemic. They saw the stimulus spending. They saw the money printing. And they see the deficit and they're like, "This is going down a path and it's now accelerated down a path. How do we get back out?" The election, it doesn't matter with respect to money printing because both parties can agree that they're addicted to the money printer and they're both going to try and print their way out of the next problem. We've basically used and abused all of the tools at our disposal, and I think that has been a big aha moment for a lot of people.

Tyler Winklevoss: (34:11)

I have yet to hear a convincing criticism that's credible. It's always ad hominems. It's like, "Oh, it's too lapsed, it's rat poison. It's a fraud. It's a Ponzi scheme." But that's not really convincing to me. If I hear an argument that's convincing, I'll let you know. But we've been at this for eight years-

Anthony Scaramucci: (34:31)

Cameron, what's the most convincing argument that you've heard, and what's your dispelling of it? What's the most convincing?

Cameron Winklevoss: (34:39)

The easy criticism to lobby against Bitcoin is that it's volatile. And it's volatile because it's an emerging store of value. It's literally 10, 11 years old. When you put it side by side with gold, which is basically 3,000 plus multi-millennia track record, it obviously doesn't have that track record and it obviously is going to have volatility because it is a nascent store of value. However, it's gone from literally white paper in 2008, to close to $400 billion in market cap in that short period of time.

Cameron Winklevoss: (35:18)

Technology adoption curves are only accelerating. If you look at the number of smartphones and devices, there's more of those on this planet than people. And so if you don't think that Bitcoin adoption is going to continue and accelerate, you're probably mistaken. If you talk to any Gen Zer, they don't want gold. They don't say, "Oh, it's shiny. It's this cool object that I saw in movies and I grew up with and I'm familiar with." They're not familiar with that. They live online.

Anthony Scaramucci: (35:48)

Don't pick on us old people, okay? Don't pick on us old people. It's harder to change the old habits.

John Darsie: (35:56)

It's Anthony's nap time. Anthony, you can go have your dinner and then take your nap.

Anthony Scaramucci: (36:01)

The dude's relentless. You know why he's so relentless? I have buried this guy on about 50 other SALT Talk. Okay, go ahead, Darsie. I know you'll finally ask these questions. Now Darsie, I know you're trying to shine with all your Bitcoin acumen and everything. Go ahead, you got the stage.

John Darsie: (36:19)

Yeah, I just wish they'd had called me in 2014 when Bitcoin was at $132 and evangelized it to me then. But I guess at $20,000, it's still in the early stages. I'll forgive you guys for that.

Tyler Winklevoss: (36:31)

Yeah. Our prediction is that Bitcoin conservatively will be worth $500,000 a Bitcoin. At $20,000, it's still super early.

Anthony Scaramucci: (36:42)

Your timeframe on something like that is what, over the next decade?

Tyler Winklevoss: (36:46)

Yeah. It could be sooner, next five years. Like Cameron said, the technology adoption curves are just so fast. What Bitcoin's achieved in ten years, the next five years. We say that Bitcoin or crypto is like dog years. A day is like a week, a week's a month. It moves so fast.

Anthony Scaramucci: (37:07)

Both Michael Saylor and Ron Paul, who we've interviewed them both, said those numbers. That would get you to the market cap of gold more or less, right? Is that what you're thinking about?

Tyler Winklevoss: (37:19)

That's how we back into it, yeah.

Anthony Scaramucci: (37:20)

Go ahead, John. I know you got-

John Darsie: (37:23)

Yeah. Would you guys consider yourselves... I think I know the answer, but I'd like you talk about it a little bit more. Bitcoin maximalist, meaning that you think there's going to be a winner takes all type of environment in the world of cryptocurrencies. Just like you see gold as the dominant player as a store of value among other precious metals, although silver obviously has a large market cap as well. Do you think Bitcoin is going to be the dominant player? Do you think there's other currencies, digital assets out there that could potentially usurp Bitcoin or at least live alongside Bitcoin as these dominant store of values?

Cameron Winklevoss: (37:59)

I think for the store of value piece of the puzzle, I think if Bitcoin's to lose, there may be a silver to Bitcoin's gold. But I don't think that there's generally multiple stores of value. But we're definitely not maximalist in the sense that we only believe in and love Bitcoin. Obviously, we hold a lot of Bitcoin, we want Bitcoin to work, we hope it works.

Cameron Winklevoss: (38:24)

We also hold Ether and other cryptocurrencies. And we're very bullish on Ethereum and the DeFi projects that have been built on top of Ethereum and much of what's going on there. We're long to space. Obviously, there are some projects that don't have a lot of merit, but there's definitely a few that have already shown a tremendous amount of promise. Bitcoin being one of them, Ethereum being another. Sort of like the world's digital computer, Ethereum or Ether, the currency. Think of it as digital oil that powers this super computer where you can run applications and all kinds of cool programming, smart contracts. And then Filecoin's a new coin that just launched and it's a decentralized data storage network. Think of Amazon S3 centralized storage bucket or Microsoft Azure. Filecoin is basically unbundling, decentralizing that. Just like Ethereum is a decentralized operating system in the cloud and Bitcoin's obviously decentralized digital gold.

John Darsie: (39:32)

Right. You guys have a stable coin called the Gemini coin. I want to talk about stable coins for a second for people who are less informed about it. What's the purpose of the existence of stable coins? How is your coin unique to other stable coins that are out there, including something like the Libra project that Facebook is working on?

Tyler Winklevoss: (39:51)

Yeah. The idea with the stable coin is to bring dollars under the blockchain. If you open a Gemini account, wire cash in, you can withdraw that cash to the Ethereum blockchain to any address, we wrap it. It's called the Gemini dollar, and it gives you a way to spend dollars on the blockchain. We're regulated by the New York Department of Financial Services. We issue it through them, we're licensed to do that. But it's a centralized stable coin, and that's kind of the one on one. We bank the cap, the dollars, are held at State Street in Goldman Sachs. We've gotten security audits. We built a constellation of trust around this. There are definitely other stable coins like Tether that are apparently not fully backed by dollars or are not regulated.

Tyler Winklevoss: (40:41)

Gemini dollar is basically the institutional grade version of the stable coin that's regulated, that's compliant, that's issued by Gemini. But essentially, we want to bring dollars onto the blockchain, or give dollars cryptocurrency characteristics. Right now, your dollars work on banking hours. So if you want to send money to London on a Friday night from New York, you've got to wait til Monday. If it's a bank holiday, it gets there Tuesday. The fastest way to do that is actually to take a bag of cash, hop on a plane at JFK and take the red-eye. That's kind of crazy because we know money is basically information.

Tyler Winklevoss: (41:19)

We know how email works 24/7/365, yet your dollars don't work like that. And that's trying to get from New York to London. Try and get from New York to Sri Lanka. When's it getting there? What's it cost? What's the friction? Maybe it's a 10% fee. Money really doesn't work. We kind of wish it worked like email worked like our money because we'd get some more free time back. But that's the essence of the Gemini dollar.

John Darsie: (41:50)

You guys have said that you think every major tech company will eventually launch their own crypto-like offering. What purpose would that serve, and what exactly would that look like?

Cameron Winklevoss: (42:02)

I think if you look at airline miles, those are effectively closed loop currency systems. You have American miles, you sort of have a currency on their platform. I don't believe you can trade those miles for other miles, but I think that there's ways where you can build incentives and loyalty.

Cameron Winklevoss: (42:24)

Another interesting place is eGaming. A lot of the items that you win or own in the virtual world are in walled gardens, if you will. You can't take that shield or item that you've worked really hard and side one game to another. We think there will be interoperability between gaming. You have communities like Fortnite where there's like 200 million people around the world playing against each other. They are going to want to interact at some point. How do you collect funds from all these different people, and what is that digital native currency that powers those worlds? We think cryptocurrency is really technology, the only technology that can do that in the current system. We think there's intersections in a couple of different areas.

John Darsie: (43:15)

Tyler, do you have anything to add? Or we'll move onto the next question.

Tyler Winklevoss: (43:18)

Yeah. No, we can move on.

John Darsie: (43:20)

All right. In terms of security, going back to devil's advocate type of questions... People talk about the security issue, that Mt. Gox was a famous case of millions of dollars of Bitcoins being stolen. How far have we come in five years in terms of institutional grade custody and also, institutional grade security around owning Bitcoins on a major exchange like a Gemini or a Coinbase?

Tyler Winklevoss: (43:48)

I think we've come really far. And ultimately, we actually built Gemini because of our experience at Mt. Gox. To be clear, Mt. Gox is a company problem, right? It's not a Bitcoin problem. There's never been a Bitcoin hack, but the companies that hold your Bitcoins, similar to a bank that holds your dollars, can have issues. Gemini has never had an issue. Coinbase has never had an issue. Kraken has never had an issue as far as I know. There's a lot of great names and players that have been around for years that have never had any incidence of merit.

Tyler Winklevoss: (44:23)

There are Wild West operations and some people can try their hands there, but I think no one's surprised when those go under. There's no regulation, there's not best practice of security. They don't do the SOC 1, the SOC 2 audits. They don't do security pen testing. All the things that our regulators make sure we do when we say we do it. They come into our office for a month, five or six examiners. They sit there and they kick the tires and they make sure we're actually doing what we say we do. We do it anyway, but it's great to have them doing it. And you can hear from them, not just take it from us. I think we've come a long way, but there are the Wild West operations. You've just got to be aware of who you're dealing with.

John Darsie: (45:09)

Are you guys Satoshi?

Cameron Winklevoss: (45:12)

No comment.

John Darsie: (45:14)

All right. We have a question from an audience member though about your opinion on whether we'll ever know who created Bitcoin and whether doing so would add any level of confidence to mainstream investors who are looking to invest in the space.

Tyler Winklevoss: (45:29)

I know-

Cameron Winklevoss: (45:29)

I think that's-

Tyler Winklevoss: (45:29)

Go ahead.

Cameron Winklevoss: (45:29)

Go ahead.

Tyler Winklevoss: (45:29)

You first.

Cameron Winklevoss: (45:35)

All right. I think that's really the beauty and the strength of Bitcoin. When you first learn that we don't know who the trader is, you're like, "That doesn't make any sense. That's kind of crazy." And then you realize it's all about the source code. There's no inside baseball. Anybody in the world can look at the source code or the ledger and understand what Bitcoin is and what it does and how it transacts.

Cameron Winklevoss: (45:59)

Therefore, you don't have this founder or person that people are looking towards or this Jesus-like figure. You don't have the Fed chairman or a group of people making decisions behind closed doors and then presenting it to the public. It is not that kind of system, and that is really I think the elegance in what attracts so many people to it. It's this open system. Everybody knows the rule set. You know where the goalposts are, and you can opt in or you can opt out.

John Darsie: (46:31)

I ask this question, Tyler, of everybody who comes on to talk about cryptocurrencies, but about the idea of central bank digital currencies. You guys are not Bitcoin maximalists. You believe distributed finance is a movement that's here to stay.

John Darsie: (46:50)

What do you think the impact of central bank digital currencies is going to be on an asset like Bitcoin? Do you think it's additive or do you think if government starts stepping in and launching their own digital currencies, that it might detract from something like Bitcoin which is fully independent?

Tyler Winklevoss: (47:06)

I think it's additive, because it's still fiat currency as far as I understand it. The money printing that's going on is basically turning cash into toilet paper. Right? Cash is trash. Whether it's digital or it's paper, it's still the same thing. It's the perfect foil for Bitcoin because Bitcoin's hard money, the supply is fixed. The more fiat regimes print or whatever, whether or not they make it digital or paper or whatever, I think it's semantics. Maybe it's a little bit more functional toilet paper that works like your email. But ultimately at the end of the day, it's still toilet paper and Bitcoin's digital gold.

Cameron Winklevoss: (47:46)

The real question is, when a central bank is going to buy Bitcoin. We're already seeing it with corporate treasuries. You guys, I think you had Michael Saylor on. He's obviously brilliant. I think he's made one of the brilliant trade of the next decade. That trade still exists, it's out in the open for others to take at $20,000 Bitcoin. We saw this three years ago and we're back here again with so much more maturity in the ecosystem. And now we're seeing treasuries, corporate treasuries, putting money towards Bitcoin to protect the value. It soon will be irresponsible not to have some of your treasury out of dollars or out of fiat, into something like Bitcoin.

Cameron Winklevoss: (48:29)

And then the question is, when is the first central bank going to take that lead? If you look at the gold buying among central banks, I think they bought more in the last two years than they have since the '60s. They see what's going on, they know what's going on. Don't listen to them. Watch what they do. And they're buying gold, because that's all they know how to do. That's what they've been doing since inception. Right? That's their muscle memory. But somebody is going to dip their toe into Bitcoin. Some really smart central banker and group is going to say, "Well gee, if we accumulate our position before every other country, we're in a really good spot." They're going to quietly silently build their position and then talk their book. You just want to make sure you're not the person when the music turns off and you don't have a seat on the Bitcoin network, and the way you buy a seat is by buying Bitcoin.

John Darsie: (49:24)

For people out there who are kicking themselves for not buying Bitcoin at $5,000 per coin when it dipped a few years ago after its initial basic rise into the mainstream, it's not too late.

Cameron Winklevoss: (49:38)

Do you know, that's-

Anthony Scaramucci: (49:39)

Ask why it dipped, though. Because I think it's important, guys. Why did it dip?

John Darsie: (49:42)

Yeah, why is it different now? Why did it have such a... It lost 80% of its value then.

Cameron Winklevoss: (49:47)

Right.

John Darsie: (49:48)

Thanksgiving this year, it lost 10%. But it seems like the dip is being bought and it's much more durable.

Cameron Winklevoss: (49:54)

I think that this time it's different, it's a different fact set. In 2017, it was very much a retail phenomenon. People got super excited, and a lot of people ploughed in. But the institutions really weren't there in a big way yet. Some were, and partners and founders at hedge funds and things were quietly getting in. This time around, you have people like Paul Tudor Jones and people like Michael Saylor who are buying. And they're not buying millions, they're buying tens and hundreds of millions. This has been happening quietly at least over the past six months during the pandemic.

Cameron Winklevoss: (50:32)

We anecdotally have these conversations all day long, conversations that even two years ago wouldn't happen. Or the person would like to learn about Bitcoin, but wasn't really sincere about putting on that position quite yet. So you have stronger hands right now, that's a big part of it. You have a much more mature ecosystem. Regulations are a little bit clearer. And the macro picture has gotten so much worse. It's horrible. I think Mnuchin's saying that, "Oh, we think that the deficit at whatever, 20-plus, 28 trillion, is manageable." What's manageable about that? How do you manage that? The math... the interest payments just will compound and it just won't work.

John Darsie: (51:19)

Well, Cameron and Tyler, we could go on for a lot longer I'm sure, but we'll leave it there for today. We hope to have on hopefully in the next few months. You were actually at our SALT Conference as Anthony mentioned, what, five or so years ago. Again, very early in the Bitcoin story. People had chances to jump on, and as you allude to it, could still be early.

Cameron Winklevoss: (51:39)

Yeah. Just to point a further point on it in closing... When we spoke at SALT, I believe the market cap for Ethereum was $1 billion. And today I think it's, I don't know, it's 50 X. I don't know. It would be interesting to see, to time stamp this conversation and see where the prices are next time we talk.

Anthony Scaramucci: (52:03)

I'm hoping that we're a good luck charm for you guys. I hope that's what that implies.

Tyler Winklevoss: (52:07)

You really are.

Cameron Winklevoss: (52:07)

I think, absolutely. I mean, we went on Squawk earlier today and Bitcoin was at $18.5, and an hour or two later it hit an all-time high. So let's see what happens in the next hour.

Anthony Scaramucci: (52:22)

As long as it's going up, guys, we're taking full credit. If it's going down, I'm blaming it on Joe Curran. I just want to make sure everybody knows that.

Cameron Winklevoss: (52:29)

Deal. Deal.

Anthony Scaramucci: (52:30)

I did learn something from my old boss, by the way. Just so you know, about where you put the blame on thing on things. Just kidding. But in all seriousness guys, thanks so much for joining us. We'd love to get you back on. And I'm looking forward to the opportunity for SkyBridge to do business with you guys sometime in the near future.

Cameron Winklevoss: (52:50)

Great, really looking forward to it.

Tyler Winklevoss: (52:52)

Likewise. Thanks for having us on, guys.