“I have a pretty bullish view for this year. $175K is the likely peak we’re going to see this year.”

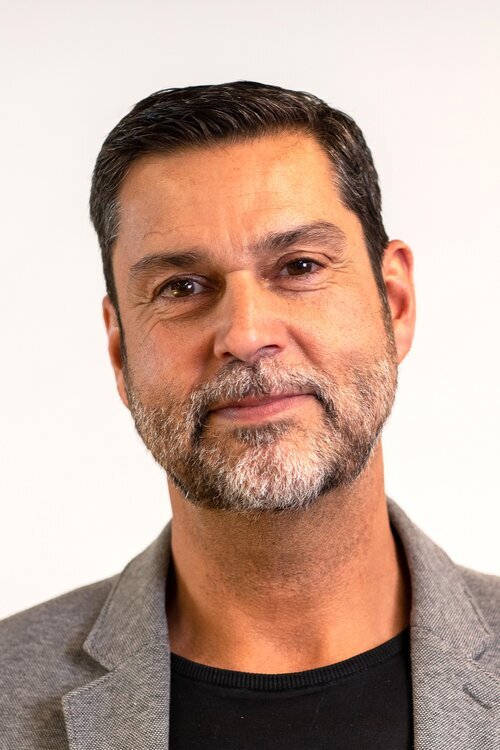

Richard Byworth is CEO of Diginex, a digital asset financial services and advisory company. Byworth has 20+ years of experience in finance, start-ups, investments and the fintech space.

Creating trusted and secure avenues through which major financial institutions can invest in Bitcoin is an important next step in its growth. The Federal Reserve will continue to expand the money supply as way to service the national debt. As the money supply grows, Bitcoin will only become more attractive as a hedge against inflation. Square, Tesla and Microstrategy have served as major catalysts in the movement towards adding Bitcoin to corporate treasuries. “Every CFO and finance department is having to explain to their board why we’re seeing this phenomenon, what is this Bitcoin asset, and why companies are putting it on their balance sheet to preserve value of their corporate treasury.”

This signals a bullish forecast for Bitcoin that will likely see its peak reach $175K by the end of 2021. As humans we are trained to think in linear progressions, but Bitcoin is growing exponentially. The Internet’s network effect saw the rapid growth of companies like Amazon, Apple and Facebook. Now, expect money to undergo the same type of transformation.

LISTEN AND SUBSCRIBE

SPEAKER

Richard Byworth

Chief Executive Officer

Diginex

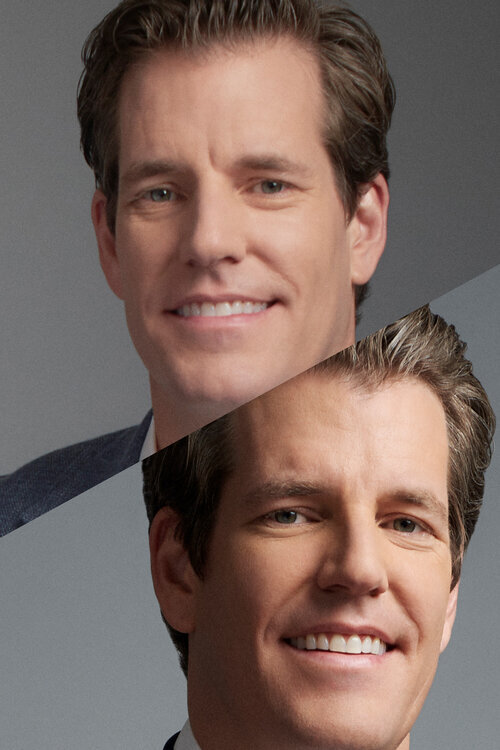

MODERATOR

Anthony Scaramucci

Founder & Managing Partner

SkyBridge

EPISODE TRANSCRIPT

John Darcie: (00:07)

Hello everyone. And welcome back to salt talks. My name is John Darcie. I'm the managing director of salt, which is a global thought leadership forum and networking platform at the intersection of finance technology and public policy. Salt talks are a digital interview series with leading investors, creators, and thinkers. And our goal on these salt talks is the same as our goal and our salt conferences, which is to provide a window into the mind of subject matter experts, as well as provide a platform for what we think are big ideas that are shaping the future. And we're very excited today to bring you the latest episode in our salt talks, digital assets series a with Richard BioWorth, who's the CEO of digital ex uh, Richard has over 20 plus years of experience spanning finance startups investments and the FinTech sectors. Uh, previously he was a managing director at Nomura, a Japanese investment bank, and Richard was running derivative and equity linked product sales for Asia Pacific products globally.

John Darcie: (01:06)

Uh, the youngest managing director in numerous history. Richard led the build-out of the number one franchise of convertible bonds in Asia from 2005. Richard has founded several companies and as an active investor, having started his first trading company in 1990, he's a board member of Bletchley park, asset management, Jersey digital ex, and sits on the advisory board to private market.io, which is a private equity fund marketplace. Uh, Richard is a Hong Kong regional ambassador ambassador for the global blockchain business council and has spoken extensively around the merits of blockchain for business and finance at the world economic forum, AKA Davos, and the United nations in Geneva hosting. Today's talk is Anthony Scaramucci, the founder and managing partner of SkyBridge capital, a global alternative investment firm. Anthony is also the chairman of salts. And with that, I'll turn it over to you, Anthony, to begin the interview.

Anthony Scaramucci: (01:59)

John, John, thank you and Richard. Thanks for joining us on your evening in Singapore. We appreciate you being here. Hong Kong, Hong Kong. Okay. I'm sorry. In Hong Kong, the

John Darcie: (02:10)

Hong Kong, the Singaporeans and the Hong Kong knees. Don't like to be a conflict.

Anthony Scaramucci: (02:15)

Okay. So he's already starting by or C's already starting. Okay. Don't worry. I'll be kicking him at the knees here shortly, but Mr. By worth, you go from investment banking to crypto. So some of your colleagues think you're nuts. Obviously many of my colleagues have always known that I am nuts, but you don't seem nuts to me. So why did you go from investment banking into crypto?

Richard Byworth: (02:40)

Yeah, for me, um, banking was, was clearly starting to get to a point where it was, it was becoming a difficult industry. So margins have been really compressed ever since 2008. We've seen a lot of bad. She'd just been thrown at absolutely everything and all the businesses that I was involved with derivatives through the Delta, one futures and options, everything was getting compressed and, uh, it just wasn't that much fun anymore. Um, I started doing some, uh, early stage investing and, uh, I invested in a company called [inaudible], which is obviously the company that I'm now the CEO of, uh, back then digital X was a cryptocurrency mining company. I'd got interested in crypto because of the w the way that Yuval Harari in the book sapiens had framed the sort of monetary belief system and kept referencing Bitcoin, which up until then, I'd always thought it was some internet scan.

Richard Byworth: (03:40)

And, uh, so I started to pay attention to look at looking at it in some detail. And once I started to re really peel back the layers of what this asset was and the impact that it could have on the world, it became very clear to me that I wanted to be involved in it. Uh, I started by investing and then as I say, having invested indigenous ex, uh, the founder of [inaudible] approached me and said, would I help him build what he envisaged as being the leading, um, regulatory focus, financial services firm in this space. And that's obviously what we've built, uh, over the last three years. Um, so yeah, that's how I got here. So,

Anthony Scaramucci: (04:18)

So let's talk about digital X, um, your history, the mission, what the company does. Um, I apologize for confusing you with Binance, which is based in Singapore. Sorry about that. Of course. Dorsey had to say that to me and hurt my feelings, but let's talk about digital X.

Richard Byworth: (04:38)

Sure. So like did genetics, um, is a, is a full digital asset ecosystem with, with regulatory focus as its core, uh, principle. So we've got, uh, an exchange at the center of that. Actually, the reason you probably think I'm in Singapore is because the exchange is based in Singapore. Um, due to COVID, I haven't actually managed to get over there yet. Um, but, uh, the exchange ed cost is at the beginning at the middle of everything that we do, the exchange is a derivative platform. Um, it's focused on bringing much more credible derivatives to this space building on what we've already seen in perpetual swap space, and then expanding into options, structured products and everything that we know goes with it from traditional finance. Um, we have our own segregated custodian. Did you vote, that's operated by an X team, administrative defense out of the United Kingdom.

Richard Byworth: (05:33)

Um, we have our own asset manager, um, different to your own. We are a fund of hedge funds. So we look at very alpha centric strategies, looking at the very unique alpha does available in this asset class with all the various different arbitrage aspects. And obviously we spoke about gray scale earlier, um, that premium arbitrage, that discount arbitrage that we now seeing, those are some of the strategies that sit inside the funnel. Obviously the unique alpha that that crypto, uh, offers we have our own boutique investment bank at cross capital. And we also have our own trading platform access, uh, which plugs into two of the largest trading technology platforms in the world, FIS and activity. So that's the full ecosystem.

Anthony Scaramucci: (06:19)

You're, you're a listing on the NASDAQ, which took place in October of last year was quite important to the company. Tell us why it was so important that digit X.

Richard Byworth: (06:32)

So we're obviously focused on bringing trust to the industry, bringing governance to the industry. And I think a lot of people certainly in this region have had issues around the way that some of the companies in this space are governed. Um, you give a good example. There was a recent one of our competitors. Um, the CEO is thrown in, uh, into custody for a while and all the Bitcoin on the platform was trapped there and no one could get the Bitcoin off. And so if you're a hedge fund or an institutional manager trying to walk right on these platforms, you know, you're getting governance, risks, highlighted all over the place, you know, for institutions, as you will know, reputational risk is everything. And if you're running reputational risk through KYC and NRS that many of these platforms run again, you are running reputational risk. And so what we did with, with the build of it was really focused on mitigating all of the reputational and governance risk. And the ultimate level of governance is being a NASDAQ listed company with that sec approval and those governance frameworks that have we're required to have. And so for us, it was really important. Uh, we were obviously the first, uh, ecosystem to be listed on NASDAQ. We've now got Coinbase following in our footsteps. So it's going to be an interesting ride for the next a year or two years, as we see more and more companies come into the space. So

Anthony Scaramucci: (07:56)

We were talking before this started about huddling. We were talking about how, uh, coins Bitcoin in particular, or being taken off of exchanges. And it looks like they're being put into cold storage. What are the implications of that for the space, your business, is this positive? Is it negative? Uh, how do you think it's going to affect pricing going forward?

Richard Byworth: (08:24)

Well, yeah, I mean, as I was saying to you, I think we're in what we, we refer to as a supply side crisis. Um, we've obviously had the harping that happened in may last year. We're now moving into a paradigm where, as you say, you got a lot of institutions, you just take square Tesla, micro strategy. Um, and, uh, and they learn have taken something like 45% of the annual production of Bitcoin post the Harvey and locked it into cold storage. Now they're not alone. I mean, they're the early movers. Uh, we're starting to see, I mean, we had two new corporates this week that announced that they were starting to put Bitcoin on their balance sheet in smaller size. But the point is that now every CFO, every finance department is having to at least explain to their board, why are we seeing this phenomenon? What is this asset that is Bitcoin? And why are companies putting on their balance sheet to preserve the, you know, their value of their corporate treasury? So that's obviously a much broader question, but yeah, I think what we're going to see in prices is massive expansion. I mean, I probably have a pretty bullish view for this year. Um, I'm not sure how bullish you are in Sydney, but I'm a 175,000 is the likely peak that we're going to see this year. Well,

Anthony Scaramucci: (09:50)

When are we wouldn't we inviting by words back on the next salt talk Dorsey, is it next week? Or I'd make sure you get them back

John Darcie: (09:57)

On when it hits 175,000 in a year. All right. Well, here's the problem with

Anthony Scaramucci: (10:04)

Me. Okay. I actually believe that, but when I'm on television, like CNBC, someone asked me because we have people that are not paying as close attention to this as you and I are Richard, I said a hundred thousand and I was, I was met with the shock and awe of the reflects of response of people that are not playing close enough attention to what's going on. So, and then I got ridiculed on Twitter. People said I was too bearish. There was

John Darcie: (10:32)

A dichotomy of reactions. There were, there were mainstream people saying, oh, Anthony's now bought into this cult. And he thinks it's going to go to a hundred thousand by the end of the year. And then all the, uh, the handlers on Twitter were like, why are you so bearish?

Anthony Scaramucci: (10:44)

But, but I think you just, you just brilliantly explained why with reasonably high likelihood. And again, I want to put all those caveats out there for people listening to us, Bitcoin is a volatile asset. It does, you can lose money. We're not suggesting take anything to the bank. Richard is not suggesting that, nor am I, but we're just looking at supply demand fundamentals and the brilliant exposition of what Richard just said about those supply demand fundamentals as why this asset class is moving higher. Okay. It may or may not happen. We both know that, but it's in our best guests. That that's the direction that it's going in. Is that fair to say that way, Richard? I hope, hope you. Yeah.

Richard Byworth: (11:27)

I mean, I think that that's the supply side issue and the question always becomes, why are they buying it? And then you'd have to look properly at the macro backdrop. And you know, again, this is, this is your world. You, you know, you're in a far better position to explain them myself, but you know, if I'll attend effectively what you're looking at with the federal reserve reserve, trying to create inflation, we're going into a period where massive amount of jobs are going to get lost. They've already been lost due to the pandemic, but technology and the deflation that that effectively brings you just look up automated vehicles as an example. Um, you think about truck drivers across the United States, how many people are going to be put out of work by automated vehicles, uh, or, um, with the advancement that companies like Tesla and Google are making. This is extremely deflationary. Now the fed can't have deflation. I mean, they've got a balance sheet of Davidge war 28 trillion today. I mean, they are drowning in debt. If we go into a deflationary cycle, they are not going to be able to handle it. They're never going to be able to pay off that debt. And certainly they're not going to get the tax receipts to even be able to service that debt. Okay. So

Anthony Scaramucci: (12:49)

Let me, let me stop you for one second, because I really want to explain this to people that are not as sophisticated as frankly, you are Richard. They can't handle it because they can't pay the debt back with dollars that are worth more than the dollars that they borrowed. And so when you have a period of deflation, the value of the currencies actually going up relative to assets. And so therefore they're in a debt trap. Uh, this is what's got central bankers scared out of their minds, and this is why the money printing presses are on overtime right now to prevent that from happening. I didn't mean to interrupt you, but I we've got a lot of young people that are listening. So I just wanted to explain that to people. So go back to what you're saying. They can't handle it deflationary spiral. So therefore,

Richard Byworth: (13:39)

Therefore they're fighting this losing battle about trying to create, create growth in, in their GDP number or let's CPI number. But effectively what you've got is, is massive deflation on the horizon through technology advancement. So you've got everything getting cheaper energy production, getting cheaper, you've got massive unemployment that's going to happen. And so they have to keep trying to drive growth through the one weapon that they have. And that's monetary debasement so effectively just printing more dollars. So we're going to see all forms of this. We've started to see what is referred to broadly in traditional finance as helicopter money. And this is effectively just handing out checks to everybody. So they just start spending money. And this is the sort of, is, is, you know, as that progresses, that's really the last step in massive monetary debasement. So corporates are thinking about this from their corporate treasury.

Richard Byworth: (14:40)

And I will, if I'm getting hit on my corporate treasury by 25, 30%, as we saw with the debasement of the dollar last year, then we need to make sure that we're protecting that. And that's what happened with micro strategy. And you're starting to see it with a lot of the macro funds as well. You've got Paul Tudor Jones has moved in Ray Dalio. I'm sure will be one of the next, you've got a lot of macro managers that are starting to understand that the Bitcoin is potentially the very best hedge against this monetary deflation.

Anthony Scaramucci: (15:11)

So, so the past 12 months have been transformational, right? We both would agree on that. Um, numerous institutional players coming into the market. Um, what were, in your opinion, the seminal turning points?

Richard Byworth: (15:26)

I think probably one of the biggest was Michael Saylor, um, discovering Bitcoin and discovering how that could protect his balance sheet. I think he has done an enormously, um, impressive job at educating others around what this means for, um, for their corporate balance sheet. He did a, a, um, conference, uh, a month and a half ago, I believe, um, where he had about 6,000 corporates attend, um, the CFOs finance directors of these companies. And I think this has been really a turning point. You've got CEOs that control that company like Michael and Elon Musk in, in Tesla. They're the ones that can move first. But as I said to you earlier, you've got every corporate boardroom now, trying to understand what is going on, why people are buying Bitcoin on their balance sheet and starting to move into that space and do it doing it themselves. So I think over the next couple of courses, we're going to see more and more of this. And that's why I'm going to end up on your show sooner rather than later, because Bitcoin is going to be 175,000.

Anthony Scaramucci: (16:37)

So let me ask you the question that I'm often asked, and I have a hard time answering, uh, the Bitcoin going from a penny to $175,000. Let's assume that we actually didn't get to that number in 12 or 13 years, scares the bejesus out of people, right? Because we're trained you where I was, anybody that's in the investment management business is trained for all of anything is too good to be true, Richard, then therefore, definitionally, it's not true run from it. Don't run towards it. And yet you've looked at this, Michael Saylor has looked at this, I looked at this, all three of us were trained that way, frankly, yet you see it and you're willing to accept it. Why, what was the intellectual chasm that you had to cross to get yourself intellectually around Bitcoin?

Richard Byworth: (17:36)

It's a great question. I think probably the, the coming back to, why do we think that way we're trained to think about linear progression, right? And the point is that this advancement of technology we're seeing in the current cycle, where we saw with the internet, as we did with Amazon, apple, Facebook, these were companies that were massively enhanced by the network effect of the internet. Now you're starting to see that with money and the value proposition that a digital transferable money globally decentralized from government is able to bring the world. That is just a phenomenon thing. And as Michael Saylor often says, Bitcoin's already won the network race, right. Is a trillion dollar network. Now you've got any competitor. I mean, what our competitors, Bitcoin cash like Klein, Bitcoin SV. I mean, these are dying protocols. You look at likewise, no, one's no one's out of development to that network for six months.

Richard Byworth: (18:40)

It's a dead protocol. As far as we assess it, in terms of the way that we think about listing assets on our platform. So Bitcoin has destroyed anything that has come close to trying to compete with it. And it's one that network effect. If you look at Metcalf's law and the way that network effects have this compounding effect, that's where our brain breaks. When we're thinking about linear models, right? It's this exponential effect that technology can have. And Bitcoin is, is no exception. You know, it's a, it's in a position where it could be a replacement for gold. It's better than gold in so many aspects. Scarcity, portability, divisibility, fungibility, verifiability, all these things it's beating gold, and it's still less than 10% of the entire market cap of gold. So where do we go? I think, uh, yeah, I think 175,000 is, uh, is fairly conservative, but so

Anthony Scaramucci: (19:46)

I want to, I want to see if I can put it in my words and you can agree or disagree, or what you're basically saying is we're trained to think linearly our minds are actually trained to think that way too. That's part of our survival mechanism, but the world is actually in some cases moving exponentially and you have the two things converging at the same time, this dilemma that the central banks are faced with. Uh, so therefore they've, uh, started printing the money digitally, electronically producing the money. And at the same time we need to standardize once again. So there's almost a need for a currency renewal, if you will, or a technological transformation of something that will allow us to trade goods and services that is more standardized and less manipulated by politicians or policy makers. And so this, these two things are happening at the same time and that's why Bitcoin is scaling. And so in order for it to hit that standard, those coins have to be worth blank, whatever plank is you and I can figure out that number. And therefore we'll start thinking about Satoshi's, which are, uh, units of Bitcoin, as opposed to Bitcoin itself. So what am I, what am I missing? Richard?

Richard Byworth: (21:06)

You're not missing anything. You're exactly. Spot on. I think that just to sort of elaborate on one of the points you made it, there are 56 million, according to Morgan Stanley, recent report, 56 million millionaires in the world, right? So 56 million millionaires, all ones who in one Bitcoin, they can't, they actually cannot own one. And by the way, you've got billionaires, like Elon Musk and Michael Saylor, just grabbing as much as they possibly can get before everyone realizes what this is. Right. And what's happening. Right. And then, yeah, I think that the, the thing you asked me a question, it, I walked, got my mind round breaking that linear model for me, it was really like one Bitcoin is one Bitcoin. And if I want, you know, my kids not to give me a hard time when they're 18 years old, they're eight and 10 now and say, dad, why didn't you have any Bitcoin? You know, now it's the sort of the center of everything financial and you know, you think, okay, well I want to get one Bitcoin for each of the kids. And then you go, well, hang on. Maybe I want 10. And then you're like, how many people could actually own 10? Like, you know, 2.1 million people in the world, could I actually own 10 Bitcoin suddenly it starts to really do it on you, how scarce this asset is.

Anthony Scaramucci: (22:31)

Okay. So the scarcity is also a very big issue. Let me ask you this, uh, in, in PR soon to this philosophical change in your mind, uh, where are we 10 years from now? Uh, when quote unquote, to use your own words, Bitcoin is at the center of our financial experience. How do the traditional financial services in the crypto industry converge lay out the case? It's 2031? Where are we?

Richard Byworth: (23:04)

So 2031, let's say Bitcoins, um, approaching $5 million per Bitcoin, as you rightly said.

Anthony Scaramucci: (23:11)

And by the way, I'll already be through my second hair transplant by 2031. Okay. And I'm just saying that to interrupt Darcie from saying it by worth. Okay. Keep going by worth.

Richard Byworth: (23:22)

Yeah. So I think what you're going to have is you're going to have a very large value, uh, of Bitcoin as a single Bitcoin. And I think you, you highlighted it just then Bitcoin divides to eight decimal places. The unit, the final unit is a Satoshi. And we will start to think in Sitoshi. I think $1 today is 9,000 Satoshis and as the price goes higher and higher, you'll probably end up with a situation where one Satoshi is one us dollar, and that will end up being the way that we think about this in terms of scaling. So, um, yeah, I think that's probably the answer. So

Anthony Scaramucci: (24:06)

The traditional finance, how do they reconcile? What this, how does a old school bank get their arms around this?

Richard Byworth: (24:16)

Um, so the way that we're seeing banks move into the space at the moment is the, is the usual way. They need to understand how they avoid that reputational risk. First major reputational risk is a bank moving into this space and getting hacked, right? So they've got to make sure they don't get hacked. So the biggest thing that they have to focus on is custody. How do we deal with custody? How do we deal with custody in a safe and secure way? So many of the conversations that we have with banks are about them getting to the point of understanding how to deal with it, how to either build their own solution, use ours, or use a white label version of our solution. I think I mentioned earlier that our solution has been built by X specialists, um, security specialists from the ministry of defense in the United Kingdom.

Richard Byworth: (25:06)

His CTO is effectively, um, ex infrastructure banking head from, from UBS. And so what they've managed to do is build a very institutionally focused risk policy engine around the way that they deal with custody. And that's the way the banks are getting into it first. So once they understand how to store it, then they can start to offer it to their clients. And then once they start to offer it to their clients, then it's really just a mindset shift around how does blockchain start to really disrupt capital markets? So it's, you know, we're talking about just purely Bitcoin, Bitcoin is a particular asset, right? Then you're starting to move into the smart protocol world. Um, and how are we going to see capital markets disrupted? And I think that is probably going to be where the banks really weighed in is about understanding the way to manage these assets and then actually change the way that capital markets transactions are transmitted using blockchain networks.

Anthony Scaramucci: (26:06)

Okay. It's well said, I've got two last questions that we have to turn it over to the millennial. Okay. Who's going to ask millennial like questions. What is next for Digitech short-term and long-term

Richard Byworth: (26:19)

So in the very short term, we've got a lot of derivative product rollout. That for us is our skillset. We will came from derivative banking. Um, but what that leads into is a broader offering on a platform so effectively allowing people to manage their risk around derivatives. When you think back to what we've been discussing as Bitcoin, you're never going to want to sell your Bitcoin. You're going to, to use your Bitcoin as you will call collateral base and trade derivatives around that sell cools, buy sell, puts, do all of that, manage your finances around this core collateral base. So once you have that derivative set, it's going to be like a private bank for digital assets. So you can buy structured products. You can invest in funds that tokenized, and you can use that collateral base without actually ever selling any of your Bitcoins. And that's that's for us is the longterm goal is that you have that prime services, drug, private bank type function for institutions on the prime side, individuals on the private bank side,

Anthony Scaramucci: (27:24)

What's the symbol for digital X so that our viewers can, uh, look you guys up and potentially invest.

Richard Byworth: (27:31)

Yeah, so we did, as you say, we listed on NASDAQ. Our ticket is ETQ O S um, uh, under the name Digitech. So ed courses is, is the name of our exchange. So a Q O S was the ticker symbol is the ticket. We'll listen, Richard, congratulations. I'm going to turn it over to John Dorsey.

Anthony Scaramucci: (27:50)

Who's sitting there in that very beautiful

Richard Byworth: (27:52)

Room. John Dorsey, the richest person at SkyBridge, possibly the richest person in the world. Go ahead,

John Darcie: (27:59)

Ignore him, Richard. But, uh, in terms of the regulatory environment, so you're sitting there in Hong Kong, what's the regulatory environment, uh, in Asia. And how do you view the global regulatory environment outlook over the next five years or so? Is it an inevitability that, that these countries approve it for full use? Or do you think there's going to be some level of crackdown? Whether it be in India, China, I know has various rules around Bitcoin, the U S government, Janet Yellen, our treasury secretary has made some critical comments about it. What do you see as the regulatory outlook?

Richard Byworth: (28:35)

I think that the regulatory outlook for the U S is quite positive. You look at people like guidelines are sitting at the top of the sec. I mean, he's very pro pro the technology. And I think he understands what it is. Yellen's, you know, I mean, probably not, um, for entirely about the asset, but probably understands the risk. It might be

John Darcie: (28:55)

Held, said she basically took every piece of FID that you could ever find on the internet and rolled it up into one and delivered it and her congressional testimony. Yeah,

Richard Byworth: (29:05)

I think, uh, you know, it's quite rich the fed saying that a big vine is, uh, is an environment. So is Austin, when you think about what the, you know, when you keep pushing that button on a fringing dollars

John Darcie: (29:20)

Or anything manipulated asset, you know, they say, oh, there's manipulation in the, uh, in the Bitcoin market. And that's rich too, obviously Bitcoiners

Richard Byworth: (29:27)

Exactly very rich, but, you know, I mean, I think energy consumption, GDP, everything you want to point out. I mean, everything around the dollar is, is the worst example of what, of, of the environmental issues around Bitcoin. Um, back to your regulatory question around Asia. I mean, if you look at the two key jurisdictions, um, for financial services, it's, it's obviously Hong Kong and Singapore. Um, both those jurisdictions are very focused on trying to understand what is the best way to regulate this asset class. Uh, Singapore actually moved with a very proactive and innovative approach. Uh, whereas, uh, Hong Kong were a little bit more while they move first with providing a regulatory framework, they actually were a bit more conservative. Um, that said, I think that the SFC here in Hong Kong is, is very pro the asset class. Um, they're trying to understand how they can, uh, continue to support the industry.

Richard Byworth: (30:26)

I mean, Hong Kong is probably the largest crypto hub in the world. Um, in terms of talent in this space, one of the reasons that we continue to hire ahead, even though we're based in Singapore, um, Japan has gone down a road of, uh, being the very first regulator to regulate the space, but now has gone extremely conservative, um, and really shutting the doors on foreigners coming in and providing services. So to your question, I think every country is taking a slightly different approach and the people that are looking at banning it well, you know, they, they're concerned about capital controls for obvious reasons, Bitcoin and other digital assets. Cryptocurrencies are a risk to a country that's trying to implement capital controls. So, uh, they don't want their citizens using it and moving money around very easily.

John Darcie: (31:19)

Right? Well, China obviously has, I think it's between 50 and 60% of the global mining operations for Bitcoin. Uh, but at the same time have restrictions on the use because of capital controls, like you mentioned, they're also developing a digital Yuan. What do you think the significance of them developing that central bank digital currency? Do you think down the road when there's not the maybe a stringent need for capital controls that they'll evolve their regulation and, you know, in keeping with the fact that they run 60% of the world's mining operations and are aggressively pursuing a central bank digital currency, do you think that they'll fully adopt and integrate digital currencies and decentralized finance

Richard Byworth: (32:00)

Look? Um, you know, China is very focused on control and central bank. Digital currency is all about control. I mean, they were the first country to issue the central bank. Digital currency has actually already issued the digital Yuan. Um, and so, you know, what I see the play for China is actually more about creating a currency that can be a competitor to the dollar. And so what you'll see with that digital currency for China is, is an internationalization of their currency, um, much more so, and they want to move that into, you know, basis like Russia, Iran, and, uh, and start to provide support for, for those regimes based on, you know, obviously their currency, um, profile. So I think by being the first mover into central bank, digital currencies, they they've seen the opportunity and they want to dominate and they're moving very fast.

John Darcie: (32:59)

You would expect these railings, that central bank, digital currencies are built on to replace the swift system. Do you expect the United States to have to respond by building its own, uh, you know, digitized dollar?

Richard Byworth: (33:12)

Yeah. I think that we will see that from the fed. Um, I think that, you know, because they're in such a position of strength, they don't have to move quite as fast. They can observe what everybody else is doing and then make their own move. And obviously that will be very quickly adopted. Um, so I think the Fed's in a pretty strong position to be able to defend. I mean, the one problem that you've got is that China doesn't have to deal with a democratic process and getting things, things through a Senate, they just get things done. So it's a, it's a, you know, when you're looking at the speed of technology that we touched on earlier, um, you know, when you're in a race like that, this is quite an advantage in that race.

John Darcie: (34:00)

Yeah. You know, not, not to turn this into a political conversation, but there are advantages and disadvantages of both systems in terms of, uh, whether it be drug development or, uh, experimentation with digital currencies. For sure. I want to talk about, you mentioned Michael Saylor as being a very important person and his adoption of Bitcoin being an important turning point. In my opinion, what we've seen from insurance companies in the United States is equally, if not more important, especially if you think of regulatory risks as the biggest threat to, uh, the inevitability of Bitcoin, you know, the idea that the United States could ban it or tax it in an onerous way. So you have mass mutual several months ago announced that they invested a hundred million dollars into Bitcoin by an iDIG NY Digg. Also a great partner of ours that we think is a fantastic organization. They announced this week at $200 million investment into the GP from the likes of Soros, Bessemer Morgan Stanley, the largest wealth management unit in the U S as well as New York life and New York life also put their chairman and CEO on the board of dig. So you, you clearly have several insurance companies that have significant exposure to Bitcoin. What do you think that means for the movement and, and sort of the acceleration of this adoption curve that you talked about?

Richard Byworth: (35:16)

Well, I think it's across the board. I think it's pensions. I think it's hedge funds is macro firms is yeah. As you say, it's insurers, mass mutual is the first big insurer that we've seen move into the space. Um, but it's not going to be the last for sure. I mean, all of these people are sitting on huge, um, huge amounts of capital and needs to put it best to work. And it's all the same trade, right. Is, is against the devaluation of the dollar. So I think, um, yeah, look, mass Mutual's may of gig and Heinz move pulls you to Jones move, Michael sailor's move. All of these were effectively leading their part of the industry. Uh, I think, um, I think, yeah, this is just going to continue. Those are the first movers. When you think about that in the context of the supply side crisis that we are already in, then you see how we very quickly move to 175,000.

John Darcie: (36:07)

Right? I want to talk about the energy piece because we think that you're going to continue to see a lot of comments around ESG, excuse me, around ESG energy usage and all the issues around that, that, you know, Bitcoin poses a risk to the climate. You have the Paris climate accord, you have an administration in the United States. That's more committed to those standards. And, uh, there was a Norwegian billionaire I'm going to butcher his name, but it's tell Ingo Roca. You might do a better job as a, uh, international citizen, but he announced that his company, which is the third largest energy producer in addition to being a conglomerate and Norway is investing into Bitcoin and also going to put their entire corporate treasury, uh, liquid investible assets into Bitcoin. But he talked a lot about in his shareholder letter, which was published a couple of days ago. That was fantastic about how Bitcoin can almost act as a battery that equalizes demand on some of these energy platforms. Can you talk more about the opportunity that actually Bitcoin creates from an energy perspective and why those concerns around climate change, uh, are actually misplaced?

Richard Byworth: (37:10)

I think that what Bitcoin does, and it's really interesting that analogy, I hadn't read that shell the letter, but it's a very, very good analogy because what we experienced, we were a miner ourselves. What we experienced was that you always want to be finding the cheapest energy effectively. What Bitcoin miners are doing is just tracking the cheapest possible energy. And the cheapest possible energy is generally orphaned energy. So it will be, you know, someone's built a hydroelectric power plant to, to support a forestry, uh, industry in Northern Sweden. That was a perfect example of, of, of where we mind. Um, back three years ago, that was orphaned energy because the forestry industry had moved out. Sustainability of the forestry had had limited the amount of deforestation that they could do. And so you'd been left with this hydroelectric power plant that had been built that wasn't being used.

Richard Byworth: (38:10)

And so what we did with, with mining was we effectively took that energy and we monetized it into that battery. I love that into that battery that is Bitcoin, and then transferred that energy into someone that was prepared to pay for it. And so I think, you know, w I looked at it often as this is a way of keeping the network that says, um, that a subsidization across between particularly the EU has done to really grow clean energy. You think about hydro electric power. You think about nuclear. All of this has been very heavily subsidized by the European union. Now, another example was when we were mining in a Gonda, which is the Eastern part of Switzerland, literally a kilometer down the road, we in Italy, there was a, a hydroelectric power station that was going to be shutting. Cause it didn't, it wasn't close enough to the grid.

Richard Byworth: (39:04)

It wasn't pairing enough. It was, it was just not profitable. So they were going to shut down. So we ran an optic fiber cable down to that hydro electric pass station use the energy monetize that kept the power station open and effectively kept that network in place until we get to a point where efficiency or population growth has got to a point where you can transfer that energy or use it in a national grid more effectively. So I always think about it is as being the sort of a placeholder to keep the network together. As what I like is an analogy about the battery. I think it's a perfect analogy. Yeah. Yeah. I mean,

John Darcie: (39:40)

Th that shareholder letter, we think it's one of the most important, excuse me, again, pieces that's been written on Bitcoin this year. You know, it was a, it was spoken in very plain English. It was a very sober assessment of where we are in Bitcoin of why he's decided. And it basically talked about how he missed out on several trends, including the advent of the internet and some things that took place in the energy sector. And he says, this is the next big idea, and I'm not going to miss out. It was, it was a great piece of research it's available on the company website for the entity that he launched, uh, called CT S E T e.io. So anybody who's watching this, I would definitely read that shareholder letter. Um, one of the best pieces we think that's been written on Bitcoin, but yeah, the energy piece, I think is fascinating because as we've spoken to several people on salt talks about this issue, it almost incentivizes the development of cheap clean energy because it equalizes demand on the grid. And so, you know, in some ways Bitcoin will have the opposite effect that, that some of these, uh, misinformed people have as it relates to carbon emissions, you know, inner Mongolia, as an example, just ban Bitcoin mining using coal, you know, China being very conscious of its contribution to greenhouse emissions. So a lot of interesting stuff happening in this space and, and rapid progress, but we'll leave it there. I don't want to take away all of our material for your parents at six months. When, before,

Anthony Scaramucci: (41:01)

Before Richard goes to the question about China, obviously they they're banning Bitcoin. What's your opinion there before we go, and then John can wrap it up,

Richard Byworth: (41:10)

Uh, look, China, bans Bitcoin every six to 18 months. Um, so, you know, as we always say about China, don't, don't watch what they say, watch what they do. Um, and the fact that you've still got such a high proportion of miners sitting in China, not being shut down the flow, still coming. Um, you know, they, they do want to have, uh, input on this network now. Um, I think that China is probably going to stop being one of the central banks or the PVOC is going to be one of the central banks to actually start buying Bitcoin on their balance sheet. Um, I wouldn't be surprised if they've already done it and then just not disclosing.

Anthony Scaramucci: (41:55)

Okay. Well, I just wanted to get that in there. I, that was my inkling, but in my inclination, but, uh, wanted to get it confirmed by you, Richard, go ahead. Young Darcie. We'll

John Darcie: (42:04)

Wrap it up there. I don't want to again, take all of our material for Richard's return appearance in six, 12 months when, uh, we're willing to guarantee

Anthony Scaramucci: (42:12)

On that. Now though, we're we're, we're in the bank. We have a handshake deal. The Bitcoins are at 175,000 and you're our guests on salts. Okay.

John Darcie: (42:23)

If it doesn't make it 175,000 in a year, you'd have to give me all your bills. No, they won't be worth that much in six months. No worries, Richard. Well, thank you for joining us. Uh, hopefully we'll get over to Asia here. When things clear up fully on COVID. We, we did our salt conference in Abu Dhabi in 2019. We've done it in Singapore twice, or whether we go back to Singapore or we bring it to Hong Kong, we'd love to have your participation. Of course, that'd

Richard Byworth: (42:50)

Be fantastic. I look forward to, or maybe even go say,

John Darcie: (42:54)

There you go, and you'll be able to buy your ticket in Bitcoin. So no worries, but thank you everybody also for tuning into today's talk with Richard by worth of digital X, a leading digital asset exchange. Just a reminder, if you missed any part of this talk or any of our previous talks, you can access our entire archive@sault.org backslash talks and on our YouTube channel, which is called salt tube. We're also on Twitter at salt conferences where we're most active. We're also on LinkedIn, Instagram, and Facebook. And please spread the word about these salt talks for your friends. We love growing our community, uh, here on salt talks, but on behalf of Anthony and the entire salt team, this is John Darcie signing off for today. We hope to see you back here soon.