How to Keep the U.S. On the Forefront of High-Tech Growth with Congressman Ro Khanna of California’s 17th Congressional District. Governor Jeb Bush, 43rd Governor of Florida. Jason Crabtree, Chief Executive Officer, QOMPLX.

Moderated by Jeff Sonnenfeld, Senior Associate Dean for Leadership Studies, School of Management, Yale University.

PRESENTED BY

SPEAKERS

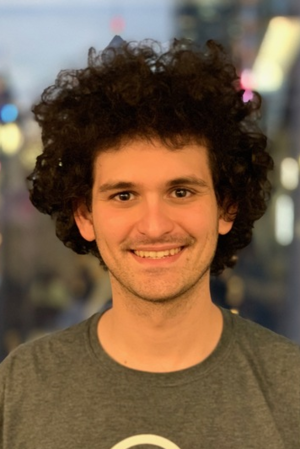

Congressman Ro Khanna

CA-17 (D)

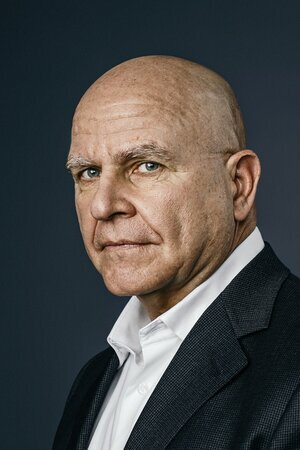

Governor Jeb Bush

43rd Governor of the State of Florida

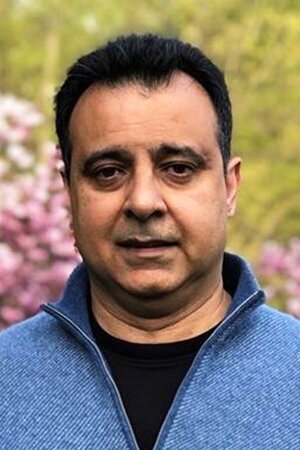

Jason Crabtree

Chief Executive Officer

QOMPLX

MODERATOR

Jeff Sonnenfeld

Senior Associate Dean for Leadership Studies

Yale University School of Management

TIMESTAMPS

EPISODE TRANSCRIPT

Jeff Sonnenfeld: (00:05)

Given that the music has gone quiet, I think that's my cue that I'm supposed to start talking now. I want to start by pandering to the audience by saying, I've been telling the panel for the last 15 minutes, don't be offended. At the end of the day, we're going into a room that's one-third larger than the Radio City Music Hall, so it's going to be so cavernous. At this time of day, it'll look empty. It's not your fault. It's my fault. And sure enough, you're all here. So extra credit for everybody. I'm Jeff Sonnenfeld. I'm up at Yale.

Jeff Sonnenfeld: (00:34)

That's all you need to hear from me, because we have such a superstar panel. Our topic is keeping America innovative, how to keep the US on the forefront of high technology growth. Innovation. Einstein said that the essence of innovation is a combination of intelligence and fun. Well, the series of superstars for intelligence and they also have a lot of fun. And my goal is to try to see if we can get some fun mixed in with their intelligence to wrestle with innovation.

Jeff Sonnenfeld: (01:08)

As the description of this session is US has ceded its core role as dominant technology power in the world with China investing trillions of dollars in innovation across deep tech, education, and advanced manufacturing at a time of partisan divide. US Congress passed the US Innovation and Competition Act of 2021 on a strong bipartisan basis, which we're going to talk about where this goes. And on the panel, we have a great mix of public and private figures to wrestle with this.

Jeff Sonnenfeld: (01:37)

But just as we think of who we have on our panel, we have Congressman Ro Khanna, who has told us that we can refer to him as Ro, so please don't think that I'm being rude and disrespectful, as progressive capitalist who has led the way on technology policy, job creation, and working across the aisle to pass multiple bills into law. Ro's named as the democrat most likely to succeed in having a bill signed by former President Trump passing five and to law ... That laugh was just off the record, by the way. Joined the Trump administration, he's got a kid running for office, we can't ... In response to the growing economic crisis, Ro led the way on the largest government investment in science and technology since the 1960s, the Endless Frontiers Act.

Jeff Sonnenfeld: (02:23)

I thought it would have been Sputnik, but this is bigger, which invest 250 billion in science and technology hubs across the US. Ro has worked to spread the wealth of high paying digital jobs to areas of the country left behind in the digital revolution, partnering with Silicon Valley get companies to establish training programs in states like Iowa, South Carolina, Mississippi, to rebuild the middle class. And the most important thing that he is ... He is a Yale alum. That's where I work. And most important of all, he's a fellow of Philadelphia way back in his heritage.

Congressman Ro Khanna: (02:57)

[inaudible 00:02:57]

Jeff Sonnenfeld: (02:57)

Governor Bush said that we can refer to him as Jeb. You're wondering if they'll have to call me professor, I don't think so. As the 43rd governor of the state of Florida, starting from 1999 to 2007, he was the third Republican elected to the state's highest office and the first Republican in the state's history to be reelected. He's most recently a candidate for Republican presidential nomination in 2016. Jeb remained true to his conservative principles throughout his two years in office, cutting nearly 20 billion in taxes, vetoing more than 2.3 billion in earmarks and reducing the state government workforce by more than 13,000.

Jeff Sonnenfeld: (03:32)

He has limited government approach, helped to unleash one of the most robust and dynamic economies in the nation, creating 1.3 million new jobs, improving the state's overall credit ratings, including achieving the first ever triple A bond rating for Florida. During his two terms, he championed major reforms of government in areas ranging from healthcare, environmental protection, civil service, and tax reform. But he also has some technology and technology background ideas that we're going to get into very shortly and across a great reach on cross-sectoral change and innovation. But we should point out that he, too, is a professor, having been a professor University of Pennsylvania, I think, at one point along the way.

Governor Jeb Bush: (04:13)

Yale didn't invite me.

Jeff Sonnenfeld: (04:14)

Yeah, yeah, I know. I will forgive you anyway. But the part I'm not going to mention is the Harvard professorship, so forget that.

Governor Jeb Bush: (04:21)

Yale didn't invite me.

Jeff Sonnenfeld: (04:22)

I thought he was such an honorable nice guy too. Jason Crabtree is the chief executive and co-founder of QOMPLX, founded with Andrew Sellers. As CEO, he guides the vision long term direction of complex and oversees all aspects of company operations. Prior to complex, Jason served as a special assistant to senior leaders of the Department of Defense and cyber community and supporting operational cybersecurity missions, including research and development, strategic risk management, and digital transformation initiatives.

Jeff Sonnenfeld: (04:53)

Like the rest of the panel, you've probably seen him in the media quite a bit. He's been on all the major networks and cable channels and in the rest of the print media speaking often on cybersecurity issues. And in fact, some of you might even be his client here. So where are we on this problem? Well, the US had led in chip development and of course, in technology since World War II. And it's not looking so great more recently.

Jeff Sonnenfeld: (05:22)

Just because they're little doesn't mean they don't matter, is that these chips are the fundamental building block for all advanced technologies, whether or not we're looking at AI or looking at perhaps any building block cutting edge technology. The chips are going to be critical for understanding our self-reliance for innovation around integrated circuits and microprocessors. And yet, what do we see now is the US has maybe 10% at most of chip manufacturing. And we take a look at backend, we're down to around 1%.

Jeff Sonnenfeld: (06:07)

If we go back a few decades, say 1990, we were around 45%. So we've dropped precipitously. Well, who's grown? Well, who do you think has grown? It's about almost 80%, just below 80%, coming from Asia with half of that, People's Republic of China and the rest split between the rest of East Asia. Now, that has led to some challenges of what we do. And I'd love to turn if I could to the Congressman, is this is not a new issue for you. You've been wrestling with this.

Congressman Ro Khanna: (06:42)

Well, Jeffrey, thank you. First of all, thank you for inviting me. It's an honor to be on the panel and honor to be here with Governor Bush who, in my view, has always approached political debate with civility and patriotism even when I've disagreed. So thank you for that. And Jason, thank you for your leadership on cybersecurity. First, let me say this, I think America is and will remain the most innovative nation in the world for a simple reason. When you come to Silicon Valley, we don't have hierarchical teams.

Congressman Ro Khanna: (07:18)

You have a team at Intel or at Apple, and they basically have the direction to do what they want. They don't have to go through five levels of bureaucracy. The last technology coming out of Europe, I mean, they did Skype, but think how many tech companies they've come out of there. And yes, China has competed on TikTok, but it's probably one of the only places where they actually have an advantage on product. We still lead in the most advanced semiconductor design. The problem is we've had this complacency.

Congressman Ro Khanna: (07:47)

We thought, okay, if we're going to invent the best product that the scale doesn't matter, and we'll just let other countries like Taiwan or Korea deal with mass production. Now, do we really want at a time with the rise of China, our semiconductor supply to be dependent on what happens in Taiwan? Do we really want all the mass production jobs not being in the United States? Of course not. We need to have that mass production of semiconductor chips in the United States.

Congressman Ro Khanna: (08:16)

And the Congress in a bipartisan basis, Senator Schumer, myself, Senator Young, and Representative Gallagher from Wisconsin, in this innovation at have provided $40 billion for semiconductor manufacturing to help these companies establish manufacturing in the United States. That, to me, is smart policy. It's public private partnership. And it's going to help make sure that we are never dependent on a foreign nation for our critical supply.

Jeff Sonnenfeld: (08:45)

Well, we've never met before, but we're best of friends now because we established the link to Philadelphia and Yale. So I can ask you the hardball question that I didn't clear with your team, and that is the Bloomberg innovation list that just came out has us falling off the top 10 for the first time ever. We're number 11. And you say the US will always be ...

Congressman Ro Khanna: (09:07)

I don't buy that. People say this, my parents are immigrants from India. Where's the line to go to China of immigrants? Why is the line here still to come to the United States? When people around the world want to stop coming to the United States is when I'll start to worry. I mean, this is still the most ... We have the most capital, the most risk capital. We have the best and brightest from around the world. We have a lot of advantages. And I'm very, very bullish. There's so many people running America down and pointing everything out. And I guess maybe because I'm the son of immigrants. I'll tell you, this is still an extraordinary country. Yes, we have challenges, we have problems, but we have a lot going for us.

Jeff Sonnenfeld: (09:50)

So we should bring Michael Bloomberg in here to explain how he's distorted the list. You want to know, he has seven metrics that define this and what are they. The level of research and development investment they have to do with the fabrication, how much of the creative work is being done here on that end too that has to do with not just design, but diffusion and adaptation. And that's some of what you build into this legislation. So maybe we'll see that change.

Jeff Sonnenfeld: (10:20)

But I'm just wondering, Jeb, when he talks about the bipartisan concern here that we ... It's got some momentum, but we have all these other things. We hear that Senator Manchin has had perhaps some great success in the last two or three hours and getting 6 of me to 10 to get a different version of voting rights legislation together. And the rumors are that the next four are lining up tonight. So maybe in two weeks or so, who knows? But it's caught in the weeds right now as infrastructure is and is the number of issues what we thought we had momentum, it's hit the wall. Do you think that Ro is too optimistic? Or do you think that both parties are going to take this over the finish line?

Governor Jeb Bush: (11:06)

Our political system ... Ro, thank you for those great words. You stole everything I was going to say. Jeffrey, thank you for hosting us. It's great being with a great entrepreneur here. So I think the key to this is to realize our system is dysfunctional, but there are good people inside it that want to find common ground. And in the pandemic, I think there's just such an eye opening experience for all of us. You take the lens back a bit, we've had learning losses in the K-12 system that are epic, that are creating inequality for 10 years down the road.

Governor Jeb Bush: (11:40)

The digital divide became pretty clear because some of us could actually enhance our productivity with high speed internet in our homes, get telehealth, be able to make sure our kids were well educated. We were thriving, many of us were thriving that environment. Too many people weren't, and we're leaving people behind. And if you look at the rural areas of our country, clearly, there's an opportunity now to say, in this crisis, what did we learn? And we've learned a couple of things. One, that there's big inequality that we can address.

Governor Jeb Bush: (12:09)

We don't have to talk about in cocktail parties. There are ways to solve this problem. And the second is supply chain dependency, which Ro is bringing up. It's not just semiconductors, it's across the board. And we should have a strategy to make sure that we're secure. It's in our national security interest to do that. Here's an opportunity. I don't think democrats republicans disagree with that. And then finally, I think we have to deal with the 10 million people that aren't getting jobs because they don't have skills for the jobs that exist.

Governor Jeb Bush: (12:38)

And that is a chronic problem that existed before the pandemic that has gotten worse. So you take those three things. They're not partisan. It's not ideological. And I think the Congress ... I hope that Joe Manchin doesn't get sick or anything because he's holding the power here and he's a rational guy and he could bring people together. And I'm optimistic that that will happen.

Jeff Sonnenfeld: (13:00)

Well, if we have a shared consensus of two out of three on the diagnosis, maybe we can stir up some trouble in the minutes that remain a little bit down the stream when we take a look at the resolution, solutions that maybe you have some different approaches, solutions. But it is nice to see people across the aisle agree, isn't it, about common issues of patriotic concern. This is your calling, Jason. Weren't you a West Point guy?

Jason Crabtree: (13:28)

I was.

Jeff Sonnenfeld: (13:28)

So, national security has been in your training from the beginning. Are we overstating this though? I mean, look at them, you got a roomful of finance ears who many of them grew up going and taking economics courses and believing David Ricardo with the theory of comparative advantage, that each company, each country brings to the global marketplace what they can do at its best, and we don't need to be self-reliant. Is that if the South Koreans are going to give it to us at a cheaper price and a lot of the manufacturing that we've lost here was also very unsafe manufacturing.

Jeff Sonnenfeld: (14:00)

There a lot of problems with women working and at the backend of chip manufacturing is very labor intensive and has a lot of toxic chemicals. Intel and others were happy to get rid of them, especially AMD. Is that a bad thing? Or is that maybe we let other countries that they're willing to do it for us, why is that a problem? And how much is Apple manufacturer? Are they're outsourcing at all?

Jason Crabtree: (14:25)

Well, I think the reality for the United States is that talent, trust, and transparency are going to be a critical part of the future. When we talk about talent, there are people that are being left behind.

Jeff Sonnenfeld: (14:35)

If we can just hold briefly on the talent because I know you don't trust me that I'll manage the time well enough to get through it, since all three of you have tried to go down that path, definitely have tried to frustrate you.

Jason Crabtree: (14:44)

That's great. Sure.

Jeff Sonnenfeld: (14:46)

But tell me about what's the security issue first there as our security expert, about relying on Korea, relying on the other parts of Asia, if you don't trust China, Taiwan, elsewhere.

Jason Crabtree: (14:59)

Well, you have to have talent to have trust. Because at the end of the day, the supply chains that we're trying to operate, especially in an increasingly digital world, an increasingly outsourced world, an increasingly interconnected world require the people who are operating things like software as a service companies like my business, they're a critical part of your operations. These are outsourced entities, and they're an ambassador for your brand.

Jason Crabtree: (15:21)

And I think when we understand what it takes to operate these things, you look at the cyber and security crisis we have in this country right now. Why is that happening? Part of it is because of massive vulnerabilities and core products at places like Microsoft that are creating massive, massive issues and costs in our home. We actually have to be digging into those things and reestablish trust that the software products, the technology products do what they say they're going to do. That only works if you have the people. It only works if you have the educational system.

Jason Crabtree: (15:46)

That only works if people want to continue to line up the gates. And if they line up with the gates, they line up with the universities and they have an opportunity to stay. We have real options, real hope about actually creating an environment where this is the best place to do applied research and development. And I'll set the Bloomberg metrics aside, but operationalizing technology is hard. How many finance professionals here have tried to do things like adopt AI and machine learning, only to find out they didn't have any of the basics in place to actually do it in practice?

Jason Crabtree: (16:15)

A lot of people. That's happening across our government. It's happening in the private sector. So when we talk about all these new topics, many of them put the cart before the horse. And we really need to make sure we're building in those fundamentals and not leaving people behind as we think about the future, the talent base that's going to do it for us.

Jeff Sonnenfeld: (16:29)

So there you have it. All three of you agree that David Ricardo is wrong, that we need to be self-sufficient, especially in something as ... You don't believe that?

Governor Jeb Bush: (16:39)

No, I don't believe complete ... It would create huge poverty all around the world, including our own country. But there's a middle ground here. There are key elements of our ... I mean, look, if Apple tomorrow, if we have frictions that get higher with China, given the fact that the supply chain for the Apple phone, which is an integral part of our lives, is made there, even though the value add is outside of China, by the way, it's here and it's in Germany, it's in Japan and Korea, our allies.

Governor Jeb Bush: (17:12)

But if they stopped allowing Apple phones to be sold, and there was a disruption in the supply chain, that would have a huge economic impact and a national security impact in our country. So there are elements that we have to harden our supply chain, for sure. I would advocate, by the way, reshoring, not nearshoring and reshoring. We should look at Mexico and we should be North American economy. And there's huge opportunities there for elements of this. Not all of it. Part of it has to be done here. Part of it can be done in Asia, for sure. I mean, Ricardo is not completely wrong at all, but it's not a zero sum game. It's not either or.

Jeff Sonnenfeld: (17:51)

So you want to bring a little bit back here and you bring it back to North America, doesn't have to be the US necessarily, but just somehow in Mexico, you can reach us a little more easily.

Governor Jeb Bush: (18:02)

I want to make sure that our rare earths that we can access it because that's an integral part of technology. I want to make sure that our reliance on semiconductors ... Look, Ford Motor Company shut down their plants because they couldn't get chips across the spectrum of our economy.

Jeff Sonnenfeld: (18:18)

Because ...

Governor Jeb Bush: (18:19)

These are issues that relate to supply chain logistical bottlenecks, as well as supply chain challenges. So we can do this in partnership with other countries. We can't do it by ourselves. But there's so many lessons learned from this last two years, let's learn them, and then act on them.

Jeff Sonnenfeld: (18:37)

Do you know what the contingency plans are if we lost 40% of our chips from China? And let's just say that things were going the wrong way in Taiwan and we don't need to make headlines that make any political conjecture about Hong Kong versus Taiwan, but let's just say that the supply was less accessible there. Would our contingency plans are in the US?

Governor Jeb Bush: (18:58)

I'll let my colleagues speak to that. I think it's pretty, but ugly.

Jeff Sonnenfeld: (19:01)

I'll save them for giving the wrong answer. We have none, is that the leaders of all the chipmakers that I talked to for this panel tell me that we don't have a contingency plan. Now, we still are a major headquartered company for chip manufacturing, but we don't really don't control where those plants are. One big shoe manufacturer told me he wanted to bring the biggest one in the country, want to bring shoes back to the US, and the Chinese told us, no, you can't do that, we're going to shut you down if you try to do it. And he realized he's just the marketing arm of a Chinese operation. So it's hard to bring it back here. Should there be incentives, some kind of tax incentives to reinvest back here in manufacturing chipmaking growth?

Congressman Ro Khanna: (19:42)

Absolutely. And there should be federal support when you have massive capital expenditures to set up volume manufacturing factories. You need federal purchase agreements or federal financing agreements. We did that with the vaccine, right? I mean, we provided purchase agreements to Pfizer and to Moderna, and that incentivized the private sector. So we have had a history going back to Alexander Hamilton of having the private sector work with the federal government to produce a very strong economy. Other countries have copied us. I don't know why we can't do what's worked to build us into the superpower we are. It's not a hard problem to solve because we have the innovation, we just need to do the volume manufacturing.

Jeff Sonnenfeld: (20:19)

Does the chips legislation have tax incentives for manufacturing bill? Because some would argue, we chose to not fabricate here to outsource it. We chose to do it, and it's much cheaper and easier for US companies to build the chipmaking plant in China than it is to do it here.

Congressman Ro Khanna: (20:35)

I think the problem ... I mean, it's a complicated issue. As the governor said on the one hand, about the fact that millions of people are out of poverty around the world is probably good for stability, but we paid insufficient attention to jobs in this country. We said, okay, as long as consumers are paying less prices, who cares? And the reality is, those are good paying jobs. We should have those jobs in the United States. And some of the chip sect is one concrete bipartisan initiative that would fund a lot of that ...

Jeff Sonnenfeld: (21:02)

What's the level of tax incentives that you would put in there? Because as you know, in Korea, in the next three years, are funding about $70 billion into chip manufacturing. It's two-and-a-half times that in China with the explicit goal that Xi Jinping has, is to have self-reliance, Jeb, in three years. They were zero in ...

Congressman Ro Khanna: (21:25)

Let me be clear on China. China is terrible at semiconductors, horrible. And where has China's innovation been? They've copied a lot of the United States innovation. I mean, I don't know. Is there anyone in this room who would want to go start their company in China? I get that they're an authoritarian system, that is an inferior system to a free market system that allows for immigration. I mean, I fundamentally believe that. The challenges on our chips, $50 billion is what chips would authorize. It would allow for ... TSMC wants to expand in Arizona. It would allow Intel, other companies to expand. The solutions are there. I just think we have to have the strategic investment.

Jeff Sonnenfeld: (22:09)

The preferred provider for a lot of US government outside the security agencies is Lenovo, that's a Chinese tech company, Chinese owned, Chinese manufacturer. You just wonder. Jeb, do you think that we're picking winners and losers by some of these tax incentives? Do we know how to do this the right way? It's national industrial planning. If the Chinese want to go into their 14th five-year plan, let them try it.

Governor Jeb Bush: (22:38)

Like the Soviets. That worked out real well for them. I think we're a bottom up country. I think there's a useful role for Washington, particularly in basic research. There's the success stories are ... I mean ...

Jeff Sonnenfeld: (22:51)

So basic research, you would fund, but you don't agree with Ro ...

Governor Jeb Bush: (22:54)

Totally.

Jeff Sonnenfeld: (22:54)

... on funding building plants.

Governor Jeb Bush: (22:56)

Providing incentives for companies that are willing to put up capital to do it rather than saying, this is the one we're going to do, making it something where you're supporting private sector involvement, which I think is what Ro has proposed in this bill, that's okay. But if you have a venture capital arm inside the Department of Energy, we went through that. It didn't really work out very well. Government is not designed to be a venture capitalists, to be a risk taker, and our government particularly. I mean, maybe China knows how to do this.

Governor Jeb Bush: (23:27)

Well, it doesn't look like it to me. Comparing Korea or China to the United States misses the whole point. We're Americans, dammit. I mean, we operate in a totally different way. We operate in a garage with a dream to pursue it. So support that rather than have an industrial policy that dictates how this is all supposed to come out.

Jeff Sonnenfeld: (23:49)

Ro, do you want to respond to that? The Chinese had the first five-year plan, gave them the first bridges, the first automobiles, the first a lot of technologies. The second five-year plan was the Great Leap Forward. That was a disaster. They made a big wrong bet in agricultural pass and small backyard furnaces for steel. It was a disaster and stuff. So what do you think? Is Jeb right that maybe you want to withdraw the national industrial planning part of this by picking the winners and losers?

Congressman Ro Khanna: (24:21)

I don't think we're picking winners and losers. I mean, obviously, the governor I probably have a disagreement of how big the role of government is. But I think fundamentally, we both believe in the public-private partnership. I mean, I imagine the governor would support the fact that we invested in DARPA. They gave us literally the internet. It wasn't China that invented the internet. It wasn't Europe. It was Vint Cerf sitting there at DARPA with US tax dollars, the fact that GPS emerged from there.

Congressman Ro Khanna: (24:47)

And the investments, if you have Intel saying, look, Korea's rolling out the red carpet, China is rolling out the red carpet, other places are. We need certain tax incentives to put the factory here. We need certain capital with certain loans. I think that is perfectly fine. Now, on the investments, I will say that I think it's better to have that administered by local regions and help with the private sector in picking bets, so you don't have government bureaucrats or Congress making some of the determinations.

Congressman Ro Khanna: (25:18)

But in terms of fundamental research and helping on factories and plant building, I think that's a perfectly good use of the federal government. One other point, there's a federal financing thing that provides loans and purchase agreements to federal agencies. Actually, Senator Rubio and I are working on something where we would say, if you want to reopen a factory in Ohio, why can't that federal financing bank help GM do that for a public purpose? So I think we have to explore those type of opportunities.

Jeff Sonnenfeld: (25:49)

So I think you're right, it was actually not Al Gore who invented the internet, good for you. And in fact, the DARPA had a long history, of course, of spawning technological development just like the Interstate Highway Act, of course, took us through parts of the country. But there are a lot of people in your party, Jeb, didn't think that was the right way to go. The ...

Governor Jeb Bush: (26:13)

You mean Dwight Eisenhower [inaudible 00:26:15] Interstate Highway system?

Jeff Sonnenfeld: (26:17)

No. I mean, Jeff ... He ...

Congressman Ro Khanna: (26:18)

Or Lincoln either.

Governor Jeb Bush: (26:19)

Lincoln was ... Transcontinental railroad Lincoln.

Jeff Sonnenfeld: (26:21)

People are still arguing against the Rural Electrification Act.

Governor Jeb Bush: (26:22)

Let's go through this.

Jeff Sonnenfeld: (26:24)

My old student, Jeff Skilling, who we probably shouldn't bring up his name here, was arguing back as a student. He said the Rural Electrification Act was awful. He said, "Those farmers, want to pay for it, they should go out and pay for them." We don't have the government tried to manipulate private markets, but sounds like you guys will find some common ground on where ...

Governor Jeb Bush: (26:39)

I mean ...

Jeff Sonnenfeld: (26:40)

... mRNA came from the government financing, Moderna and Pfizer, great.

Governor Jeb Bush: (26:45)

And if we said that they found the basic research that created this incredible platform from which now we can find cures and then they provide it to the private sector and allow entrepreneurs, many of whom are coming from other countries to pursue their dreams and they do it with a vengeance. And they do it through trial and error, and they do it one step forward, 10 steps back, 20 steps forward, as is the case with Moderna. I mean, did not have $1 of revenue, and now it's a business worth billions of dollars.

Governor Jeb Bush: (27:16)

That wouldn't have happened if you contain that through a bunch of rules and through the government being heavy handed. But there is a proper role for these long term basic, infrastructure deals, as well as research to maintain our competitive posture, for sure.

Jeff Sonnenfeld: (27:31)

Some people are trying to layer into Ro's legislation, blocking the loss of intellectual property developed in US universities that can migrate back to other countries. Do you see any problems with it?

Jason Crabtree: (27:45)

The reality of this is that when you look at things like mRNA and you look at a lot of DARPA programs, when basic research programs are actually creating these fundamental technologies, entrepreneurs can combine them in novel ways to create new services that deliver operational business benefit or consumer benefit. And that's where the government, to your point, Jeff and Ro, I think, the reality is that's a much more appropriate place for private sector to play.

Jason Crabtree: (28:09)

And I think one of the things we have to be careful of, and I think we've gotten close to the line, and I don't think the new legislation does, but I think there have been some historical missteps where we've started to play venture capitalist or we've started to get into picking winners and losers. And those haven't always ended well. But the reality of this for us has to be that those fundamental building block technologies need to get mature to technology readiness levels, that they can be readily accepted by private sector capital and risk takers that are not in a position to take fundamental technology risk.

Jason Crabtree: (28:38)

They're there to take distribution risk. They're they take actual product market fit risk. They're able to think about how those combinatorics are going to manifest in commercial opportunity. And that's something that's a lot more important, but it can't turn into Silicon Valley, no offense, tourism and innovation tourism. Most of the good ideas in America aren't in Silicon Valley, they're all over the country. And that goes back to how we have to make sure not to leave the rest of the country behind [inaudible 00:29:00].

Congressman Ro Khanna: (29:00)

So, Jason, what's your view on making sure that we build capacity?

Jason Crabtree: (29:05)

Well, building capacity comes down to actually helping [inaudible 00:29:09] ...

Governor Jeb Bush: (29:09)

Let's see what your ... We've got six [inaudible 00:29:09].

Jeff Sonnenfeld: (29:09)

Yeah, I know. Before we move on to the talent management issue, which I know Jeb and Jason was starting to open that door again, and we're going to turn to it and one second, anything you want to tell us more about your expertise in cybersecurity and technology? I won't make you talk about cryptocurrency because you chase that up before. Surveys overwhelmingly blame cryptocurrency for Ransomware, but that would have three quarters of this room up in arms. I wouldn't possibly bring that up right now.

Jeff Sonnenfeld: (29:38)

However, you look at the new three Chinese cybersecurity laws, the first of them, which was three years ago, says like the old what happens in Las Vegas stays in Las Vegas. By the way, I hope Anthony Scaramucci keeps us in New York and not Las Vegas, is that data created in China has to stay in China. I think that would be a violation of general agreement on tariffs and trades going back 30 years, but nobody's challenged it.

Jason Crabtree: (30:07)

Well, internet balkanization is a real thing. And one of the challenges that we have to address as a country is it goes back to this idea of trust and supply chain transparency. It's not just the hardware level. There's more technology above the chip than in the chip. Not to say that they aren't important building blocks.

Jeff Sonnenfeld: (30:22)

Are you worried about this Chinese light has to be managed by Chinese?

Jason Crabtree: (30:25)

That's not just China.

Jeff Sonnenfeld: (30:26)

Chinese software and Chinese hardware?

Jason Crabtree: (30:26)

There's all kinds of data and nationalization and localization laws. And remember that we're seeing the same kinds of changes happening with privacy considerations, not just things like GDPR in the UK. There's California has a law, Virginia, where we're headquartered, has a new law. And by and large, that's going to be positive for us to think about data is an emerging element of property. Remember, most of the corporate balance sheet used to be physical assets, those factories, intangibles, dominate the market value of most real digitizing technology companies.

Jason Crabtree: (30:56)

So we have to deal with incentives and structure and investment that aligns with the fact that most of the value you're creating as an entrepreneur in a digital business is increasingly getting trapped in a different part of the balance sheet, and that has massive ramifications for how we actually build capacity.

Jeff Sonnenfeld: (31:11)

Well, you just nailed it and you've been such a good sport. Tell us about the skill shortage and what we do about talent issues that we take a look at universities, is close to 90% of universities in our country have the majority of their STEM students are international students.

Jason Crabtree: (31:29)

Sure.

Jeff Sonnenfeld: (31:29)

And we're down 75% this year at international student enrollment.

Jason Crabtree: (31:32)

Well, I mean, this is a huge challenge. So I think for us, we have to do a better job of making it attractive to start and build businesses here. And we have to do a good job of tying this to immigration policy reform. When you look at the amount of technology talent that is starting to go to overseas, right? I went to grad school at Oxford with my co-founder. But a lot of those folks should have come to the United States to start businesses. And a bunch of them didn't, a bunch of them went to other parts of the world.

Jason Crabtree: (31:58)

I'd love for everybody that we graduated with overseas to want to come here because this is the best place to build a business. Some of them are. But when we have talent applying to US universities and you look at the amount of university research R&D spending that is starting to globalize, we should be maximizing the amount of it that continues to build in the United States. We should be maximizing the conversion of those talented people into our society and bringing their families here. And some of that's just stability and trust that they don't have uncertainty.

Jeff Sonnenfeld: (32:24)

But instead, we've seen the US which has been such a magnet for the world's top talent, as well as people who are suffering as refugees, that we see them as somehow displacing opportunities for American workers, when the reality is their course, their job creating, and that 45% of the current Fortune 500 firms are either created by immigrants or by first generation at Google, Tesla, Intel. These are all created by immigrants and a quarter of the tech workforce is foreign born, the current workforce.

Jason Crabtree: (33:04)

International talent, Jeff, is so important. And we have to create a society that's predictable and welcoming. And if you don't have a predictable future and you're thinking about bringing your family here, that undermines our competitiveness as a country.

Jeff Sonnenfeld: (33:17)

What's happened, Ro? Is it the last four years, just between us and ... Yeah, I trust these people with your life, by the way, is that candidly that [inaudible 00:33:26] ...

Congressman Ro Khanna: (33:26)

What happened is Jeb didn't win in 2016. His vision on immigration would have been much better than Donald Trump's. I mean, I don't agree on everything. But let me say this as a son of immigrants. I was born in Philadelphia, 1976, or bicentenary. My grandfather spent four years in jail with Gandhi as part of India's independence movement. My parents came here in the 1970s. I grew up in Bucks County. It was about 95% White when I was growing up. I had little league coaches who believed in me.

Congressman Ro Khanna: (33:55)

I had high school teachers who believed in me, neighbors who believed in me. And at the age of 40, this country elected me to represent Silicon Valley, arguably, the most powerful economic place in the world. That story is not possible in almost any other country. Germany wouldn't put a first generation German in charge representing their most important industry. That, ultimately, I believe is the story of America. And no politician is going to change that fundamental story. We're a story of people who come with ambition, dreams, and it's what makes us the most exceptional nation in the world. And I don't care how many Donald Trumps or other people come around, they're not going to change the fundamental [crosstalk 00:34:39].

Jeff Sonnenfeld: (34:38)

What do we do to make this more hospitable to new Americans to come here? How do we get people a permanent residency status earlier? But there are people here that are coming for technology jobs, can't get an audit, can't get a driver's license, can't rent a house, let alone buy a house, and that their spouse can't work. The complications are ... And the kids, they age out of protection and under the visa. It's easier said than done. And there's a reason why we are falling. You can talk about us still being a magnet, but we aren't the magnet we were, that we need to brush it off a little bit.

Congressman Ro Khanna: (35:13)

We could talk about the details of policy, but I'll say and I'll give the governor the last word. There are places ... Look, I don't want to ... That Jeb Bush and I disagree. There are certain places that George W. Bush and I disagree. But President Bush, one of the moments that I thought was a highlight, was after 9/11 when he went out and he talked about Muslim Americans being Americans. And Jeb has always, in your rhetoric, been pro the value of immigrants to this country. We need more people willing to tell that story of America.

Congressman Ro Khanna: (35:44)

We need more people willing to tell that story in the Republican Party. It's not about the policies. It's about what you believe America is. And I think if we have more voices like that, we're going to be fine as a country.

Governor Jeb Bush: (35:57)

I think it's a wedge issue on both sides. And both sides think they win by having this gridlock because the gridlock existed before President Trump got in. We should control the border. You mentioned all these other countries that really got it going on great. They control the borders. They don't allow people to come in. And they actually don't allow many people to come in legally for that matter. And I think we need to move to a merit based system where we narrow the number of people coming.

Governor Jeb Bush: (36:26)

We're the only country in the world that has extended family being allowed in, adult siblings and parents. I think parents ought to be able to come in and children of immigrants ought to be coming in. But if you narrow that and then expanded by a half a million, the people that would be restricted legally to pick the kind of people you want to create jobs for all Americans, that's part of the answer. We have to control the border. There's a solution here if we depoliticize this.

Governor Jeb Bush: (36:56)

But the bigger issue to me is, why is it that we don't focus on the next generation of Americans not being able to have the skills to be successful? I mean, this shouldn't be a political issue either. But we dumbed down, we lower expectations. We actually had the state of Oregon this year pass the law that said it is unjust to have an accountability system, a testing system that has Whites and Asians being more successful than other minorities. Who thinks that's going to be a great outcome over 10 years?

Governor Jeb Bush: (37:32)

Where you're ending up saying, you have this what my brother called the bigotry, the soft bigotry of low expectations. We should have high lofty expectations for every person. We don't have the luxury of having some kids educated and some kids not. Our demographics demand that we do far better. And then the final thing I'd say is where the whole focus is on getting a four-year degree, and psychology is the number one major, and 60% of kids graduate in six years with a four-year degree and the number one degree is psychology. Come on, man.

Governor Jeb Bush: (38:06)

I mean, we should maybe move away from that and start focusing on career and college readiness in high school. And then offer nationally recognized certificates to give people, immediate jobs at a much higher wage than what they could ever imagine being a psych major after four years of that.

Jeff Sonnenfeld: (38:21)

Do you think that Senator Sanders in the social infrastructure, the budget resolution piece is on to a solution here by taking a look at free community college for everybody?

Governor Jeb Bush: (38:37)

No. When you ...

Jeff Sonnenfeld: (38:38)

Is that not intended to address, those left out ...

Governor Jeb Bush: (38:43)

No.

Jeff Sonnenfeld: (38:43)

... educationally? What do you think that's all about?

Governor Jeb Bush: (38:44)

If there's no expectations, no standards, it's just free something, I don't think that's the ...

Jeff Sonnenfeld: (38:50)

That's even worse than psychology. Jeb, what do you think? Jeb.

Governor Jeb Bush: (38:52)

Well, it's worse if you ... At least you won't have debt and fail. I mean, that's a better alternative than failing with that, but we should be having much higher expectations. We should have ... Kids are much smarter than we give them credit for.

Jeff Sonnenfeld: (39:06)

Ro, is that part of a solution that Senator Sanders has in mind? Because, personally, you helped made his campaign.

Congressman Ro Khanna: (39:10)

I do. Look, I ... There are 25 million digital jobs by 2025, 25 million, more than construction and manufacturing combined. And most of them don't require a four-year degree. They require a credential, they require skill. So I would say, in a digital age, you need more than K through 12. If we have free K through 12, we can have a free vocational or post-secondary education that we disagree on that. But at the very least, we ought to make sure that they are collaborating with the private sector on the credentials that are going to get them employed. And that I think that there are ... Look, obviously, the governor and I come from a different perspective. But the point is, there's enough of a Venn diagram of overlap to get things done and ...

Jeff Sonnenfeld: (39:51)

Jason, did you find the talent you need?

Jason Crabtree: (39:55)

The reality is areas like cybersecurity technology have lots of opportunities, but they require skills. And it requires a mix of vocational skills and it does require some people with liberal arts. But remember, areas like the law are ripe for a lot of automation with a lot of the kinds of technologies that we're thinking about. There's a lot of opportunities for automation in finance. So we have to get out of saying that there's inherent value in four years or six years and 10 years and say, what are the life skills these people have to support their families, to be contributing members of society, to be good citizens, and in addition to good employees?

Governor Jeb Bush: (40:24)

I want to make it clear, I'm not disparaging psych majors. And every time I say this, someone comes up and says, "How dare you say that?" Look, I mean, you're going to go to graduate school, you're going to spend more time in school. We have a lot of therapists. We probably need more film makers.

Jeff Sonnenfeld: (40:40)

As a psych major myself, I'm happy to hear you say that.

Congressman Ro Khanna: (40:42)

Jeb, it's better than Marco Rubio who wants what I like, we work together. And the Republican debates said, "Well, what do we need philosophy majors for?" And I didn't say, "Well, it was philosophers who helped build America's founding." I mean, Madison, Jefferson, there's a role for them.

Jeff Sonnenfeld: (40:56)

Yeah. There is a role for all and there also was a role for this panel. And this panel knocked it out of the park. I tried not to get in their way too much, but to bring out some modest variations. But basically, we have three great patriots, three great Americans that are huge contributors to American society. I admire the three of you enormously. And thank you for not letting me tempt you in the cyber cryptocurrency because they would be furious. And the five minutes that were taken away from us, that would have gotten us into it.

Jeff Sonnenfeld: (41:27)

Since we're from Philadelphia, Gene Ormandy, who was the great conductor of the Philadelphia Orchestra once was going into taking the orchestra into a rehearsal, and the orchestra erupted. Even the concert master was like shop steward, he said, "We're not ready to perform." And he said, "You have to perform, it's Friday. We're performing tonight." So they said, "Listen," Ormandy said, "It's just Mahler. As long as we begin together and end together, they'll never know the difference." We, as Philadelphians, at least we began together and ended together. I want to thank you so much for your trust and your wisdom.

Congressman Ro Khanna: (41:58)

Thank you.

Jeff Sonnenfeld: (41:59)

Thanks.